Question: r 11) From the following prepare (a) Profit and Loss accounts (b) Cost sheet taking factory overheads 25% on prime cost, office overheads at 50%

r

r

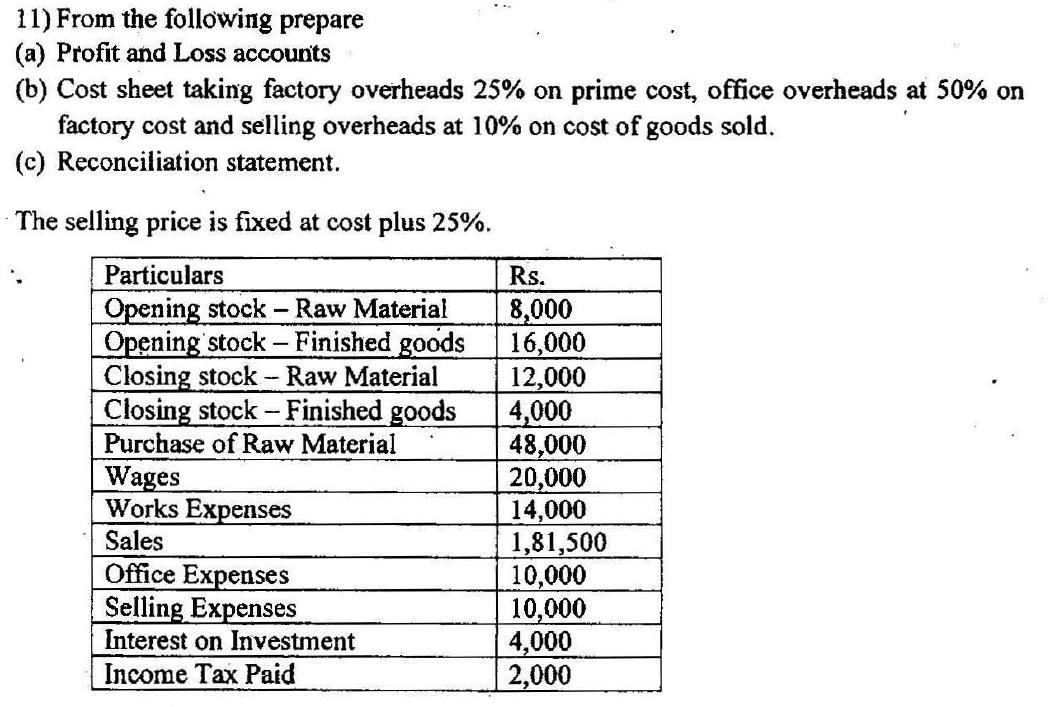

11) From the following prepare (a) Profit and Loss accounts (b) Cost sheet taking factory overheads 25% on prime cost, office overheads at 50% on factory cost and selling overheads at 10% on cost of goods sold. (c) Reconciliation statement. The selling price is fixed at cost plus 25%. Particulars Opening stock - Raw Material Opening stock - Finished goods Closing stock - Raw Material Closing stock - Finished goods Purchase of Raw Material Wages Works Expenses Sales Office Expenses Selling Expenses Interest on Investment Income Tax Paid Rs. 8,000 16,000 12,000 4,000 48,000 20,000 14,000 1,81,500 10,000 10,000 4,000 2,000

Step by Step Solution

3.50 Rating (163 Votes )

There are 3 Steps involved in it

a Profit and Loss account Particulars Rs Sales 181500 Cost of goods sold Opening stock Finished good... View full answer

Get step-by-step solutions from verified subject matter experts