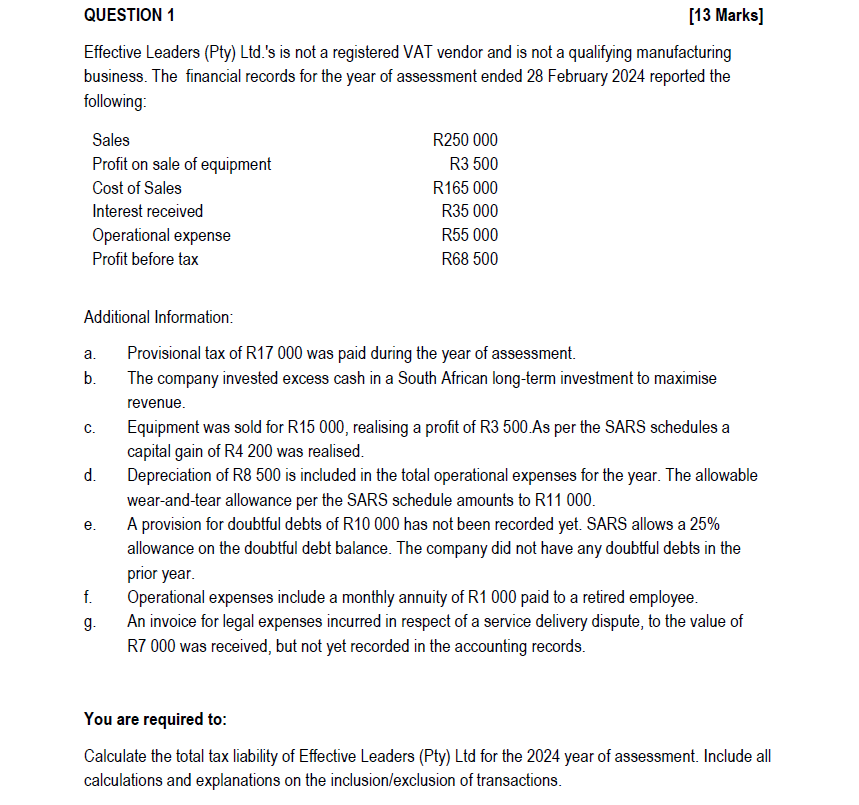

Question: QUESTION 1 Effective Leaders ( Pty ) Ltd . ' s is not a registered VAT vendor and is not a qualifying manufacturing business. The

QUESTION Effective Leaders Pty Ltds is not a registered VAT vendor and is not a qualifying manufacturing business. The financial records for the year of assessment ended February reported the following: Additional Information: a Provisional tax of R was paid during the year of assessment. b The company invested excess cash in a South African longterm investment to maximise revenue. c Equipment was sold for R realising a profit of R As per the SARS schedules a capital gain of R was realised. d Depreciation of R is included in the total operational expenses for the year. The allowable wearandtear allowance per the SARS schedule amounts to R e A provision for doubtful debts of R has not been recorded yet. SARS allows a allowance on the doubtful debt balance. The company did not have any doubtful debts in the prior year. f Operational expenses include a monthly annuity of R paid to a retired employee. g An invoice for legal expenses incurred in respect of a service delivery dispute, to the value of R was received, but not yet recorded in the accounting records. You are required to: Calculate the total tax liability of Effective Leaders Pty Ltd for the year of assessment. Include all calculations and explanations on the inclusionexclusion of transactions.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock