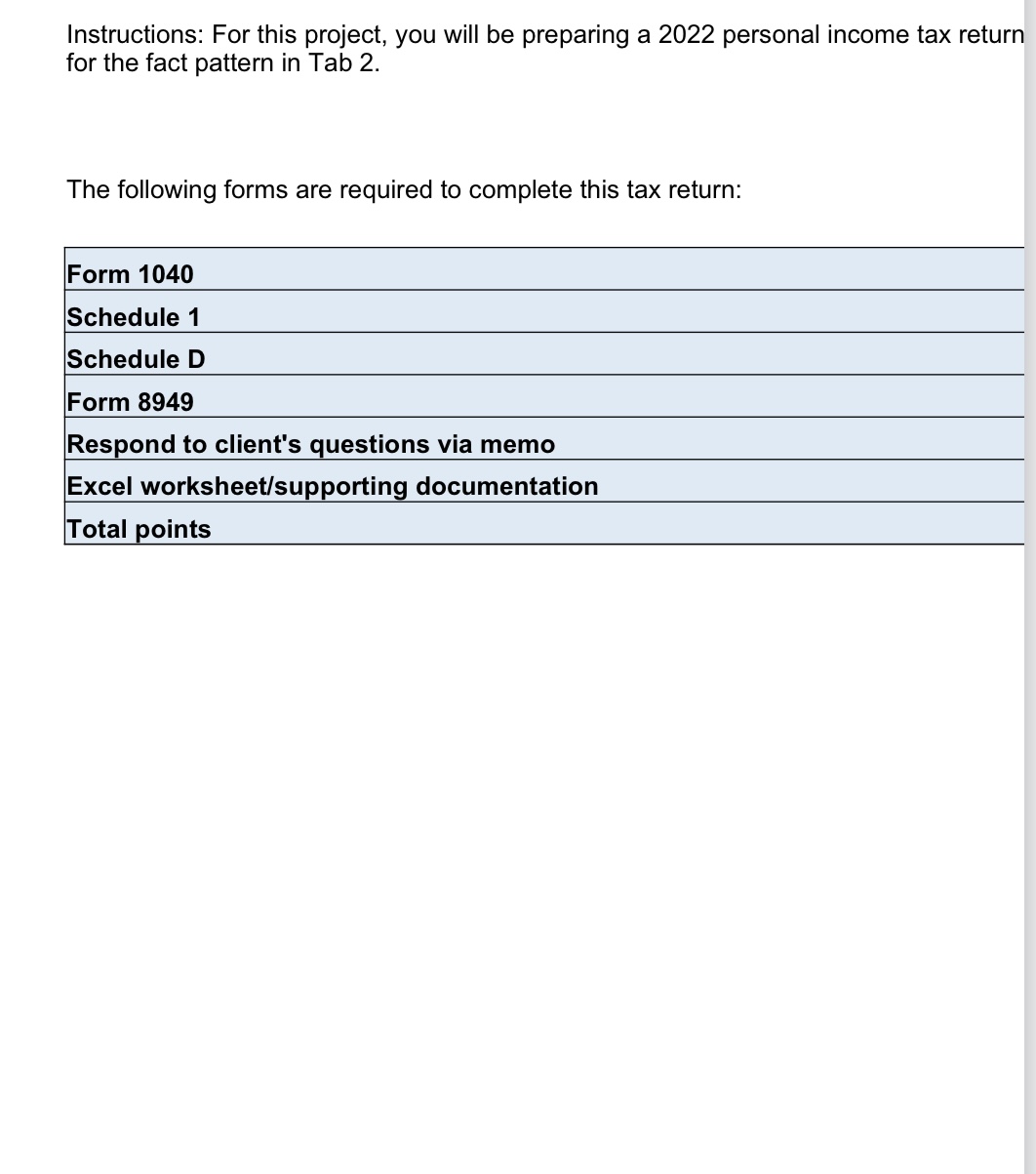

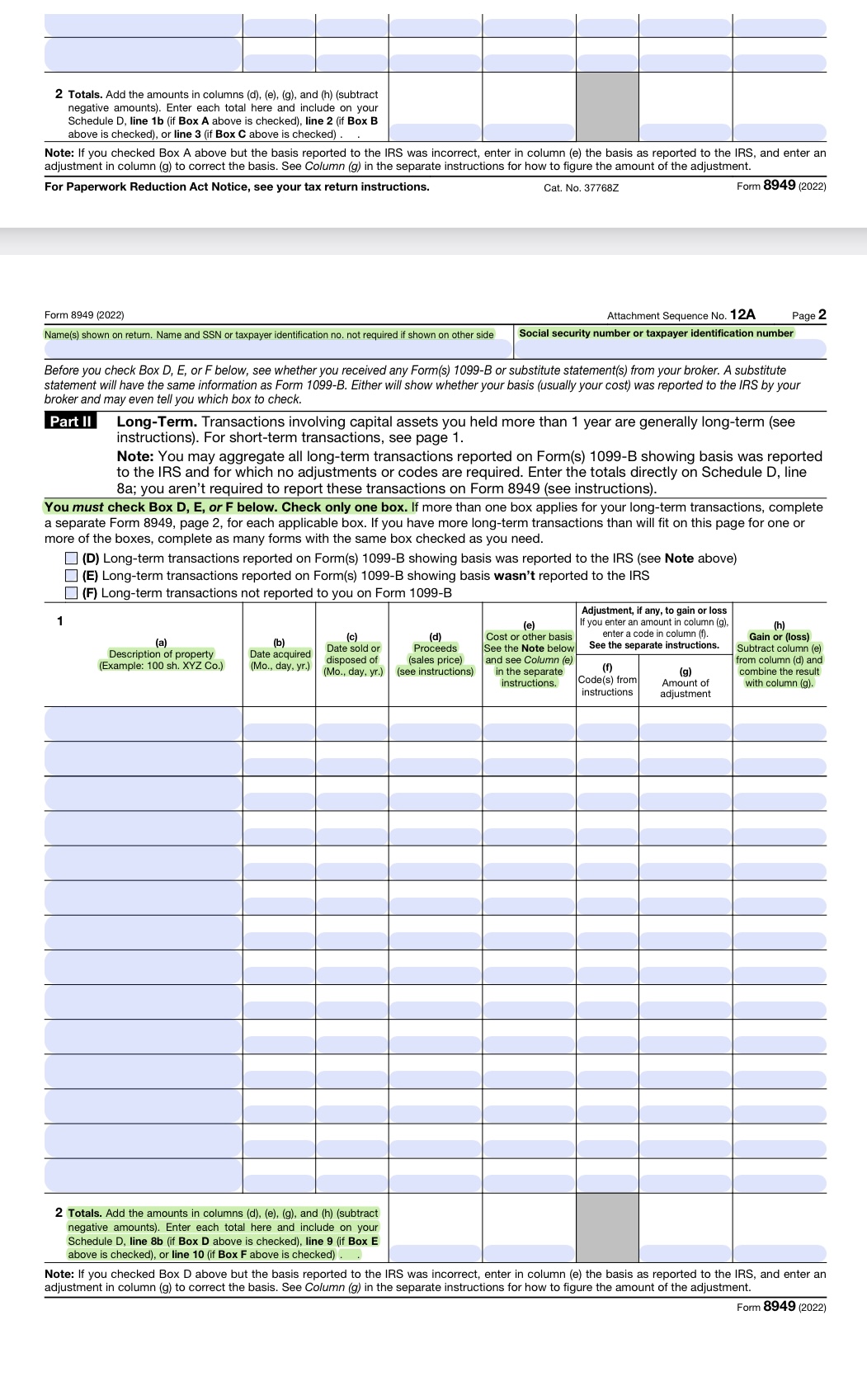

Question: Question 1: Copy and Paste Go URL Link: https://www.irs.gov/pub/irs-pdf/f8949.pdf https://www.irs.gov/pub/irs-pdf/f1040.pdf https://www.irs.gov/pub/irs-pdf/f1040s1.pdf https://www.irs.gov/pub/irs-pdf/f1040sd.pdf Fill out the forms shown in Copy and Paste into Microsoft Excel Date:

Question 1:

Copy and Paste Go URL Link: https://www.irs.gov/pub/irs-pdf/f8949.pdf

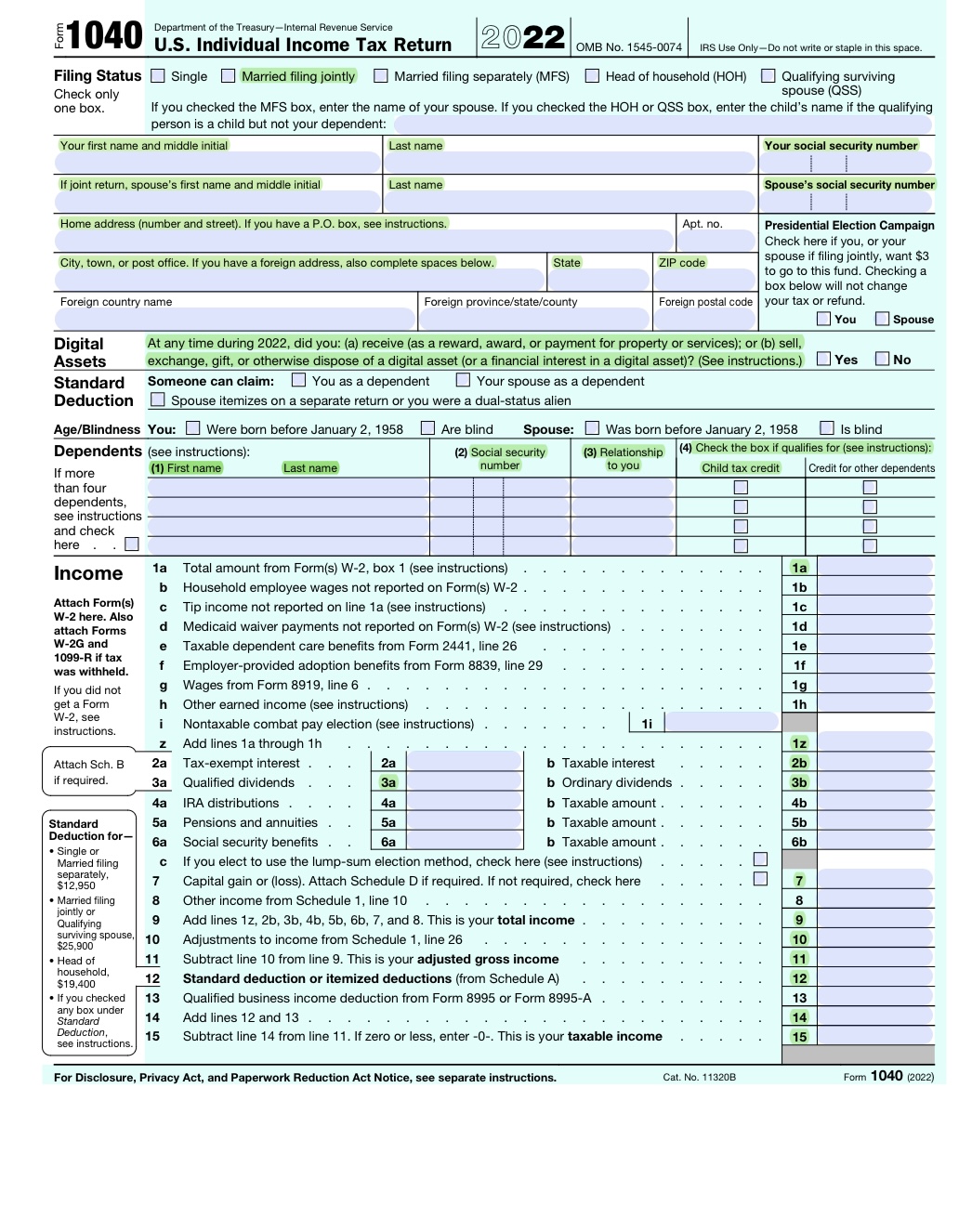

https://www.irs.gov/pub/irs-pdf/f1040.pdf

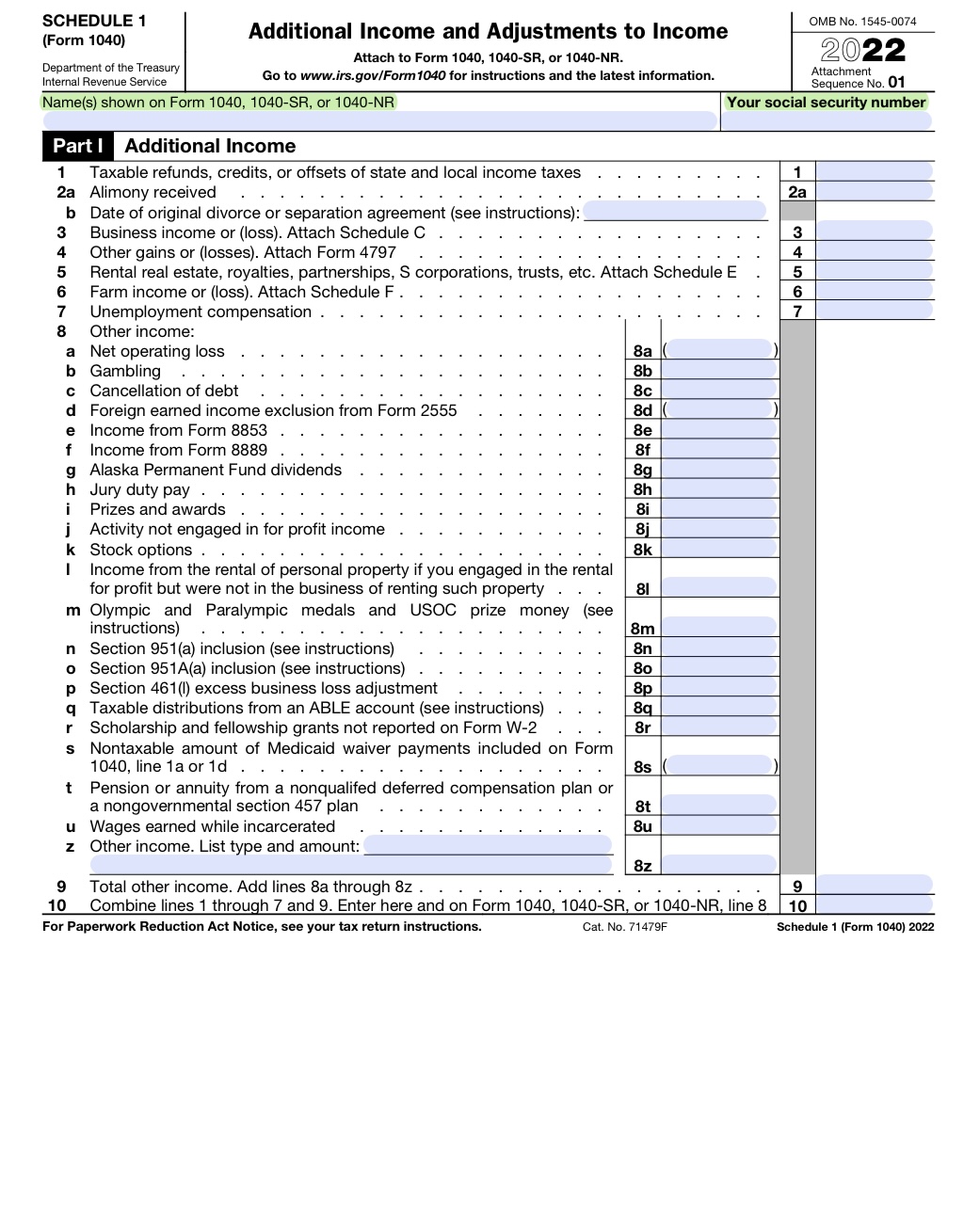

https://www.irs.gov/pub/irs-pdf/f1040s1.pdf

https://www.irs.gov/pub/irs-pdf/f1040sd.pdf

Fill out the forms shown in

Copy and Paste into Microsoft Excel

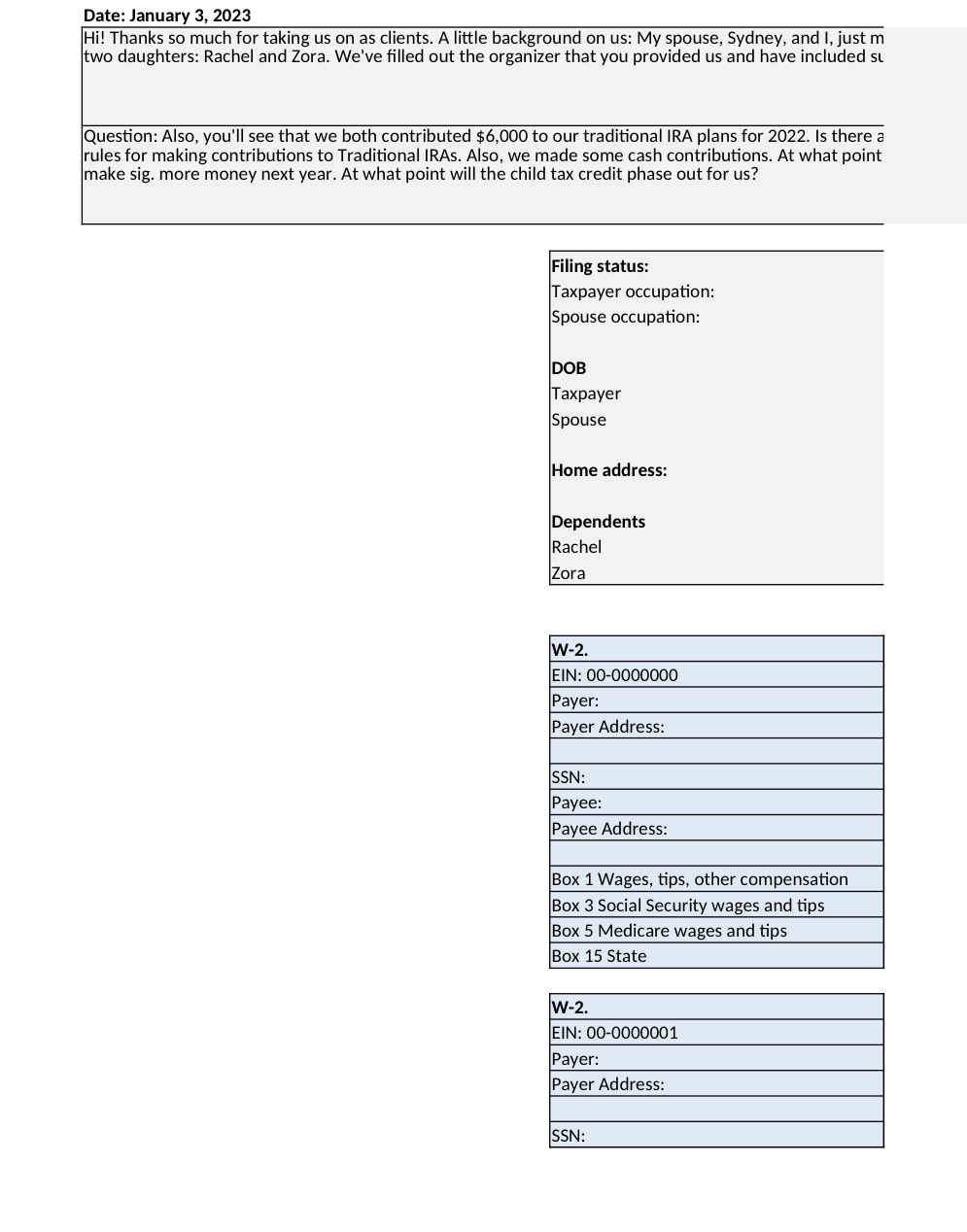

| Date: January 3, 2023 | |||||||

| Hi! Thanks so much for taking us on as clients. A little background on us: My spouse, Sydney, and I, just moved to Texas January 1, 2022. We want to buy a house, but right now we are just renting. We have two daughters: Rachel and Zora. We've filled out the organizer that you provided us and have included supporting documentation below. Please let us know if you need any additional information from us. | |||||||

| Question: Also, you'll see that we both contributed $6,000 to our traditional IRA plans for 2022. Is there any point where we can contribute more and get a deduction? I guess I just want a refresher on the rules for making contributions to Traditional IRAs. Also, we made some cash contributions. At what point does charitable contributions help for tax purposes? Last, I believe both myself and my spouse will make sig. more money next year. At what point will the child tax credit phase out for us? | |||||||

| Filing status: | MFJ | ||||||

| Taxpayer occupation: | Engineer | ||||||

| Spouse occupation: | Engineer | ||||||

| DOB | |||||||

| Taxpayer | 1/5/75 | ||||||

| Spouse | 6/8/75 | ||||||

| Home address: | 123 Rock Rd, Tx, 75001 | ||||||

| Dependents | DOB | SSN | |||||

| Rachel | 1/6/15 | 000-00-0009 | |||||

| Zora | 1/25/20 | 000-00-0010 | |||||

| W-2. | Not required by retirement plan | ||||||

| EIN: 00-0000000 | |||||||

| Payer: | Automobile Engineering Co | ||||||

| Payer Address: | 10 Tree Rd, Tx, 87532 | ||||||

| SSN: | 000-00-0003 | ||||||

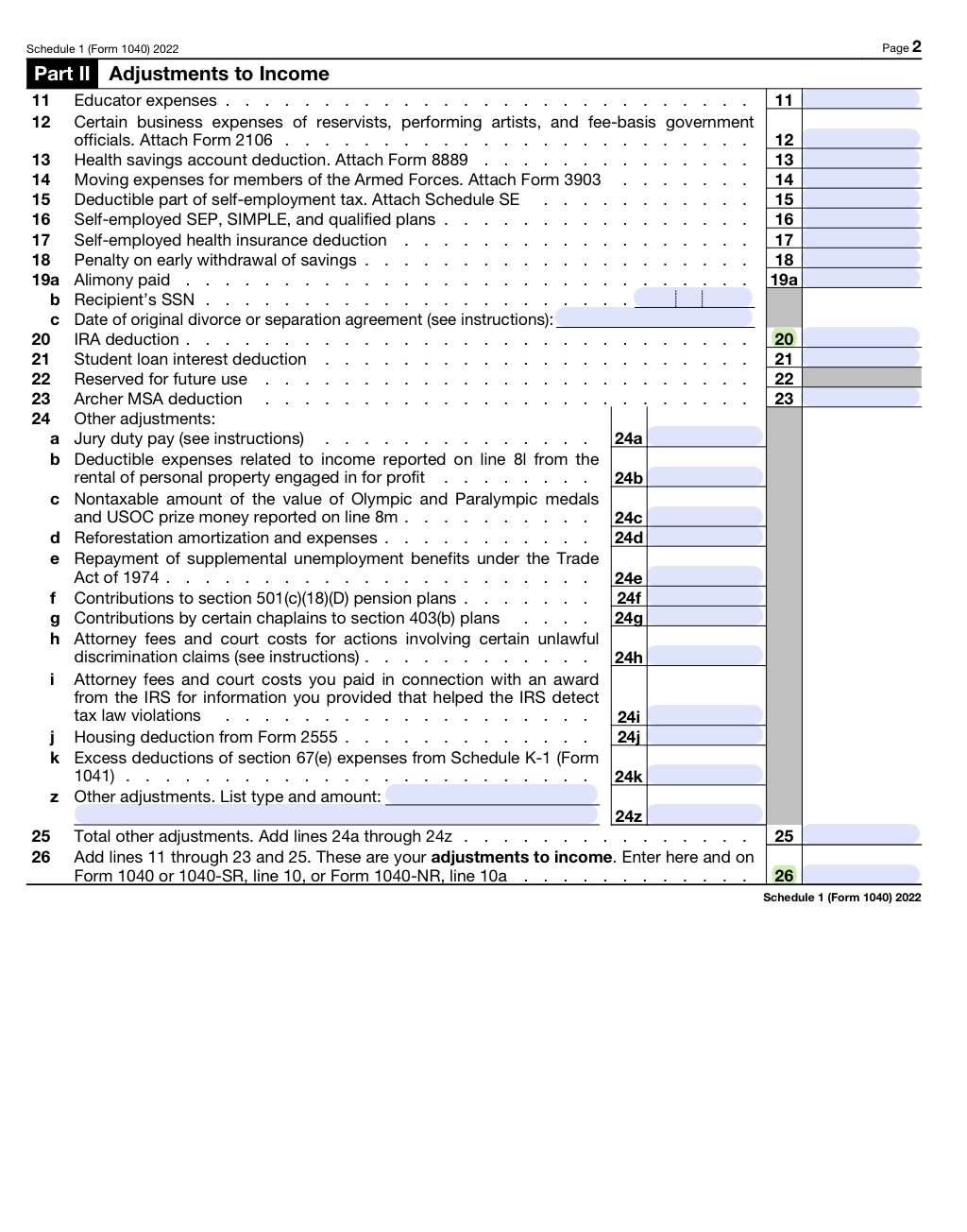

| Payee: | Sydney Jossey | ||||||

| Payee Address: | 11 Tree Rd, Tx, 87532 | ||||||

| Box 1 Wages, tips, other compensation | 150,000.00 | Box 2 Fed income tax withheld | 12,500.00 | ||||

| Box 3 Social Security wages and tips | 147,000.00 | Box 4 Social security tax withheld | 9,114.00 | ||||

| Box 5 Medicare wages and tips | 150,000.00 | Box 6 Medicare tax withheld | 2,175.00 | ||||

| Box 15 State | TX | Box 16 | 150,000.00 | ||||

| W-2. | Not covered by retirement plan | ||||||

| EIN: 00-0000001 | |||||||

| Payer: | Sky Engineering Co | ||||||

| Payer Address: | 10 Tree Rd, Tx, 87532 | ||||||

| SSN: | 000-00-0005 | ||||||

| Payee: | Asher Jossey | ||||||

| Payee Address: | 11 Tree Rd, Tx, 87532 | ||||||

| Box 1 | 100,000.00 | Box 2 | 13,500.00 | ||||

| Box 3 | 100,000.00 | Box 4 | 6,200.00 | ||||

| Box 5 | 100,000.00 | Box 6 | 1,450.00 | ||||

| Box 15 | TX | Box 16 | 100,000.00 | ||||

| 1099-INT | |||||||

| Payer: Wells Fargo | |||||||

| Box 1 | 105.00 | ||||||

| 1099-DIV | |||||||

| Payer: Verizon Co | |||||||

| Box 1a: Ordinary Dividends | 500.00 | ||||||

| Box 1b: Qualified Dividends | 500.00 | ||||||

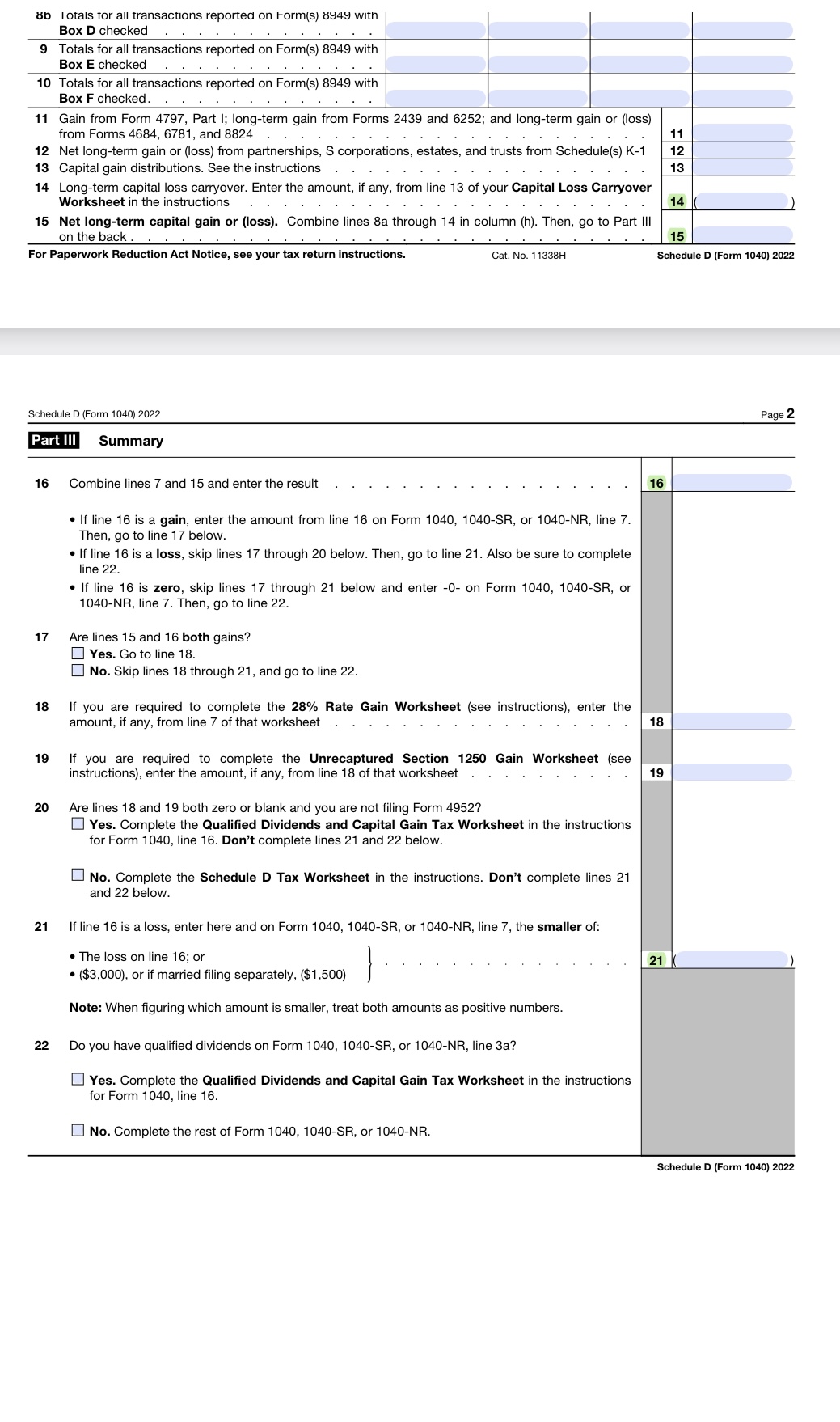

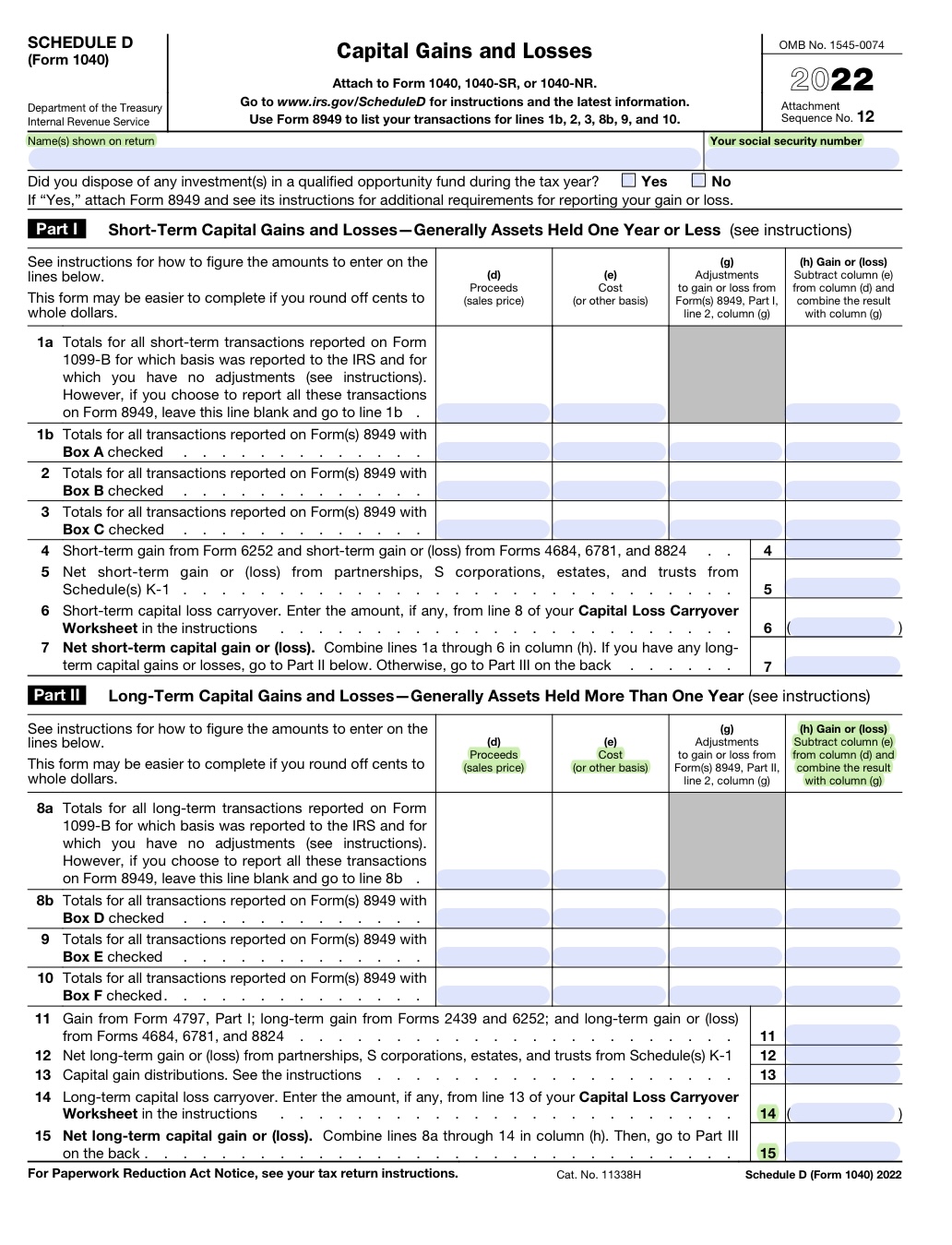

| 1099-B 2022 Proceeds from Broker & Barter Exchange Transactions | |||||||

| Long-term capital gains and losses - 1099-B Line 2 - Box 6 Net Proceeds | |||||||

| Covered Transactions - Cost basis reported to IRS - Form 8949, Part II, D | |||||||

| Description of property | 10 Shares XYB Financial Services | ||||||

| Date acquired | 1/1/00 | ||||||

| Date sold | 1/15/22 | ||||||

| Proceeds | 100,000.00 | ||||||

| Costs Basis | 150,000.00 | ||||||

| Note - we did not have any virtual currency during 2022 | |||||||

| Charitable giving | |||||||

| **FYZ Organization | 500.00 | **Any item with ** is a qualified charitable organization | |||||

| **JKK Organization | 200.00 | * Any item with * is a qualified medical expense | |||||

| GoFundMe total | 700.00 | ||||||

| Given - general sales tax - $1748 | |||||||

| Medical | |||||||

| Medical premiums | 8,000.00 | ||||||

| Real Estate Taxes | - | ||||||

| Mortgage Interest | - | ||||||

| Note - (from client) - receipts available upon request | |||||||

| Contributions to Traditional IRA | |||||||

| Taxpayer | 6,000.00 | ||||||

| Spouse | 6,000.00 | ||||||

| Estimated federal tax payments | |||||||

| Q1 | 2,500.00 | ||||||

| Q2 | 2,500.00 | ||||||

| Q3 | 1,000.00 | ||||||

| Q4 | 1,000.00 |

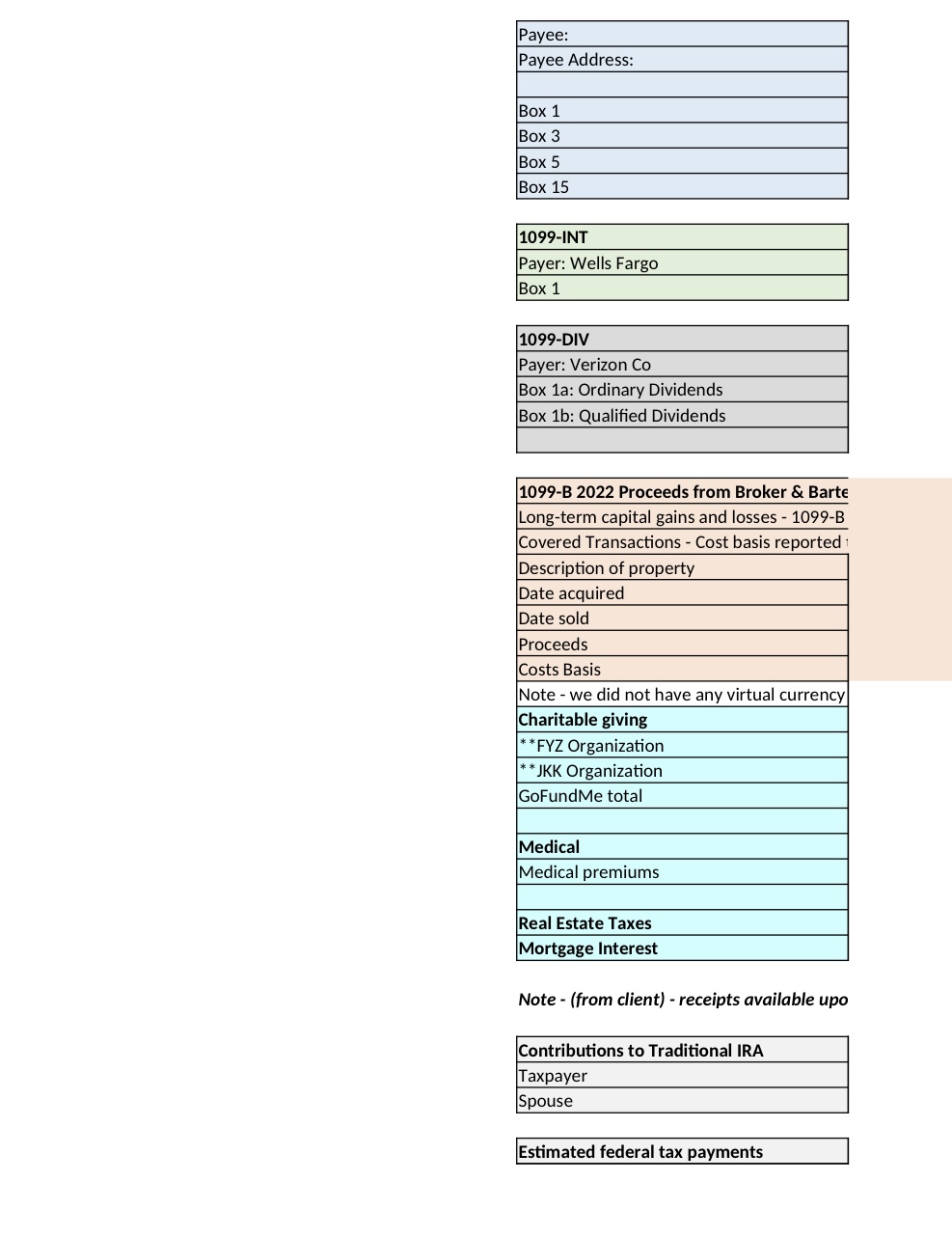

| Total income | |||

| Line 1a | |||

| Taxpayer (Asher) | - | ||

| Spouse (Sydney) | - | ||

| Total Line 1a | - | ||

| Line 2b Taxable Interest | - | ||

| Line 3b Ordinary dividends | - | Line 3a Qualified dividends | - |

| Line 7 Capital gain or (loss) | - | ||

| Line 9 Total income | - | ||

| Line 10 Adjustments to income (Schedule 1) | - | ||

| Line 11 Adjusted gross income | - | ||

| Line 12 Standard deduction | - | ||

| Line 14 Total of Stand or Itemize and QBI deduction | - | ||

| Line 15 Taxable income | - |

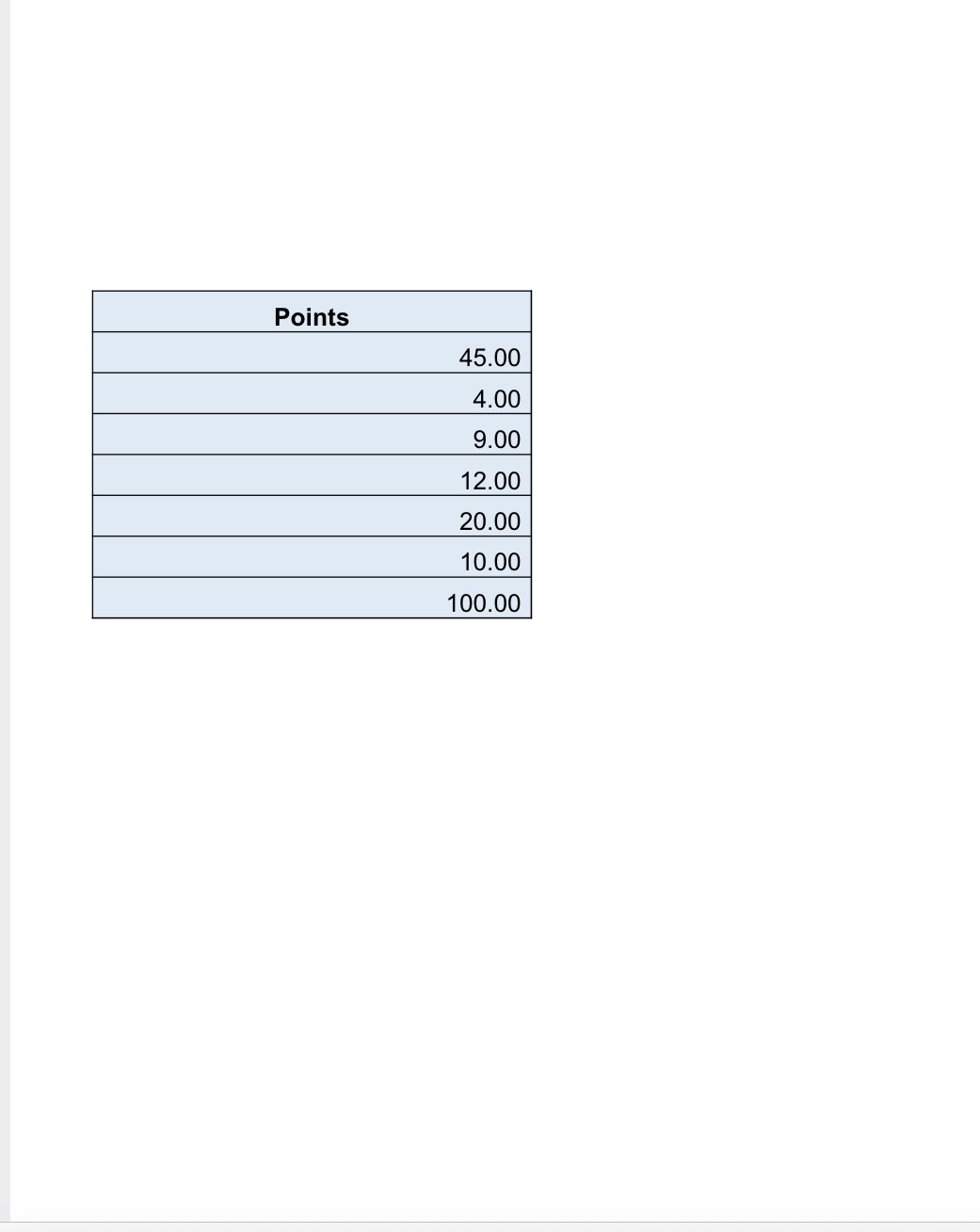

| - | S-term gain | ||||

| Cost basis | - | ||||

| Proceeds | - | ||||

| - | Long-term capital loss of $50,000 | ||||

| - | deductible annually against ordinary income | ||||

| - |

Form 8949 Sales and Other Dispositions of Capital Assets OMB No. 1545-0074 Go to www.irs.gov/Form8949 for instructions and the latest information. 2022 Department of the Treasury File with your Schedule D to list your transactions for lines 1b, 2, 3, 8b, 9, and 10 of Schedule D. Attachment Internal Revenue Service Sequence No. 12A Name(s) shown on return Social security number or taxpayer identification number Before you check Box A, B, or C below, see whether you received any Form(s) 1099-B or substitute statement(s) from your broker. A substitute statement will have the same information as Form 1099-B. Either will show whether your basis (usually your cost) was reported to the IRS by your broker and may even tell you which box to check Part I Short-Term. Transactions involving capital assets you held 1 year or less are generally short-term (see instructions). For long-term transactions, see page 2. Note: You may aggregate all short-term transactions reported on Form(s) 1099-B showing basis was reported to the IRS and for which no adjustments or codes are required. Enter the totals directly on Schedule D, line 1a; you aren't required to report these transactions on Form 8949 (see instructions). You must check Box A, B, or C below. Check only one box. If more than one box applies for your short-term transactions, complete a separate Form 8949, page 1, for each applicable box. If you have more short-term transactions than will fit on this page for one or more of the boxes, complete as many forms with the same box checked as you need. (A) Short-term transactions reported on Form(s) 1099-B showing basis was reported to the IRS (see Note above) (B) Short-term transactions reported on Form(s) 1099-B showing basis wasn't reported to the IRS (C) Short-term transactions not reported to you on Form 1099-B Adjustment, if any, to gain or loss (e) If you enter an amount in column (g), (a) (b) (c) (d) Cost or other basis enter a code in column (1). Gain or (loss) Date sold or Proceeds See the separate instructions. Description of property Date acquired See the Note below Subtract column (e) (Example: 100 sh. XYZ Co.) (Mo., day, yr.) disposed of (sales price) and see Column (e) from column (d) and (Mo., day, yr.) (see instructions) in the separate (g) combine the result instructions. Code(s) from Amount of with column (g) instructions adjustment 2 Totals. Add the amounts in columns (d), (e), (g), and (h) (subtract negative amounts). Enter each total here and include on your Schedule D, line 1b (if Box A above is checked), line 2 (if Box B above is checked), or line 3 (if Box C above is checked) . Note: If you checked Box A above but the basis reported to the IRS was incorrect, enter in column (e) the basis as reported to the IRS, and enter an adjustment in column (9) to correct the basis. See Column (9) in the separate instructions for how to figure the amount of the adjustment. For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 37768Z Form 8949 (2022)8b Iotais for all transactions reported on Form(s) 8949 with Box D checked 9 Totals for all transactions reported on Form(s) 8949 with Box E checked 10 Totals for all transactions reported on Form(s) 8949 with Box F checked. 11 Gain from Form 4797, Part I; long-term gain from Forms 2439 and 6252; and long-term gain or (loss) from Forms 4684, 6781, and 8824 11 12 Net long-term gain or (loss) from partnerships, S corporations, estates, and trusts from Schedule(s) K-1 12 13 Capital gain distributions. See the instructions 13 14 Long-term capital loss carryover. Enter the amount, if any, from line 13 of your Capital Loss Carryover Worksheet in the instructions 14 15 Net long-term capital gain or (loss). Combine lines 8a through 14 in column (h). Then, go to Part III on the back 15 For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 11338H Schedule D (Form 1040) 2022 Schedule D (Form 1040) 2022 Page 2 Part Ill Summary 16 Combine lines 7 and 15 and enter the result 16 . If line 16 is a gain, enter the amount from line 16 on Form 1040, 1040-SR, or 1040-NR, line 7. Then, go to line 17 below. . If line 16 is a loss, skip lines 17 through 20 below. Then, go to line 21. Also be sure to complete line 22. . If line 16 is zero, skip lines 17 through 21 below and enter -0- on Form 1040, 1040-SR, or 1040-NR, line 7. Then, go to line 22. 17 Are lines 15 and 16 both gains? Yes. Go to line 18. No. Skip lines 18 through 21, and go to line 22. 18 If you are required to complete the 28% Rate Gain Worksheet (see instructions), enter the amount, if any, from line 7 of that worksheet 18 19 If you are required to complete the Unrecaptured Section 1250 Gain Worksheet (see instructions), enter the amount, if any, from line 18 of that worksheet 19 20 Are lines 18 and 19 both zero or blank and you are not filing Form 4952? Yes. Complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040, line 16. Don't complete lines 21 and 22 below. No. Complete the Schedule D Tax Worksheet in the instructions. Don't complete lines 21 and 22 below. 21 If line 16 is a loss, enter here and on Form 1040, 1040-SR, or 1040-NR, line 7, the smaller of: The loss on line 16; or 21 ($3,000), or if married filing separately, ($1,500) Note: When figuring which amount is smaller, treat both amounts as positive numbers. 22 Do you have qualified dividends on Form 1040, 1040-SR, or 1040-NR, line 3a? Yes. Complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040, line 16 No. Complete the rest of Form 1040, 1040-SR, or 1040-NR. Schedule D (Form 1040) 2022Instructions: For this project, you will be preparing a 2022 personal income tax return for the fact pattern in Tab 2. The following forms are required to complete this tax return: Form 1040 Schedule 1 Schedule D Form 8949 Respond to client's questions via memo Excel worksheet/supporting documentation Total points Schedule 1 (Form 1040) 2022 Page 2 Part II Adjustments to Income 11 Educator expenses . 11 12 Certain business expenses of reservists, performing artists, and fee-basis government officials. Attach Form 2106 . 12 13 Health savings account deduction. Attach Form 8889 . 13 14 Moving expenses for members of the Armed Forces. Attach Form 3903 14 15 Deductible part of self-employment tax. Attach Schedule SE 15 16 Self-employed SEP, SIMPLE, and qualified plans . 16 17 Self-employed health insurance deduction 17 18 Penalty on early withdrawal of savings . 18 19a Alimony paid 19a b Recipient's SSN . . C Date of original divorce or separation agreement (see instructions): 20 IRA deduction . 20 21 Student loan interest deduction 21 22 Reserved for future use 22 23 Archer MSA deduction 23 24 Other adjustments: a Jury duty pay (see instructions) 24a b Deductible expenses related to income reported on line 81 from the rental of personal property engaged in for profit . 24h c Nontaxable amount of the value of Olympic and Paralympic medals and USOC prize money reported on line 8m . 240 d Reforestation amortization and expenses . 24d e Repayment of supplemental unemployment benefits under the Trade Act of 1974 . 24e f Contributions to section 501 (c)(18)(D) pension plans . 24f g Contributions by certain chaplains to section 403(b) plans 24g h Attorney fees and court costs for actions involving certain unlawful discrimination claims (see instructions) . . . 24h i Attorney fees and court costs you paid in connection with an award from the IRS for information you provided that helped the IRS detect tax law violations 24i Housing deduction from Form 2555 . . 24j k Excess deductions of section 67(e) expenses from Schedule K-1 (Form 041) . 24k Other adjustments. List type and amount: 24z 25 Total other adjustments. Add lines 24a through 24z . . 25 26 Add lines 11 through 23 and 25. These are your adjustments to income. Enter here and on Form 1040 or 1040-SR, line 10, or Form 1040-NR, line 10a 26 Schedule 1 (Form 1040) 2022Payee: Payee Address: Box 1 Box 3 Box 5 Box 15 1099-INT Payer: Wells Fargo Box 1 1099-DIV Payer: Verizon Co Box 1a: Ordinary Dividends Box 1b: Qualified Dividends 1099-B 2022 Proceeds from Broker & Barte Long-term capital gains and losses - 1099-B Covered Transactions - Cost basis reported Description of property Date acquired Date sold Proceeds Costs Basis Note - we did not have any virtual currency Charitable giving * *FYZ Organization **JKK Organization GoFundMe total Medical Medical premiums Real Estate Taxes Mortgage Interest Note - (from client) - receipts available upo Contributions to Traditional IRA Taxpayer Spouse Estimated federal tax paymentssuonannSULAAS and check here Income 1a Total amount from Form(s) W-2, box 1 (see instructions) 1a Household employee wages not reported on Form(s) W-2 1b Attach Form(s) 1c W-2 here. Also Tip income not reported on line 1a (see instructions) attach Forms Medicaid waiver payments not reported on Form(s) W-2 (see instructions) 1d W-2G and Taxable dependent care benefits from Form 2441, line 26 1e D 1099-R if tax was withheld. Employer-provided adoption benefits from Form 8839, line 29 if If you did not Wages from Form 8919, line 6 . 1g get a Form Other earned income (see instructions) 1h W-2, see instructions. Nontaxable combat pay election (see instructions) Z Add lines 1a through 1h 1z Attach Sch. B 2a Tax-exempt interest b Taxable interest 2b f required 3a Qualified dividends 3a b Ordinary dividends 3b IRA distributions 4a b Taxable amount . 4b Standard 5a Pensions and annuities . 5a b Taxable amount . 5b Deduction for- 6a 6a 6b . Single or Social security benefits . . b Taxable amount . Married filing If you elect to use the lump-sum election method, check here (see instructions) separately, 0 $12,950 Capital gain or (loss). Attach Schedule D if required. If not required, check here 7 Married filing Other income from Schedule 1, line 10 . 8 jointly or Qualifying Add lines 1z, 2b, 3b, 4b, 5b, 6b, 7, and 8. This is your total income 19 surviving spouse, $25,900 10 Adjustments to income from Schedule 1, line 26 10 Head of 11 Subtract line 10 from line 9. This is your adjusted gross income 11 household, $19,400 12 Standard deduction or itemized deductions (from Schedule A) 12 If you checked 13 Qualified business income deduction from Form 8995 or Form 8995-A 13 any box under Standard 14 Add lines 12 and 13 . 14 Deduction, 15 see instructions. Subtract line 14 from line 11. If zero or less, enter -0-. This is your taxable income 15 For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. Cat. No. 11320B Form 1040 (2022) Form 1040 (2022) Page 2 Tax and 16 Tax (see instructions). Check if any from Form(s): 1 8814 2 4972 3 16 Credits 17 Amount from Schedule 2, line 3 17 18 Add lines 16 and 17 . 18 19 Child tax credit or credit for other dependents from Schedule 8812 19 20 Amount from Schedule 3, line 8 20 Add lines 19 and 20 . 21 Subtract line 21 from line 18. If zero or less, enter -0- 22 23 Other taxes, including self-employment tax, from Schedule 2, line 21 23 24 Add lines 22 and 23. This is your total tax 24 Payments 25 Federal income tax withheld from: a Form(s) W-2 25a Form(s) 1099 25b C Other forms (see instructions) 25c d Add lines 25a through 25c 25d If you have a 26 2022 estimated tax payments and amount applied from 2021 return . 26 qualifying child, attach Sch. EIC. 27 Earned income credit (EIC) . . 27 28 Additional child tax credit from Schedule 8812 28 29 American opportunity credit from Form 8863, line 8 . 29 30 Reserved for future use . . 30 31 Amount from Schedule 3, line 15 31 32 Add lines 27, 28, 29, and 31. These are your total other payments and refundable credits 32 33 Add lines 25d, 26, and 32. These are your total payments 33 Refund 34 If line 33 is more than line 24, subtract line 24 from line 33. This is the amount you overpaid 34 35a Amount of line 34 you want refunded to you. If Form 8888 is attached, check here 35a Direct deposit? b Routing number c Type: Checking Savings See instructions. d Account number 36 Amount of line 34 you want applied to your 2023 estimated tax . 36 Amount 37 Subtract line 33 from line 24. This is the amount you owe. You Owe For details on how to pay, go to www.irs.gov/Payments or see instructions . 37 38 Estimated tax penalty (see instructions) 38 Third Party Do you want to allow another person to discuss this return with the IRS? See Designee instructions Yes. Complete below. No Designee's Phone Personal identification name no. number (PIN) Sign Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief, they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge. Here Your signature Date Your occupation If the IRS sent you an Identity Protection PIN, enter it here Joint return? (see inst.) See instructions. Spouse's signature. If a joint return, both must sign. Date Spouse's occupation If the IRS sent your spouse an Keep a copy for Identity Protection PIN, enter it here your records. (see inst.) Phone no. Email address Preparer's name Preparer's signature Date PTIN Check if: Paid Self-employed Preparer Phone no . Use Only Firm's name Firm's address Firm's EIN Go to www.irs.gov/Form1040 for instructions and the latest information. Form 1040 (2022)2 Totals. Add the amounts In columns (on. [9). [g]. and (h) [subtract negative amounts]. Enter each total here and include on your Schedule D. line 1!: (if Box A above is checked], line 2 (If Box El above is checked]. or line 3 Gt Box 0 above is checked) . Note: it you checked Box A above but the basis reported to the IRS was incorrect. enter in column [a] the basis as reported to the iRS, and enter an adjustment in column (9} to correct the basis. See Column {9} in the separate instructions for how to figure the amount ofthe adjustment. Form 8949 (20223 For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 377682 Form 8949 2022: Attachment Sequence No. 12A Page 2 Namels} shown on return. Name and SSN or taxpayerioentltication no. not required If shown on other side Social security number or taxpayer identification number Before you check Box D, E. or F below. see whether you received any Fonnls) 109978 or substitute statementfs) from your broker. A substitute statement will have the same information as Form 10998. Either will Show whether your basis fusuallyyour cost) was reported to the MS by your broker and may even tell you which box to check. Long-Term. Transactions involving capital assets you held more than 1 year are generally long-term (see instructions}. For short-term transactions, see page t. Note: You may aggregate all long-term transactions reported on Form(sj 1099-3 showing basis was reported to the IRS and for which no adjustments or codes are required. Enter the totals directly on Schedule D, line 8a: you aren't required to report these transactions on Form 8949 (see instructions]. You must check Box D. E. or F below. Check only one box. It more than one box applies for your longterm transactions, complete a separate Form 8949. page 2, for each applicable box. It you have more longsterm transactions than will fit on this page for one or more of the boxes. complete as many forms with the same box checked as you need. (D) Longterm transactions reported on Form(s) 'lDQQ-B showing basis was reported to the IRS (see Note above) {E} Longterm transactions reported on Form(s) 10993 showing basis wasn't reported to the IRS {F} Longterm transactions not reported to you on Form 10998 Adjustment, it any, to gain or loss 1 [e] If you enter an amount in column [9], \"1] [all [b] Is) to} cost or other basis enter a we I\" PU'UW' {i can or oss] Description of property Date acquired Date sold or Proceeds See the Note below See "'9 separate Instructions. Subtract column (e1 {Example' 100 an XYZ Co) {Mo da r) disposed of (sales price) and see Colman (e) from column td} and ' ' ' " v, y ' (Mo. day. yr.) [see instructions} In the separate "3 (g) combine the result Instructions. 00555] from Amou nt of with column {g}. inslru clions adjustment 2 Totals. Add the amounts in columns negative amounts). Enter each tota here and inc [d], le). {9), and {h} {subtract ude on your Schedule D, line 6b {if Box D above is checked}, line 9 {if Box E above is checked], or line 1001301 F above is checked) . Note: it you checked Box D above but the basis reported to the IRS was incorrect, enter in column (e) the basis as reported to the lRS, and enter an adjustment in column (9) to correct the basis. See Column (9) in the separate instructions for how to figure the amount ofthe adjustment. Form 8949 (2022] \fDate: January 3, 2023 Hi! Thanks so much for taking us on as clients. A little background on us: My spouse, Sydney, and I, just m two daughters: Rachel and Zora. We've filled out the organizer that you provided us and have included su Question: Also, you'll see that we both contributed $6,000 to our traditional IRA plans for 2022. Is there a rules for making contributions to Traditional IRAS. Also, we made some cash contributions. At what point make sig. more money next year. At what point will the child tax credit phase out for us? Filing status: Taxpayer occupation: Spouse occupation: DOB Taxpayer Spouse Home address: Dependents Rachel Zora W-2 EIN: 00-0000000 Payer: Payer Address SSN: Payee: Payee Address: Box 1 Wages, tips, other compensation Box 3 Social Security wages and tips Box 5 Medicare wages and tips Box 15 State W - 2 . EIN: 00-0000001 Payer: Payer Address: SSN:SCHEDULE D Capital Gains and Losses OMB No. 1545-00?4 (Form 1040} _ Attach to Form 1040, 1040-SR, or 1040-NR. 2 22 D 6D artmenl of the Treasury Go to www.irs.govf3chedule for instructious and the latest information. Attachment Internal Revenue Service Use Form 8949 to list your transactions for lines 1b, 2, 3, 8b, 9, and 10. Sequence No. 12 Name(s} shown on return Your social security number Did you dispose of any investmentls} in a qualified opportunity fund during the tax year? [:1 Yes I: No If \"Yes," attach Form 8949 and see its instructions for additional requirements for reporting your gain or loss. See instructions for how to figure the amounts to enter on the to] lines below. [d] is] Adjustments . . _ Procews Cost to gain or loss from This form may be easier to complete If you round off cents to {53.95 price} [or other basis; Fan-\"[5; 3949' part I, whole dollars. line 2. column [9] 1a Totals for all short-term transactions reported on Form 10993 for which basis was reported to the IRS and for which you have no adjustments {see instructions). However, if you choose to report all these transactions on Form 8949, leave this line blank and go to line 1b Totals for all transactions reported on Formts} 8949 with Box A checked Short-Term Capital Gains and LossesGenerally Assets Held One Year or Less (see instructions) [h] Gain or [loss] Subtract colum n ie} from oolu mn [d] and combine the result with column {9} Totals for all transactions reported on Formts} 8949 with Box B checked 3 Totals for all transactions reported on Formts} 8949 with Box C checked . . . . . . 4 Short term gain from Form 6252 and short term gain or (loss) from Forms 4684, 6781, and 8824 4 5 Net shortterm gain or {loss} from partnerships, S corporations, estates, and trusts from Schedule{s} K1 5 E Short term capital loss carryover. Enter the amount, it any, from line 8 of your Capital Loss Carryover Worksheet In the instructions . . . . . IB { l 7 Net short- term capital gain or {loss}. Combine lines 1a through 6 In column {h}. If you have any long term capital gains or losses, go to Part II below. Othennvise, go to Part III on the back 7 Part II Long-Term Capital Gains and LossesGenerally Assets Held More Than One Year (see instructions) See instructions for how to figure the amounts to enter on the is) [h] Gain or [loss] lines below. [d] to] Adjustments Subtract column re} _ _ _ Proceeds Cost to gain or loss from from column {d} and ThIS 10"\" may be 8853' TO GOWDIGTB If YOU VOUHU 0ft Gems '[0 (sales price} {or other basis} Form{s} 3949. Part II, combine the result whole dollars. line 2, column [9] with column (9} 8a Totals for all longterm transactions reported on Form 10993 for which basis was reported to the IRS and for which you have no adjustments {see instructions). However. if you choose to report all these transactions on Form 8949, leave this line blank and go to line 8b 8b Totals for all transactions reported on Formts} 8949 with Box D checked 9 Totals for all transactions reported on Formts} 8949 with Box E checked 10 Totals for all transactions reported on Formls} 8949 with Box F checked. . . . . . 11 Gain from Form 479?, Part I: long term gain from Forms 2439 and 6252; and longterm gain or {loss} from Forms 4684, 6?81, and 8824 . . . . . . . . . . . . . 11 12 Net long- -ten'n gain or (loss) from partnerships, S corporations, estates, and trusts from Schedule{s) K- 1 12 13 Capital gain distributions. See the instructions 13 14 Long- -tenTI capital loss canyover. Enter the amount, if any, from line 13 of your Capital Loss Carryover Worksheet In the instructions . . . . . . . . . . . . . . 14 { ll 15 Net long- -term capital gain or {loss}. Combine lines 8a through 14 in column [h]. Then, go to Part III on the back . 15 For Paperwork Heductiou Act Notice, see your tax return instructions. Cat, No_ 11338H Schedule D [Form 1940] 2022 $1040 Department of the Treasury-Internal Revenue Service U.S. Individual Income Tax Return 2022 OMB No. 1545-0074 | IRS Use Only-Do not write or staple in this space. Filing Status _ Single Married filing jointly Married filing separately (MFS) Head of household (HOH) _ Qualifying surviving Check only spouse (QSS) one box. If you checked the MFS box, enter the name of your spouse. If you checked the HOH or QSS box, enter the child's name if the qualifying person is a child but not your dependent: Your first name and middle initial Last name Your social security number If joint return, spouse's first name and middle initial Last name Spouse's social security number Home address (number and street). If you have a P.O. box, see instructions. Apt. no. Presidential Election Check here if you, or your spouse if filing jointly, want $3 City, town, or post office. If you have a foreign address, also complete spaces below. State ZIP code to go to this fund. Checking a box below will not change Foreign country name Foreign province/state/county Foreign postal code | your tax or refund. You Spouse Digital At any time during 2022, did you: (a) receive (as a reward, award, or payment for property or services); or (b) sell, Assets exchange, gift, or otherwise dispose of a digital asset (or a financial interest in a digital asset)? (See instructions.) | Yes No Standard Someone can claim: You as a dependent Your spouse as a dependent Deduction Spouse itemizes on a separate return or you were a dual-status alien Age/Blindness You: Were born before January 2, 1958 Are blind Spouse: Was born before January 2, 1958 Is blind Dependents (see instructions): (2) Social security (3) Relationship (4) Check the box if qualifies for (see instructions): number to you If more (1) First name Last name Child tax credit Credit for other dependents than four dependents, see instructions and check here . .0 Income 1a Total amount from Form(s) W-2, box 1 (see instructions) 1a b Household employee wages not reported on Form(s) W-2 . 1b Attach Form(s) C W-2 here. Also Tip income not reported on line 1a (see instructions) 1c attach Forms d Medicaid waiver payments not reported on Form(s) W-2 (see instructions) 1d W-2G and e Taxable dependent care benefits from Form 2441, line 26 le 1099-R if tax was withheld. Employer-provided adoption benefits from Form 8839, line 29 if If you did not 9 Wages from Form 8919, line 6 . 1g get a Form Other earned income (see instructions) 1h W-2, see instructions. Nontaxable combat pay election (see instructions) . Z Add lines 1a through 1h 1z Attach Sch. B 2a Tax-exempt interest 2a b Taxable interest 2b if required. 3a Qualified dividends 3a b Ordinary dividends 3b 4a IRA distributions 4a b Taxable amount . 4b Standard 5a Pensions and annuities 5a b Taxable amount . 5b Deduction for- Ba Social security benefits . 6a b Taxable amount . 6b . Single or Married filing If you elect to use the lump-sum election method, check here (see instructions) separately, $12,950 Capital gain or (loss). Attach Schedule D if required. If not required, check here 7 Married filing Other income from Schedule 1, line 10 8 jointly or Qualifying Add lines 1z, 2b, 3b, 4b, 5b, 6b, 7, and 8. This is your total income 9 surviving spouse, $25,900 Adjustments to income from Schedule 1, line 26 10 Head of Subtract line 10 from line 9. This is your adjusted gross income 11 household $19,400 Standard deduction or itemized deductions (from Schedule A) 12 . If you checked Qualified business income deduction from Form 8995 or Form 8995-A 13 any box under Standard Add lines 12 and 13 14 Deduction, 15 see instructions Subtract line 14 from line 11. If zero or less, enter -0-. This is your taxable income 15 For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. Cat. No. 11320B Form 1040 (2022)SCHEDULE 1 OMB No. 1545-0074 (Form 1040) Additional Income and Adjustments to Income Attach to Form 1040, 1040-SR, or 1040-NR. 2022 Department of the Treasury Go to www.irs.gov/Form 1040 for instructions and the latest information. Attachment Internal Revenue Service Sequence No. 01 Name(s) shown on Form 1040, 1040-SR, or 1040-NR Your social security number Part I Additional Income 1 Taxable refunds, credits, or offsets of state and local income taxes 2a Alimony received 2a b Date of original divorce or separation agreement (see instructions): Business income or (loss). Attach Schedule C . . 3 Other gains or (losses). Attach Form 4797 4 Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach Schedule E 5 Farm income or (loss). Attach Schedule F . 6 Unemployment compensation . 7 Other income: Net operating loss 8a Gambling 8b Cancellation of debt 8c Foreign earned income exclusion from Form 2555 8d Income from Form 8853 8e Income from Form 8889 8f Alaska Permanent Fund dividends 8g h Jury duty pay 8h Prizes and awards . 8i Activity not engaged in for profit income 8j k Stock options . 8k Income from the rental of personal property if you engaged in the rental for profit but were not in the business of renting such property . 81 m Olympic and Paralympic medals and USOC prize money (see instructions) . 8m n Section 951(a) inclusion (see instructions) 8n Section 951A(a) inclusion (see instructions) . 80 Section 461(1) excess business loss adjustment 8p Taxable distributions from an ABLE account (see instructions) 8q Scholarship and fellowship grants not reported on Form W-2 8r Nontaxable amount of Medicaid waiver payments included on Form 1040, line fa or 1d . 8s Pension or annuity from a nonqualifed deferred compensation plan or a nongovernmental section 457 plan 8t u Wages earned while incarcerated 84 z Other income. List type and amount: 8z 9 Total other income. Add lines 8a through 8z . 9 10 Combine lines 1 through 7 and 9. Enter here and on Form 1040, 1040-SR, or 1040-NR, line 8 10 For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 71479F Schedule 1 (Form 1040) 2022

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts