Question: Question 1 Crane Co. processes jam and sells it to the public. Crane leases equipment used in its production processes from Larkspur, Inc. This year,

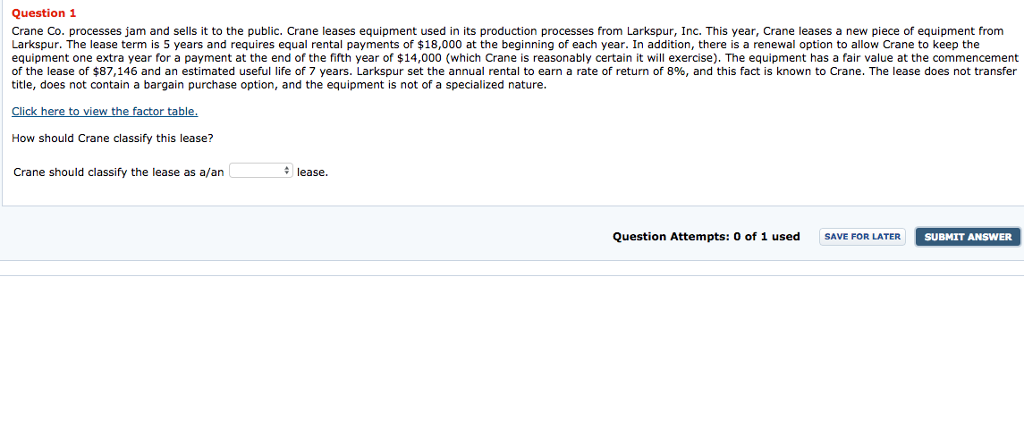

Question 1 Crane Co. processes jam and sells it to the public. Crane leases equipment used in its production processes from Larkspur, Inc. This year, Crane leases a new piece of equipment from Larkspur. The lease term is 5 years and requires equal rental payments of $18,000 at the beginning of each year. In addition, there is a renewal option to allow Crane to keep the equipment one extra year for a payment at the end of the fifth year of $14,000 (which Crane is reasonably certain it will exercise). The equipment has a fair value at the commencement of the lease of $87,146 and an estimated useful life of 7 years. Larkspur set the annual rental to earn a rate of return of 8%, and this fact is known to Crane. The lease does not transfer title, does not contain a bargain purchase option, and the equipment is not of a specialized nature. Click here to view the factor table. How should Crane classify this lease? Crane should classify the lease as a/an lease. Question Attempts: o of 1 used SAVE FOR LATERSUBMIT ANSWER SUBMIT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts