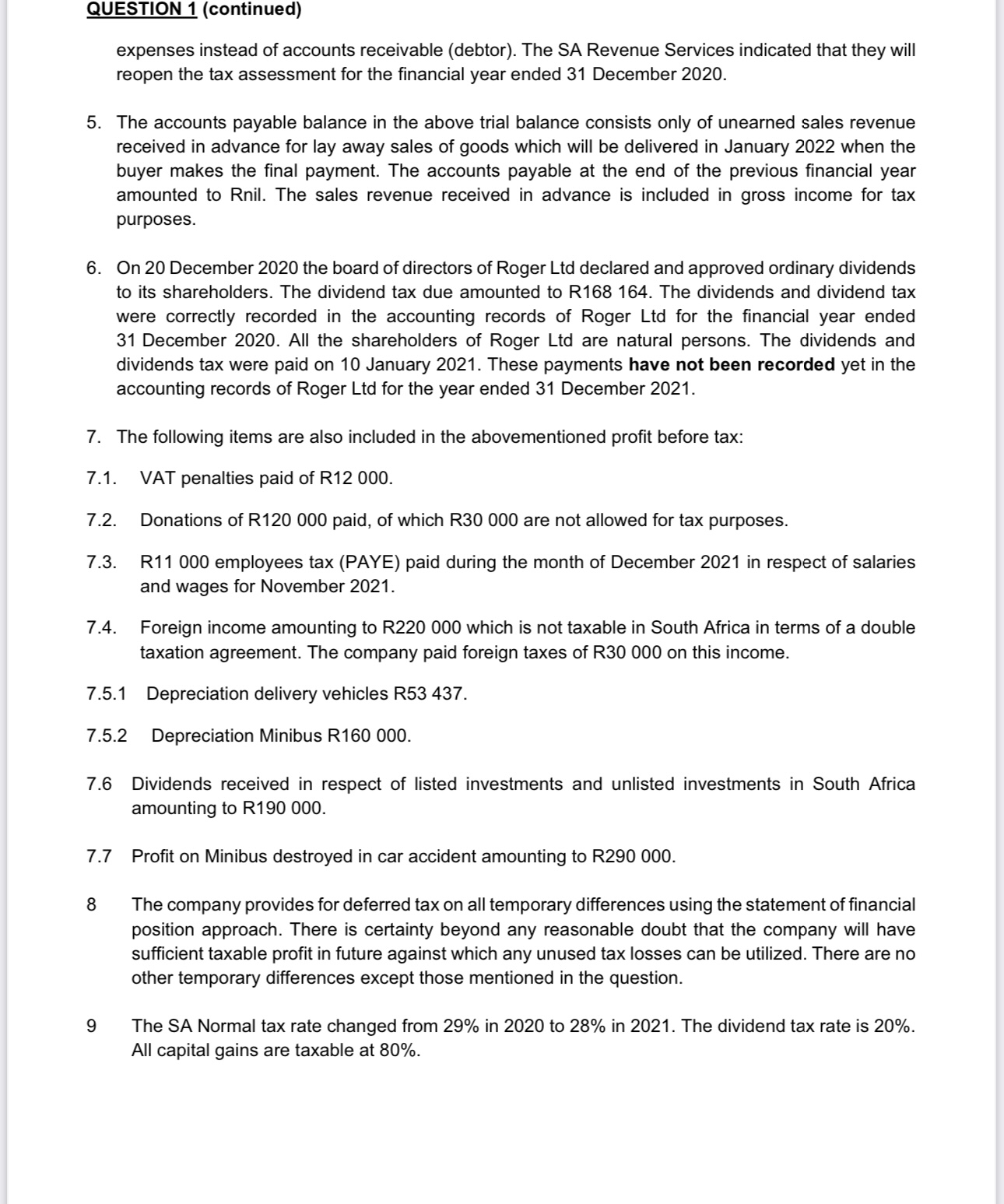

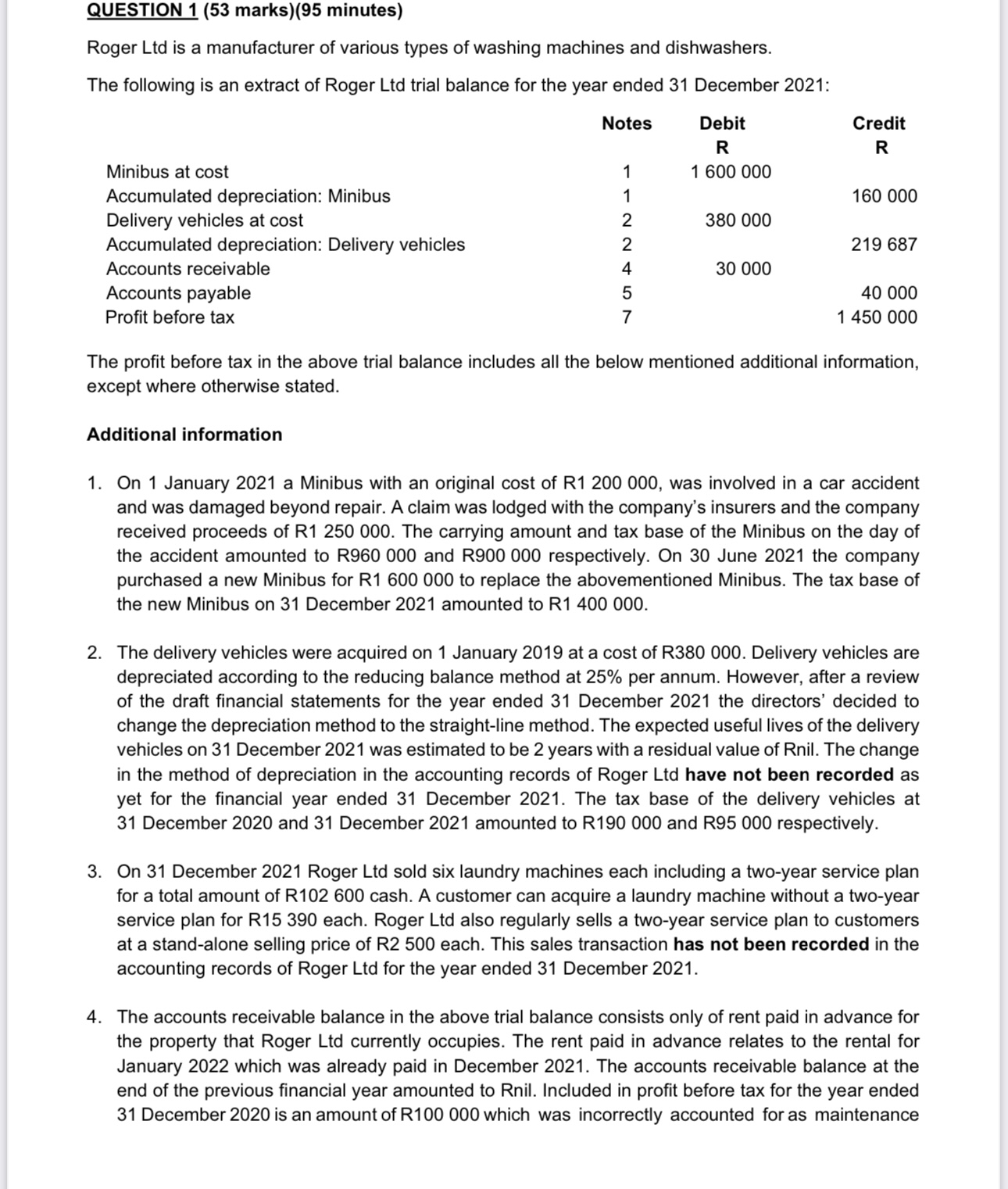

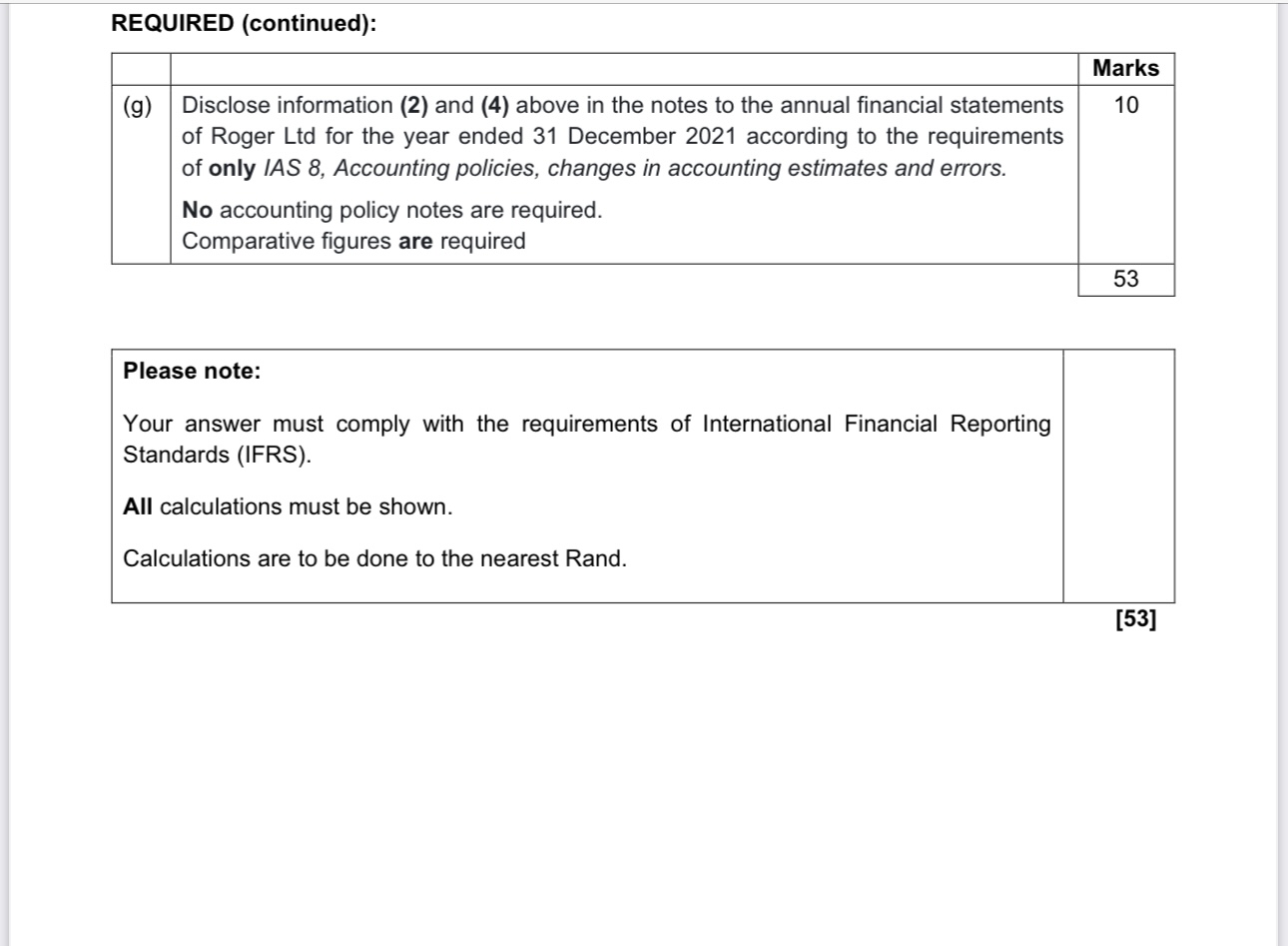

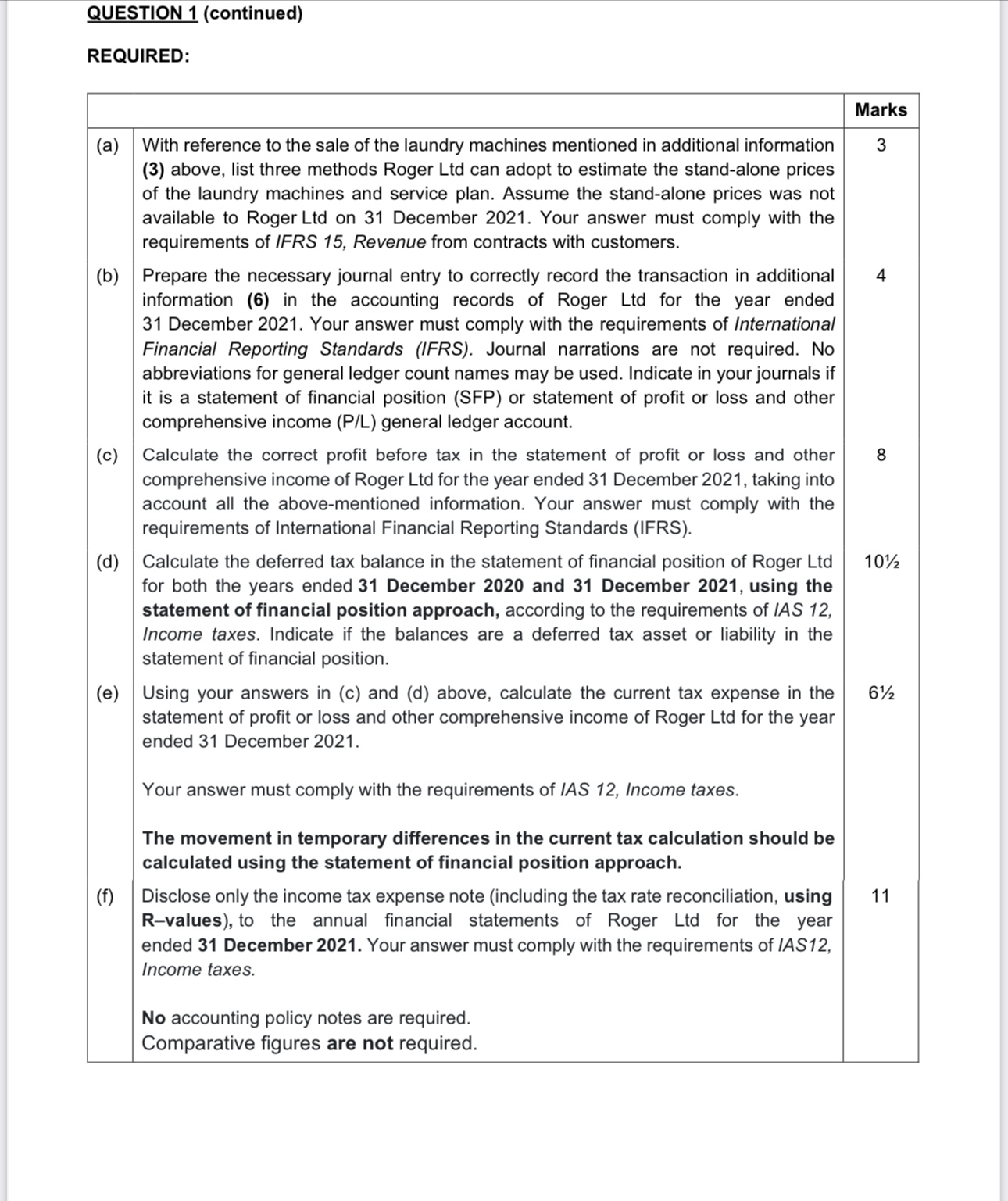

Question: QUESTION 1 (continued) 7. 7.1. 7.2. 7.3. 7.4. 7.5. 7.5 7.6 7.7 expenses instead of accounts receivable (debtor). The SA Revenue Services indicated that they

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts