Question: QUESTION 1 Demand for novels is given by D ( p ) = 7 5 - 3 p , where p is the price of

QUESTION

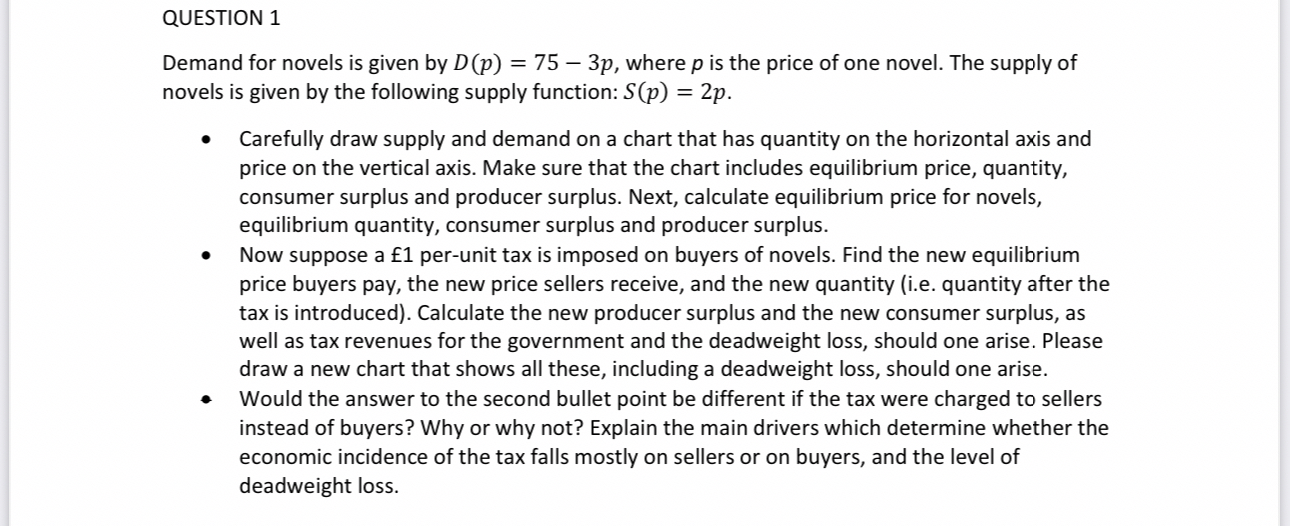

Demand for novels is given by where is the price of one novel. The supply of novels is given by the following supply function:

Carefully draw supply and demand on a chart that has quantity on the horizontal axis and price on the vertical axis. Make sure that the chart includes equilibrium price, quantity, consumer surplus and producer surplus. Next, calculate equilibrium price for novels, equilibrium quantity, consumer surplus and producer surplus.

Now suppose a perunit tax is imposed on buyers of novels. Find the new equilibrium price buyers pay, the new price sellers receive, and the new quantity ie quantity after the tax is introduced Calculate the new producer surplus and the new consumer surplus, as well as tax revenues for the government and the deadweight loss, should one arise. Please draw a new chart that shows all these, including a deadweight loss, should one arise.

Would the answer to the second bullet point be different if the tax were charged to sellers instead of buyers? Why or why not? Explain the main drivers which determine whether the economic incidence of the tax falls mostly on sellers or on buyers, and the level of deadweight loss.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock