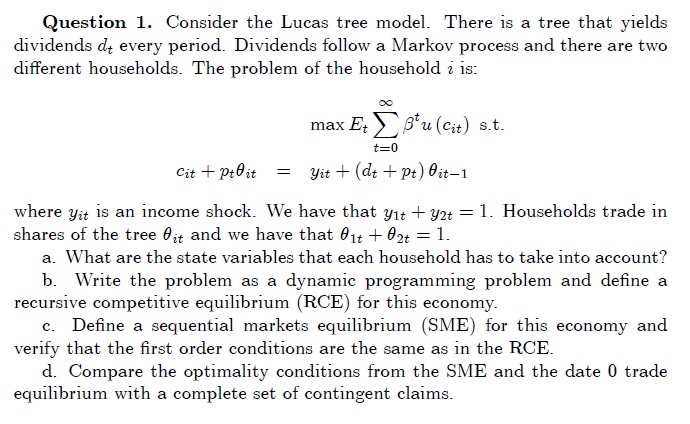

Question: Question 1 . Consider the Lucas tree model. There i s a tree that yields dividends d t every period. Dividends follow a Markov process

Question Consider the Lucas tree model. There a tree that yields

dividends every period. Dividends follow a Markov process and there are two

different households. The problem the household :

where income shock. have that Households trade

shares the tree and have that

What are the state variables that each household has take into account?

Write the problem a dynamic programming problem and define

recursive competitive equilibrium for this economy.

Define a sequential markets equilibrium for this economy and

verify that the first order conditions are the same the RCE.

Compare the optimality conditions from the SME and the date trade

equilibrium with a complete set contingent claims. Question Consider the Lucas tree model. There a tree that yields

dividends every period. Dividends follow a Markov process and there are two

different households. The problem the household :

where income shock. have that Households trade

shares the tree and have that

What are the state variables that each household has take into account?

Write the problem a dynamic programming problem and define

recursive competitive Question Consider the Lucas tree model. There a tree that yields

dividends every period. Dividends follow a Markov process and there are two

different households. The problem the household :

where income shock. have that Households trade

shares the tree and have that

What are the state variables that each household has take into account?

Write the problem a dynamic programming problem and define

recursive competitive equilibrium for this economy.

Define a sequential markets equilibrium for this economy and

verify that the first order conditions are the same the RCE.

Compare the optimality conditions from the SME and the date trade

equilibrium with a complete set contingent claims.equilibrium for this economy.

Define a sequential markets equilibrium for this economy and

verify that the first order conditions are the same the RCE.

Compare the optimality conditions from the SME and the date trade

equilibrium with a complete set contingent claims.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock