Question: Question #1 Consider two stocks, A and B, with the following prices on two given dates. (Date 2 prices are pre-split.) Stock Date 1 Date

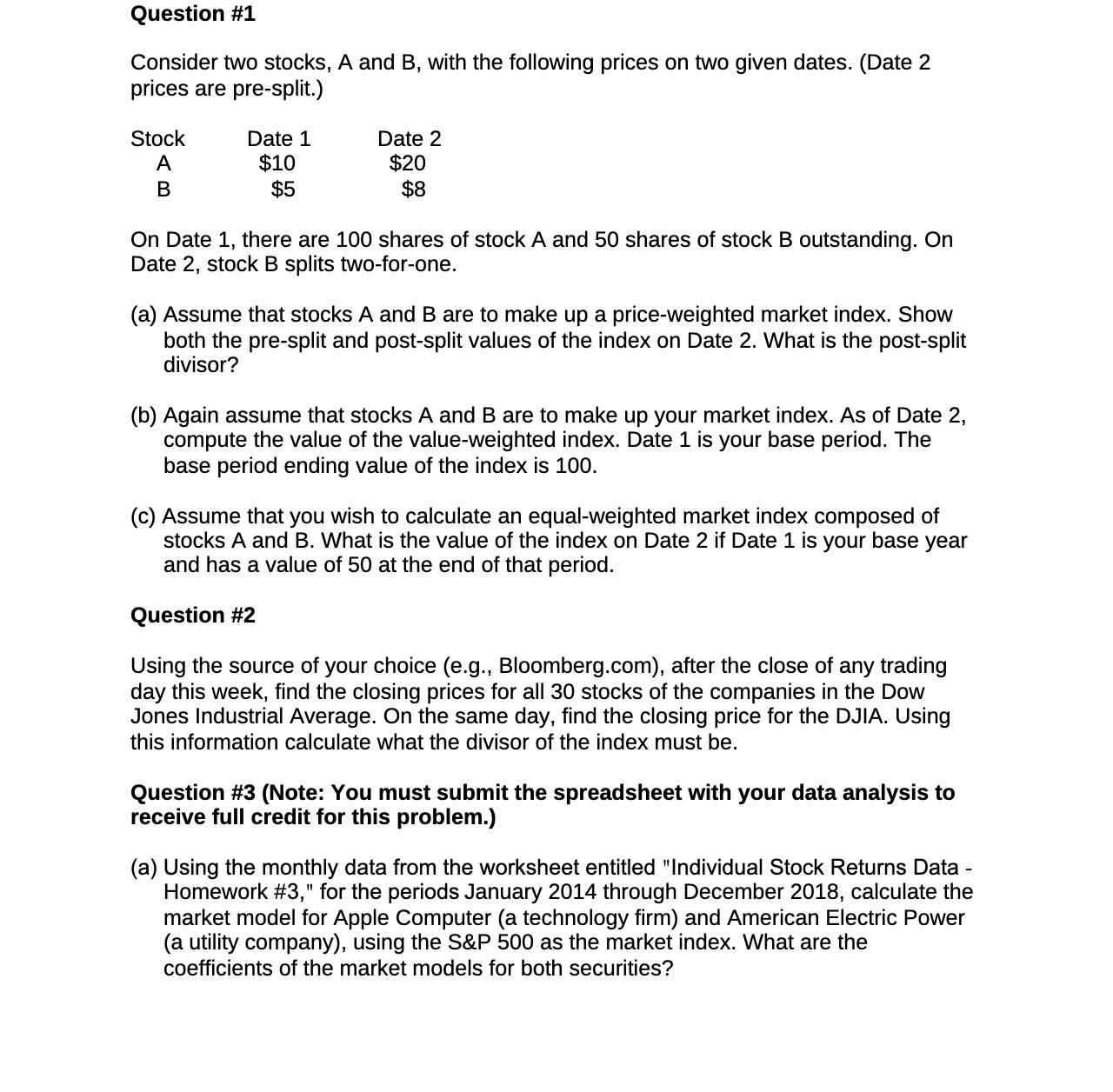

Question #1 Consider two stocks, A and B, with the following prices on two given dates. (Date 2 prices are pre-split.) Stock Date 1 Date 2 A $10 $20 B $5 $8 On Date 1. there are 100 shares of stock A and 50 shares of stock B outstanding. On Date 2, stock B splits two-forone. (a) Assume that stocks A and B are to make up a price-weighted market index. Show both the presplit and postsplit values of the index on Date 2. What is the postsplit divisor? (b) Again assume that stocks A and B are to make up your market index. As of Date 2, compute the value of the valueweighted index. Date 1 is your base period. The base period ending value of the index is 100. (c) Assume that you wish to calculate an equalweighted market index composed of stocks A and B. What is the value of the index on Date 2 if Date 1 is your base year and has a value of 50 at the end of that period. Question #2 Using the source of your choice (e.g.. Bloomberg.com), after the close of any trading day this week, find the closing prices for all 30 stocks of the companies in the Dow Jones Industrial Average. 0n the same day, find the closing price for the DJIA. Using this information calculate what the divisor of the index must be. Question #3 (Note: You must submit the spreadsheet with your data analysis to receive full credit for this problem.) (a) Using the monthly data from the worksheet entitled "Individual Stock Returns Data - Homework #3," for the periods January 2014 through December 2018, calculate the market model for Apple Computer (a technology firm) and American Electric Power (a utility company), using the S&P 500 as the market index. What are the coefficients of the market models for both securities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts