Question: QUESTION 1 ) Currently, the spot exchange rate is $ 0 . 8 5 / A$ and the one - year forward exchange rate is

QUESTION

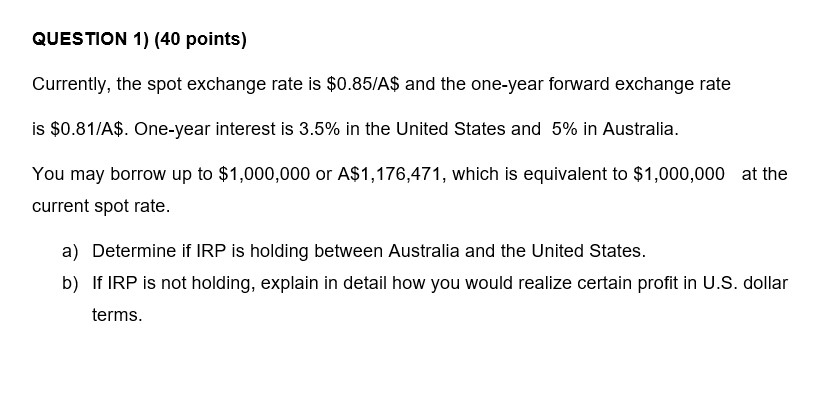

Currently, the spot exchange rate is $A$ and the oneyear forward exchange rate is $A$ Oneyear interest is in the United States and in Australia. You may borrow up to $ or A$ which is equivalent to $ at the current spot rate.

a Determine if IRP is holding between Australia and the United States.

b If IRP is not holding, explain in detail how you would realize certain profit in US dollar terms.

QUESTION

Ford and Fiat companies can borrow for a fiveyear term at the following rates:

Ford Fiat

Fixedrate borrowing cost :

Floatingrate borrowing cost : LIBOR QUESTION points

Currently, the spot exchange rate is $$ and the oneyear forward exchange rate

is $$ Oneyear interest is in the United States and in Australia.

You may borrow up to $ or $ which is equivalent to $ at the

current spot rate.

a Determine if IRP is holding between Australia and the United States.

b If IRP is not holding, explain in detail how you would realize certain profit in US dollar

terms. QUESTION points

Ford and Fiat companies can borrow for a fiveyear term at the following rates:

a Calculate the quality spread differential QSD

b Assume that Citibank is involved as swap bank in this transaction.

Develop and design an interest rate swap in which both Ford and Fiat companies have savings

in their borrowing costs and that Citibank has a net gain.LIBOR

a Calculate the quality spread differential QSD

b Assume that Citibank is involved as swap bank in this transaction.

Develop and design an interest rate swap in which both Ford and Fiat companies have savings in their borrowing costs and that Citibank has a net gain.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock