Question: QUESTION 1 Find the best answer John makes $200,000 and pays $2000 in tuition. What is his American Opportunity Credit? Which contributions qualify for the

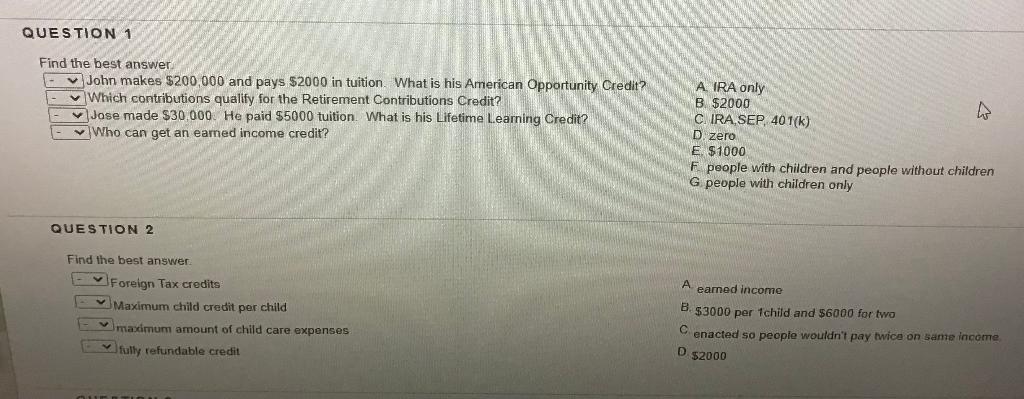

QUESTION 1 Find the best answer John makes $200,000 and pays $2000 in tuition. What is his American Opportunity Credit? Which contributions qualify for the Retirement Contributions Credit? v Jase made $30,000. He paid $5000 tuition. What is his Lifetime Learning Credit? Who can get an eamed income credit? A IRA only B. $2000 IRA SEP. 401(k) D. zero E $1000 F people with children and people without children G people with children only QUESTION 2 Find the best answer Foreign Tax credits Maximum child credit per child maximum amount of child care expenses fully refundable credit A earned income B.$3000 per 1child and $6000 for two Cenacted so people wouldn't pay twice on same income D $2000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts