Question: Question 1 (e) + (f) Question 2+3 posted separately! PROBLEM 15.4 Calculation and interpretation of ratios Data for White Star Limited is as follows: WHITE

Question 1 (e) + (f) Question 2+3 posted separately!

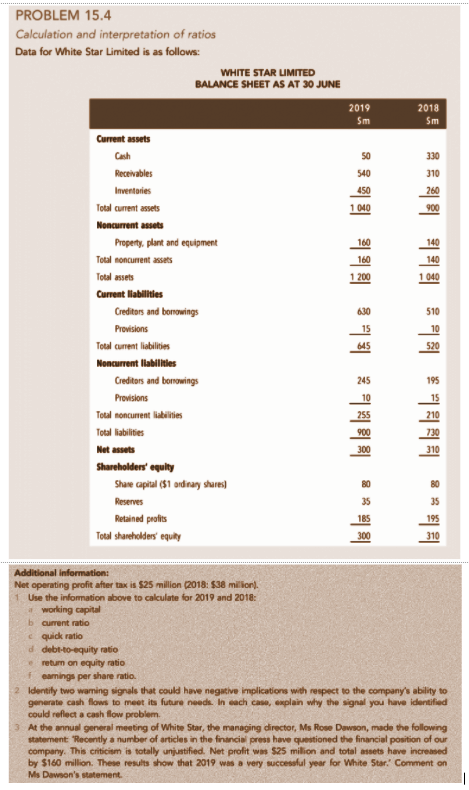

PROBLEM 15.4 Calculation and interpretation of ratios Data for White Star Limited is as follows: WHITE STAR LIMITED BALANCE SHEET AS AT 30 JUNE 2019 Sm 2018 Sm Current assets Cash Receivables Inventaries Total current assets Moncurrent assets Property, plant and equipment Total noncurrent assets Total assets Current liabilities Creditors and borrowings Provisions Total current liabilities Moncurrent liabilities Creditors and borrowings Provisions Total noncurrent liabilities Total liabilities Net assets Shareholders' equity Share capital ($1 ordinary shares) Reserves Retained profits Total shareholders equiry | | | | | | | | | | | #| | | # #| | | | 245 255 884181 | 35 195 310 300 Additional information: Net operating profit after tax is $25 million (2018: $38 million). 1 Use the information above to calculate for 2019 and 2018: working capital b current ratio quick ratio d debt-to-equity ratio return on equity ratio earnings per share ratio Identily two warning signals that could have negative implications with respect to the company's ability to generate cash flows to meet its future needs. In each case, explain why the signal you have identified could reflect a cash flow problem 3 At the annual general meeting of White Star, the managing director, Ms Rose Dawson, made the following statement "Recently a number of articles in the financial press have questioned the financial position of our company. This criticism is totally unjustified. Net prolit was 525 milion and total assets have increased by $160 million. These results show that 2019 was a very successful year for White Star. Comment on Ms Dawson's statement

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts