Question: Question #1 Evaluate whether the following statement is true or false: 'financial leverage increases the dispersion of the return on equity in response to the

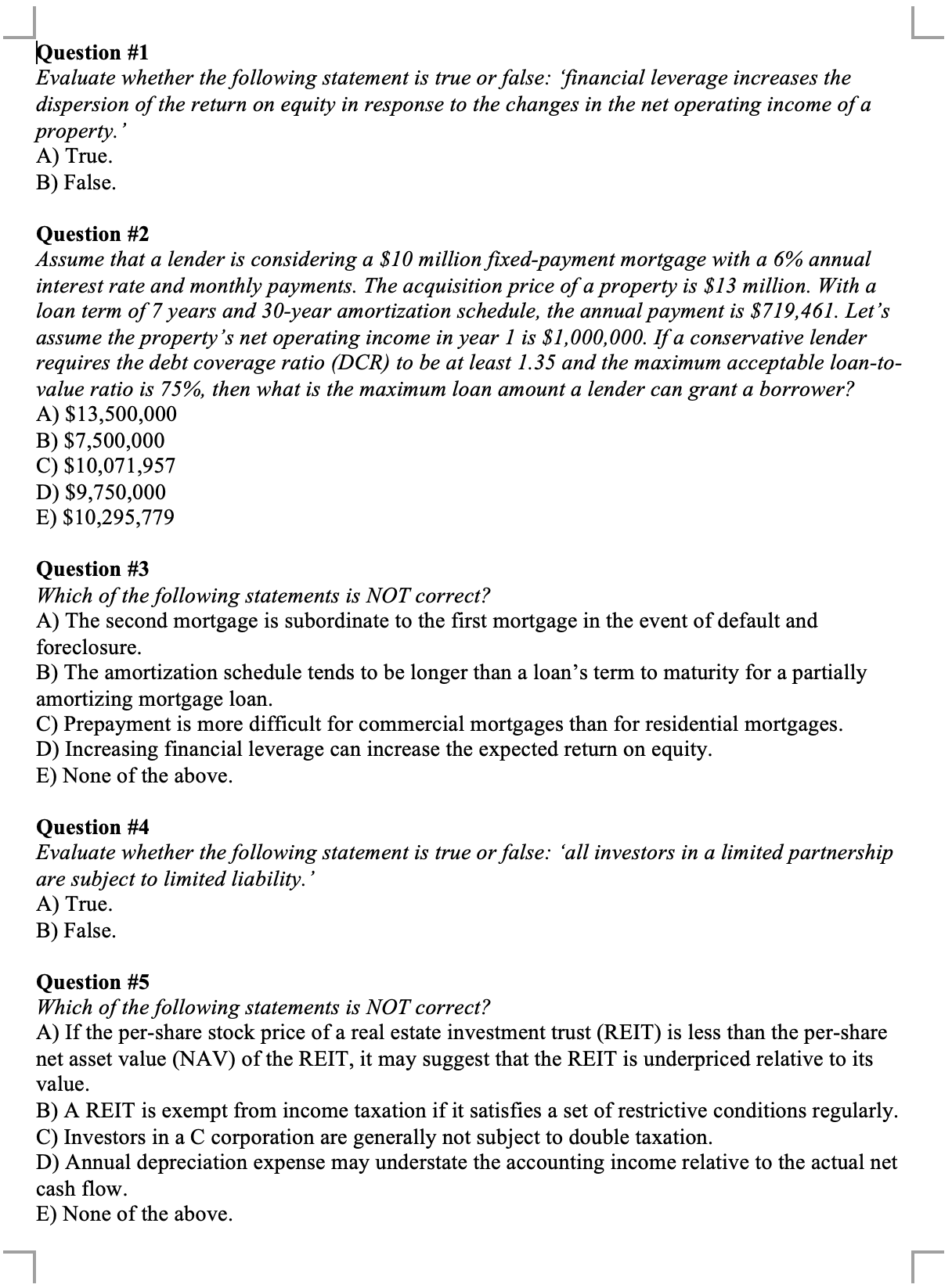

Question \#1 Evaluate whether the following statement is true or false: 'financial leverage increases the dispersion of the return on equity in response to the changes in the net operating income of a property.' A) True. B) False. Question \#2 Assume that a lender is considering a \$10 million fixed-payment mortgage with a 6% annual interest rate and monthly payments. The acquisition price of a property is $13 million. With a loan term of 7 years and 30-year amortization schedule, the annual payment is \$719,461. Let's assume the property's net operating income in year 1 is $1,000,000. If a conservative lender requires the debt coverage ratio (DCR) to be at least 1.35 and the maximum acceptable loan-tovalue ratio is 75%, then what is the maximum loan amount a lender can grant a borrower? A) $13,500,000 B) $7,500,000 C) $10,071,957 D) $9,750,000 E) $10,295,779 Question \#3 Which of the following statements is NOT correct? A) The second mortgage is subordinate to the first mortgage in the event of default and foreclosure. B) The amortization schedule tends to be longer than a loan's term to maturity for a partially amortizing mortgage loan. C) Prepayment is more difficult for commercial mortgages than for residential mortgages. D) Increasing financial leverage can increase the expected return on equity. E) None of the above. Question \#4 Evaluate whether the following statement is true or false: 'all investors in a limited partnership are subject to limited liability.' A) True. B) False. Question \#5 Which of the following statements is NOT correct? A) If the per-share stock price of a real estate investment trust (REIT) is less than the per-share net asset value (NAV) of the REIT, it may suggest that the REIT is underpriced relative to its value. B) A REIT is exempt from income taxation if it satisfies a set of restrictive conditions regularly. C) Investors in a C corporation are generally not subject to double taxation. D) Annual depreciation expense may understate the accounting income relative to the actual net cash flow. E) None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts