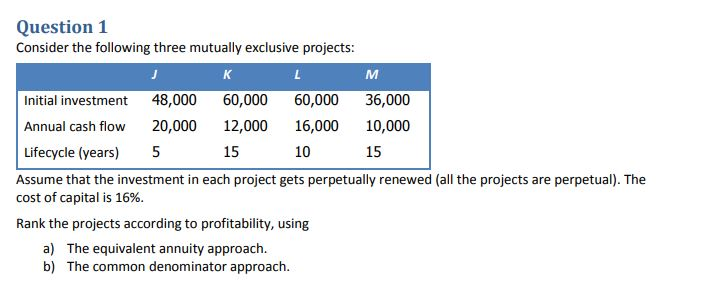

Question: Question 1 Consider the following three mutually exclusive projects: Initial investment 48,000 60,000 60,000 36,000 Annual cash flow 20,000 12,000 16,000 10,000 Lifecycle (years)5 15

Question 1 Consider the following three mutually exclusive projects: Initial investment 48,000 60,000 60,000 36,000 Annual cash flow 20,000 12,000 16,000 10,000 Lifecycle (years)5 15 10 15 Assume that the investment in each project gets perpetually renewed (all the projects are perpetual). The cost of capital is 16%. Rank the projects according to profitability, using a) b) The equivalent annuity approach. The common denominator approach

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock