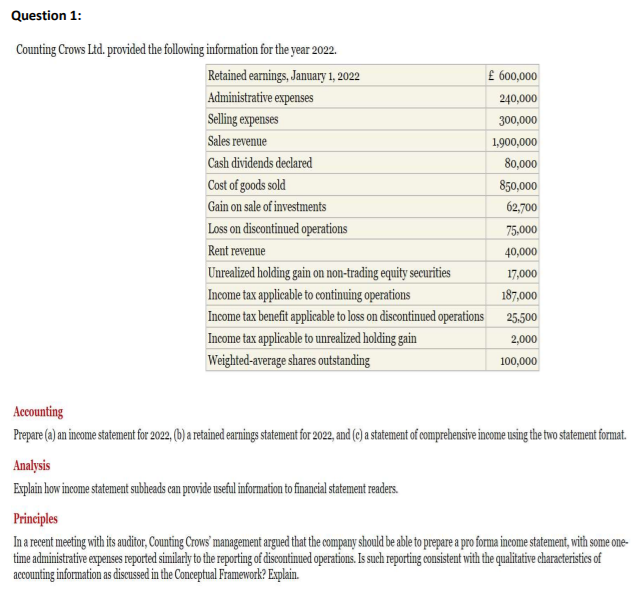

Question: Question 1: Counting Crows Ltd. provided the following information for the year 2022. Retained earnings, January 1, 2022 600,000 Administrative expenses 240,000 Selling expenses 300,000

Question 1: Counting Crows Ltd. provided the following information for the year 2022. Retained earnings, January 1, 2022 600,000 Administrative expenses 240,000 Selling expenses 300,000 Sales revenue 1,900,000 Cash dividends declared 80,000 Cost of goods sold 850,000 Gain on sale of investments 62,700 Loss on discontinued operations 75,000 Rent revenue 40,000 Unrealized holding gain on non-trading equity securities 17,000 Income tax applicable to continuing operations 187,000 Income tax benefit applicable to loss on discontinued operations 25.500 Income tax applicable to unrealized holding gain 2,000 Weighted-average shares outstanding 100,000 Accounting Prepare (a) an income statement for 2022, (b) a retained earnings statement for 2022, and (C) a statement of comprehensive income using the two statement format. Analysis Explain how income statement subheads can provide useful information to financial statement readers. Principles In a recent meeting with its auditor, Counting Crows" management argued that the company should be able to prepare a pro forma income statement, with some one- time administrative expenses reported similarly to the reporting of discontinued operations. Is such reporting consistent with the qualitative characteristics of accounting information as discussed in the Conceptual Framework? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts