Question: QUESTION 1 Consider the following table, which gives a security analyst's expected return on two stocks for two particular market returns Market ReturnStock A Stock

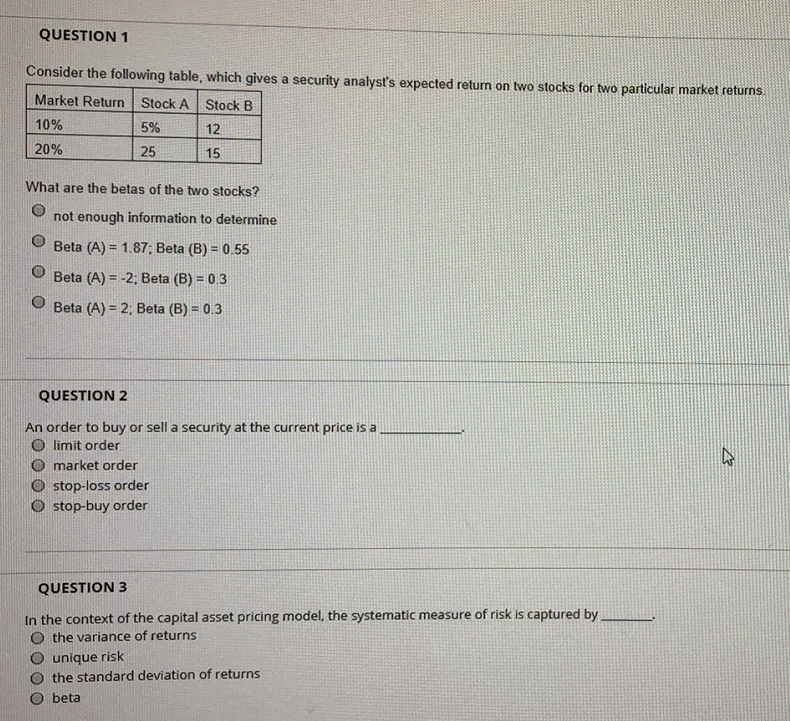

QUESTION 1 Consider the following table, which gives a security analyst's expected return on two stocks for two particular market returns Market ReturnStock A Stock B 10% 5% 12 20% 25 15 What are the betas of the two stocks? O not enough information to determine Beta (A) = 1.87. Beta (B) = 0.55 O Beta (A) = -2; Beta (B) = 0.3 Beta (A) = 2; Beta (B) = 0.3 QUESTION 2 An order to buy or sell a security at the current price is a O limit order O market order O stop-loss order stop-buy order QUESTION 3 In the context of the capital asset pricing model, the systematic measure of risk is captured by O the variance of returns unique risk the standard deviation of returns beta

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts