Question: Question 1 Dato Dzul is considering two mutually exclusive projects, Project West Ham and Project Averton. Project West Ham will require an initial outlay

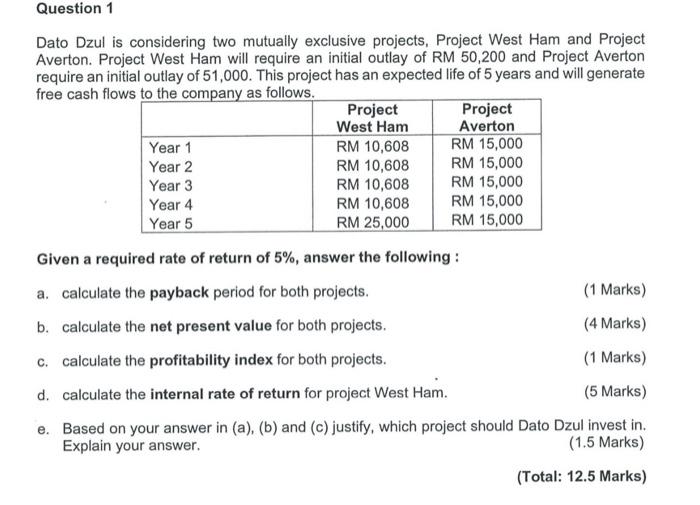

Question 1 Dato Dzul is considering two mutually exclusive projects, Project West Ham and Project Averton. Project West Ham will require an initial outlay of RM 50,200 and Project Averton require an initial outlay of 51,000. This project has an expected life of 5 years and will generate free cash flows to the company as follows. Project West Ham Year 1 Year 2 Year 3 Year 4 Year 5 RM 10,608 Project Averton RM 15,000 RM 10,608 RM 15,000 RM 10,608 RM 15,000 RM 10,608 RM 15,000 RM 25,000 RM 15,000 Given a required rate of return of 5%, answer the following: a. calculate the payback period for both projects. b. calculate the net present value for both projects. c. calculate the profitability index for both projects. (1 Marks) (4 Marks) (1 Marks) d. calculate the internal rate of return for project West Ham. (5 Marks) e. Based on your answer in (a), (b) and (c) justify, which project should Dato Dzul invest in. Explain your answer. (1.5 Marks) (Total: 12.5 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts