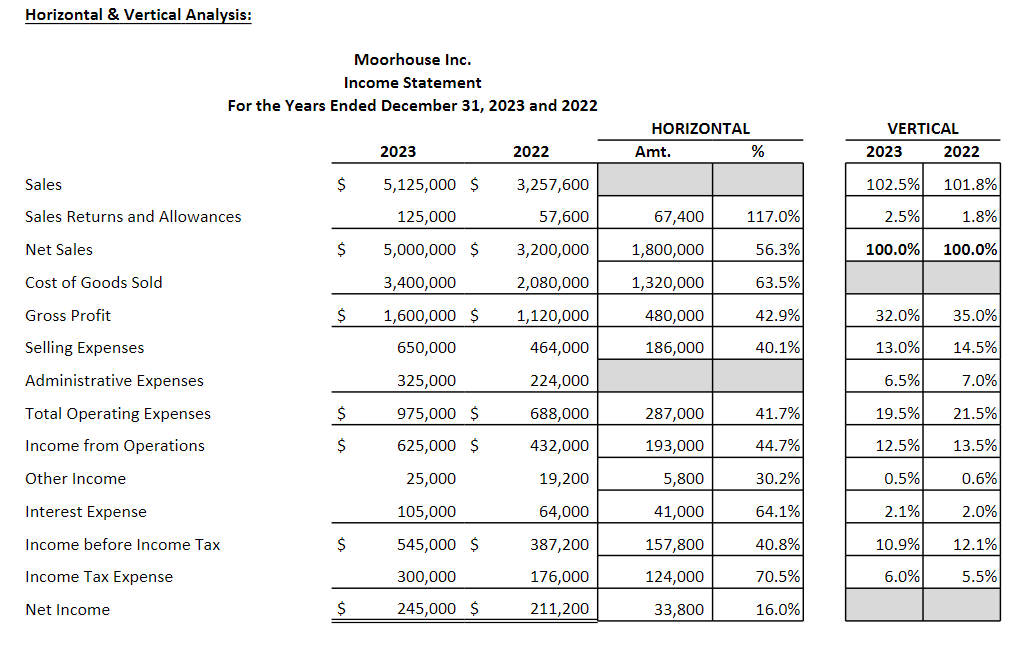

Question: Question 1 Consider the Horizontal Analysis for Moorhouse Inc. For the Sales line, calculate the dollar change and % increase or (decrease). Select the correct

Question 1

Consider the Horizontal Analysis for Moorhouse Inc. For the Sales line, calculate the dollar change and % increase or (decrease). Select the correct answer from the possible answers listed.

- $1,435,093 and 34.2%

- $398,067 and (18.4%)

- $1,867,400 and 57.3%

- $785,204 and 64.4%

Question 2

Consider the Vertical Analysis for Moorhouse Inc. For the Cost of Goods Sold line, calculate the 2023 and 2022 percentages. Select the correct answer from the possible answers listed.

- 68.0% and 65.0%

- 45.6% and 78.3%

- 23.9% and 78.2%

- None of the listed answers are correct.

Question 3

Consider the Horizontal Analysis for Moorhouse Inc. For the Administrative Expenses line, calculate the dollar change and % increase or (decrease). Select the correct answer from the possible answers listed.

- $43,208 and 78%

- $101,000 and 45.1%

- $106,736 and 34.4%

- $90,102 and (24.6%)

Question 4

Consider the Vertical Analysis for Moorhouse Inc. For the Net Income line, calculate the 2023 and 2022 percentages. Select the correct answer from the possible answers listed.

- 5.9% and 2.4%

- 8.4% and 13.4%

- 12.3% and 4.8%

- 4.9% and 6.6%

Question 5

Consider the Horizontal Analysis for Moorhouse Inc. For the Accounts Receivable line, calculate the dollar change and % increase or (decrease). Select the correct answer from the possible answers listed.

- $100,000 and 30.8%

- $43,000 and (52.4%)

- ($25,000) and (32.7%)

- None of the listed answers are correct.

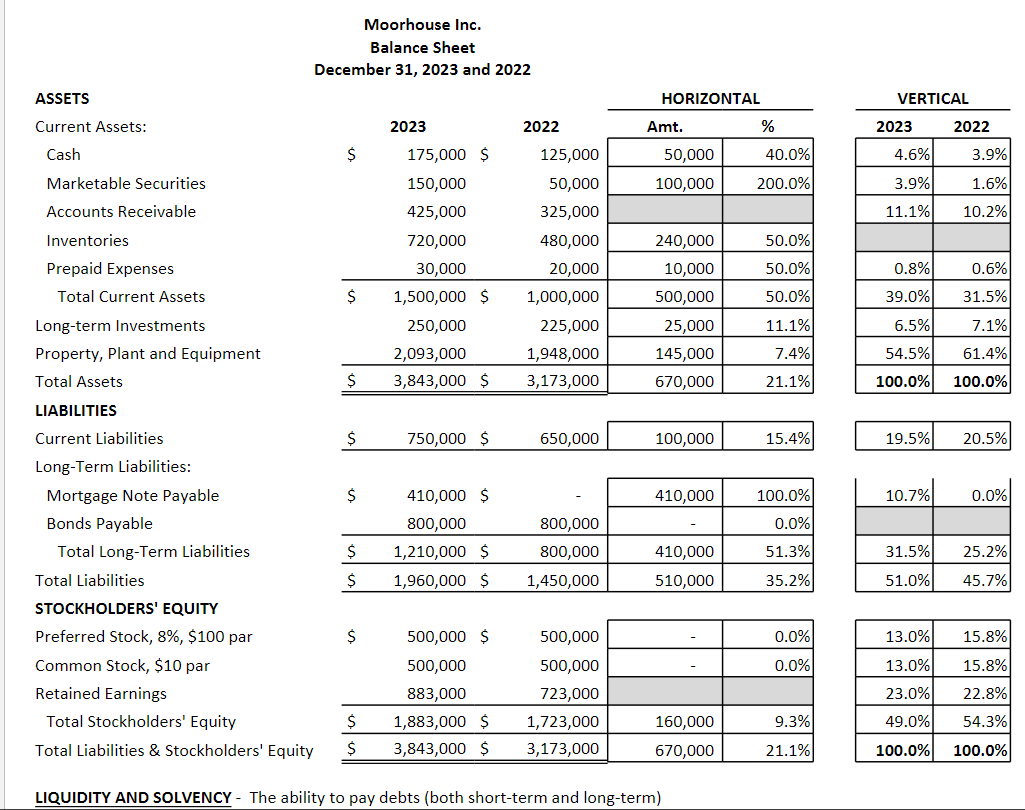

Question 6

Consider the Vertical Analysis for Moorhouse Inc. For the Inventories line, calculate the 2023 and 2022 percentages. Select the correct answer from the possible answers listed.

- 14.2% and 19.4%

- 18.7% and 15.1%

- 51.2% and 48.2%

- 12.8% and 13.9%

Question 7

Consider the Vertical Analysis for Moorhouse Inc. For the Bonds Payable line, calculate the 2023 and 2022 percentages. Select the correct answer from the possible answers listed.

- 15.3% and 19.5%

- 14.0% and 12.6%

- 20.8% and 25.2%

- None of the listed answers are correct.

Question 8

Consider the Horizontal Analysis for Moorhouse Inc. For the Retained Earnings line, calculate the dollar change and % increase or (decrease). Select the correct answer from the possible answers listed.

- $160,000 and 22.1%

- $135,000 and 52.7%

- $42,839 and 14.3%

- $198,000 and 15.0%

Question 9

Consider the Horizontal and Vertical Analysis for Moorhouse Inc. Net Sales increased substantially in 2023 compared to 2022. However, the Gross Profit % on the Vertical Analysis declined in 2023 compared to 2022. What answer best explains what may have caused this to occur?

- The company's Cost of Goods Sold as a percentage of Sales decreased in 2023 compared to 2022. It appears that Moorhouse discounted it's sales price for goods.

- The company experienced a lower amount of Sales Returns in 2023 and that explains the decrease in Gross Profit %.

- Moorhouse's Cost of Goods sold decreased in 2023 when compared to 2022 and that trend may indicate a supplier problem.

- The company's Cost of Goods Sold as a percentage of Sales increased in 2023 compared to 2022 possibly indicating that Moorhouse's suppliers may have increased their prices for inventory that Moorhouse purchased in 2023.

Question 10

Which of the following analysis is often used to prepare Common Sized financial statements that can be used to compare information to another company?

- Horizontal Analysis

- Vertical Analysis

- Sideways Analysis

- None of the listed answers are correct.

Horizontal \& Vertical Analysis: Moorhouse Inc. Income Statement For the Years Ended December 31, 2023 and 2022 Moorhouse Inc

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts