Question: QUESTION 1: Cygnet Vines Ltd has identified the five (5) possible investment projects below. The firms cost of capital is 10%. Project A B C

QUESTION 1:

Cygnet Vines Ltd has identified the five (5) possible investment projects below. The firms cost of capital is 10%.

|

|

| Project |

|

|

|

|

|

|

| A | B | C | D | E |

| Initial investment | $10,000 | $20,000 | $40,000 | $50,000 | $60,000 | |

| Annual CF | 1 | $3,500 | 8,500 | 12,700 | 18,000 | 22,000 |

|

| 2 | 3,500 | 8,500 | 12,900 | 18,000 | 22,000 |

|

| 3 | 5,000 | 8,500 | 13,500 | 18,000 | 22,000 |

|

| 4 | 6,500 | 8,500 | 13,500 | 18,000 | 22,000 |

a Calculate the NPV for all projects. Rank the projects in descending order of NPV.

b Calculate the IRR for all projects. Rank the projects in descending order of IRR.

c Calculate payback period for all projects. If the cut off point is 3 years, which projects will be accepted?

d Explain why rankings based on NPV and IRR could conflict for the projects Cygnet Vines is considering. Which method is recommended where rankings conflict?

e Assuming the projects are mutually exclusive, which project should be recommended? Justify your answer.

QUESTION 3

Deloraine Ltd (Deloraine) is a small listed public company. Its shares are currently trading at $8 per share. Deloraine is considering different dividend policies for the future including cash dividend and share dividend policies. Deloraine's shareholders' equity is as follows: Preference shares (10,000 shares) $100,000 Ordinary shares (200,000 shares) $600,000 Retained Earnings $350,000 Total shareholders' equity: $1,050,000

a) Briefly discuss the advantages and disadvantages of the following dividend policies from the firm's point of view:

i Payment of a fixed cash dividend payout

ii Payment of a cash dividend at a constant pay-out ratio equal to 40% of positive earnings

iii Payment of a share dividend

b) Show the effect that the payment of a $0.80 cash dividend to ordinary shareholders would have on Deloraine's shareholders' equity.

C)Show the effect that the payment of 10% share dividend to ordinary shareholders would have on Deloraine's shareholders' equity.

d Show the effect that the 5-for-2 share split would have on Deloraine's shareholders' equity.

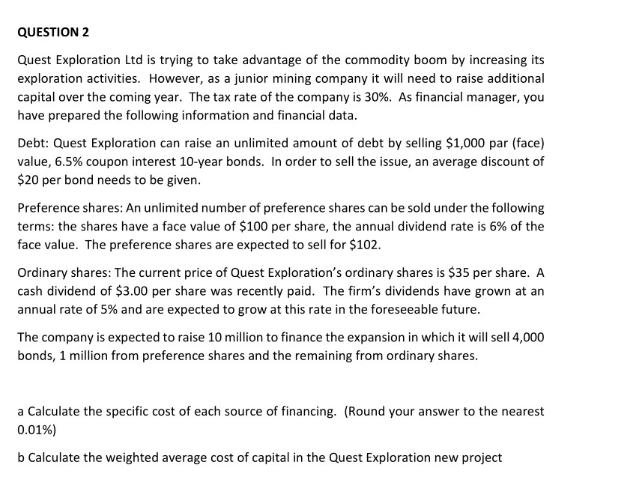

QUESTION 2 Quest Exploration Ltd is trying to take advantage of the commodity boom by increasing its exploration activities. However, as a junior mining company it will need to raise additional capital over the coming year. The tax rate of the company is 30%. As financial manager, you have prepared the following information and financial data Debt: Quest Exploration can raise an unlimited amount of debt by selling $1,000 par (face) value, 6.5% coupon interest 10-year bonds. In order to sell the issue, an average discount of $20 per bond needs to be given. Preference shares: An unlimited number of preference shares can be sold under the following terms: the shares have a face value of $100 per share, the annual dividend rate is 6% of the face value. The preference shares are expected to sell for $102. Ordinary shares: The current price of Quest Exploration's ordinary shares is $35 per share. A cash dividend of $3.00 per share was recently paid. The firm's dividends have grown at an annual rate of 5% and are expected to grow at this rate in the foreseeable future. The company is expected to raise 10 million to finance the expansion in which it will sell 4,000 bonds, 1 million from preference shares and the remaining from ordinary shares a Calculate the specific cost of each source of financing. (Round your answer to the nearest 0.01%) b Calculate the weighted average cost of capital in the Quest Exploration new project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts