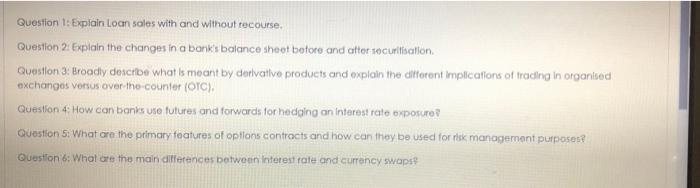

Question: Question 1: Explain loan soles with and without recourse, Question 2: Explain the changes in a bank's balance sheet botore and after securitation Question 3:

Question 1: Explain loan soles with and without recourse, Question 2: Explain the changes in a bank's balance sheet botore and after securitation Question 3: Broadly describe what is meant by derivative products and explain the different implications of trading in organised exchanges versus over the counter (Orc) Question 4. How can banks une futures and forwards for hedging an interest rate exposure Questions: What are the primary features of options contracts and how can they be used for risk management purposes? Question: What are the main differences between interest rate and currency swaps

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts