Question: QUESTION 1 Do some research (use sources other than your prescribed textbook) on the traditional costing system and the activity?based costing (ABC) system and answer

QUESTION 1

Do some research (use sources other than your prescribed textbook) on the traditional costing system and the activity?based costing (ABC) system and answer the following questions. Remember to reference your answer and add your reference list to the bottom of this question.

a) Discuss any two differences between the traditional costing system and the activity?based costing (ABC) system for a business.

b) Identify one characteristic in organisation that make them more suited to using ABC method as opposed to the traditional costing method. Provide a reason for your answer.

c) Discuss three advantages of activity?based costing.

QUESTION 2

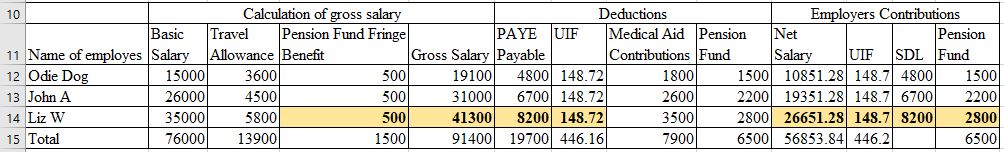

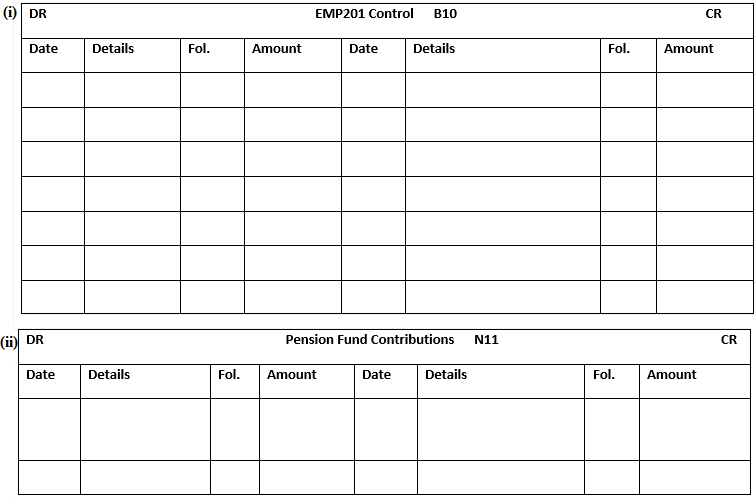

Garfield Enterprises employs 3 employees and run their payroll on 25th of each month. Employees are paid via magnetic tape.

The EMP201 return is submitted on the last day of each month together with a cheque for the amount owing.

Garfield Enterprises pays a pension fund fringe benefit equal to the employees' own pension fund contribution.

Garfield Enterprises pays the amounts owing, on behalf of the employees, to the Pension Fund and Medical Aid Fund on the last day

of the month.

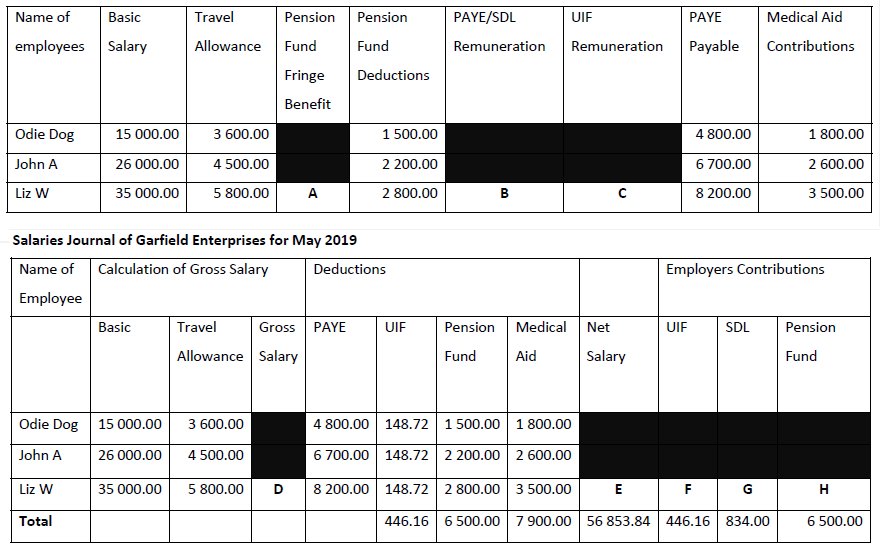

PAYE/ SDL remuneration is gross salary less deductible retirement fund contributions.

Maximum monthly threshold for UIF remuneration is R 14 872.

The following information was taken from the books of Garfield Enterprises for May 2019:

10 Calculation of gross salary Deductions Employers Contributions Basic Travel Pension Fund Fringe PAYE UIF Medical Aid Pension Net Pension 11 Name of employes Salary Allowance Benefit Gross Salary |Payable Contributions Fund Salary UIF SDL Fund 12 Odie Dog 15000 3600 500 19100 4800 148.72 1800 1500 10851.28 148.7 4800 1500 13 John A 26000 4500 500 31000 6700 148.72 2600 2200 19351.28 148.7 6700 2200 14 Liz W 35000 5800 500 41300 8200 148.72 3500 2800 26651.28 148.7 8200 2800 15 Total 76000 13900 1500 91400 19700 446.16 7900 6500 56853.84 446.2 6500(1) DR EMP201 Control B10 CR Date Details Fol. Amount Date Details Fol. Amount DR Pension Fund Contributions N11 CR Date Details Fol. Amount Date Details Fol. AmountName of Basic Travel Pension Pension PAYE/SDL UIF PAYE Medical Aid employees Salary Allowance Fund Fund Remuneration Remuneration Payable Contributions Fringe Deductions Benefit Odie Dog 15 000.00 3 600.00 1 500.00 4 800.00 1 800.00 John A 26 000.00 4 500.00 2 200.00 6 700.00 2 600.00 Liz W 35 000.00 5 800.00 A 2 800.00 B C 8 200.00 3 500.00 Salaries Journal of Garfield Enterprises for May 2019 Name of Calculation of Gross Salary Deductions Employers Contributions Employee Basic Travel Gross PAYE UIF Pension Medical Net UIF SDL Pension Allowance Salary Fund Aid Salary Fund Odie Dog 15 000.00 3 600.00 4 800.00 148.72 1 500.00 1 800.00 John A 26 000.00 4 500.00 6 700.00 148.72 2 200.00 2 600.00 Liz W 35 000.00 5 800.00 D 8 200.00 148.72 2 800.00 3 500.00 E F G H Total 446.16 6 500.00 7 900.00 56 853.84 446.16 834.00 6 500.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts