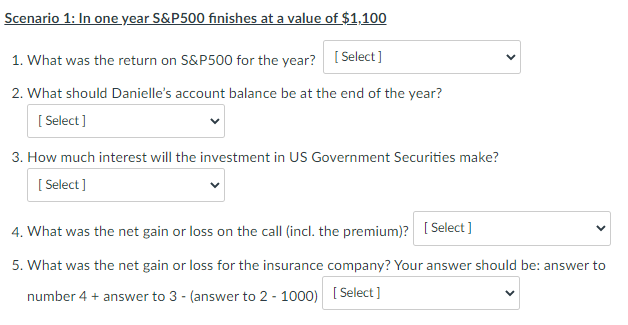

Question: Question 1 Drop down answers 15% 10% 20% 100% Question 2 Drop down answers 1500 1100 1000 1200 Question 3 Drop down answers 1 10

| Question 1 Drop down answers | 15% | 10% | 20% | 100% | |

| Question 2 Drop down answers | 1500 | 1100 | 1000 | 1200 | |

| Question 3 Drop down answers | 1 | 10 | 100 | 0 | |

| Question 4 Drop down answers | 110 | 100 | 80 | 90 | |

| Question 5 Drop down answers | -10 | 10 | 1,100 | 0 |

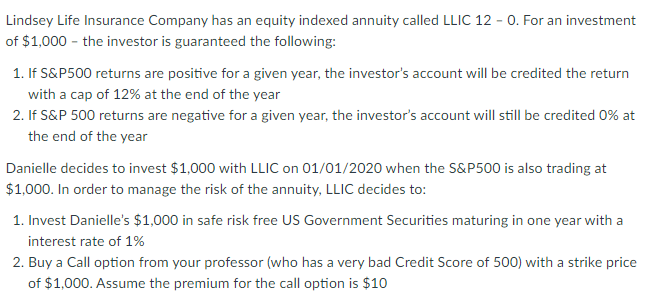

Lindsey Life Insurance Company has an equity indexed annuity called LLIC 12 -0. For an investment of $1,000 - the investor is guaranteed the following: 1. If S&P500 returns are positive for a given year, the investor's account will be credited the return with a cap of 12% at the end of the year 2. If S&P 500 returns are negative for a given year, the investor's account will still be credited 0% at the end of the year Danielle decides to invest $1,000 with LLIC on 01/01/2020 when the S&P500 is also trading at $1,000. In order to manage the risk of the annuity, LLIC decides to: 1. Invest Danielle's $1,000 in safe risk free US Government Securities maturing in one year with a interest rate of 1% 2. Buy a Call option from your professor (who has a very bad Credit Score of 500) with a strike price of $1,000. Assume the premium for the call option is $10 Scenario 1: In one year S&P500 finishes at a value of $1,100

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts