Question: Question 1 Consider three assets: two risky assets (asset 1 and asset 2) and the riskless asset. Asset 1 has an expected return of

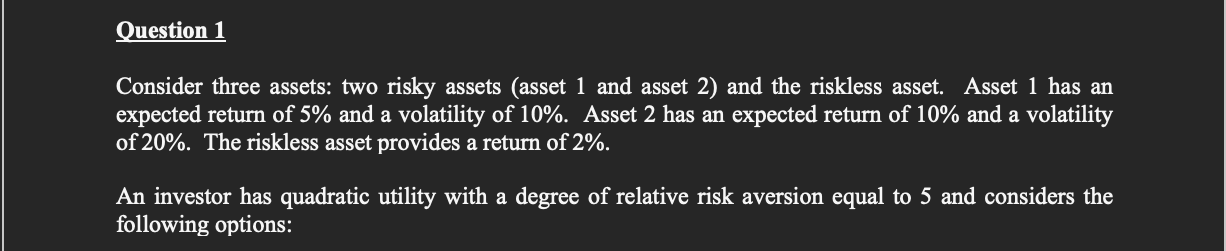

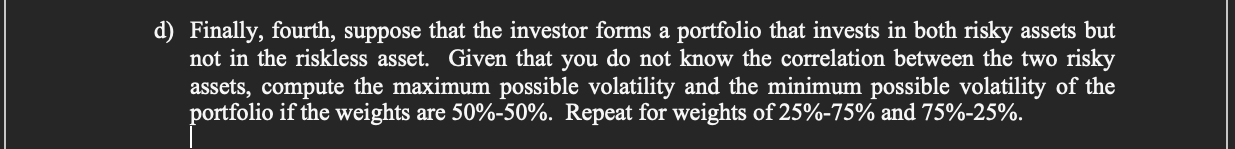

Question 1 Consider three assets: two risky assets (asset 1 and asset 2) and the riskless asset. Asset 1 has an expected return of 5% and a volatility of 10%. Asset 2 has an expected return of 10% and a volatility of 20%. The riskless asset provides a return of 2%. An investor has quadratic utility with a degree of relative risk aversion equal to 5 and considers the following options: d) Finally, fourth, suppose that the investor forms a portfolio that invests in both risky assets but not in the riskless asset. Given that you do not know the correlation between the two risky assets, compute the maximum possible volatility and the minimum possible volatility of the portfolio if the weights are 50%-50%. Repeat for weights of 25%-75% and 75%-25%.

Step by Step Solution

There are 3 Steps involved in it

To calculate the maximum and minimum possible volatility of a portfolio that invests in both risky a... View full answer

Get step-by-step solutions from verified subject matter experts