Question: Question: 1. Finding Bond basic terms and predict the bond price with the modified duration: Assuming there' a bond A $1,000, 6% coupon bond matures

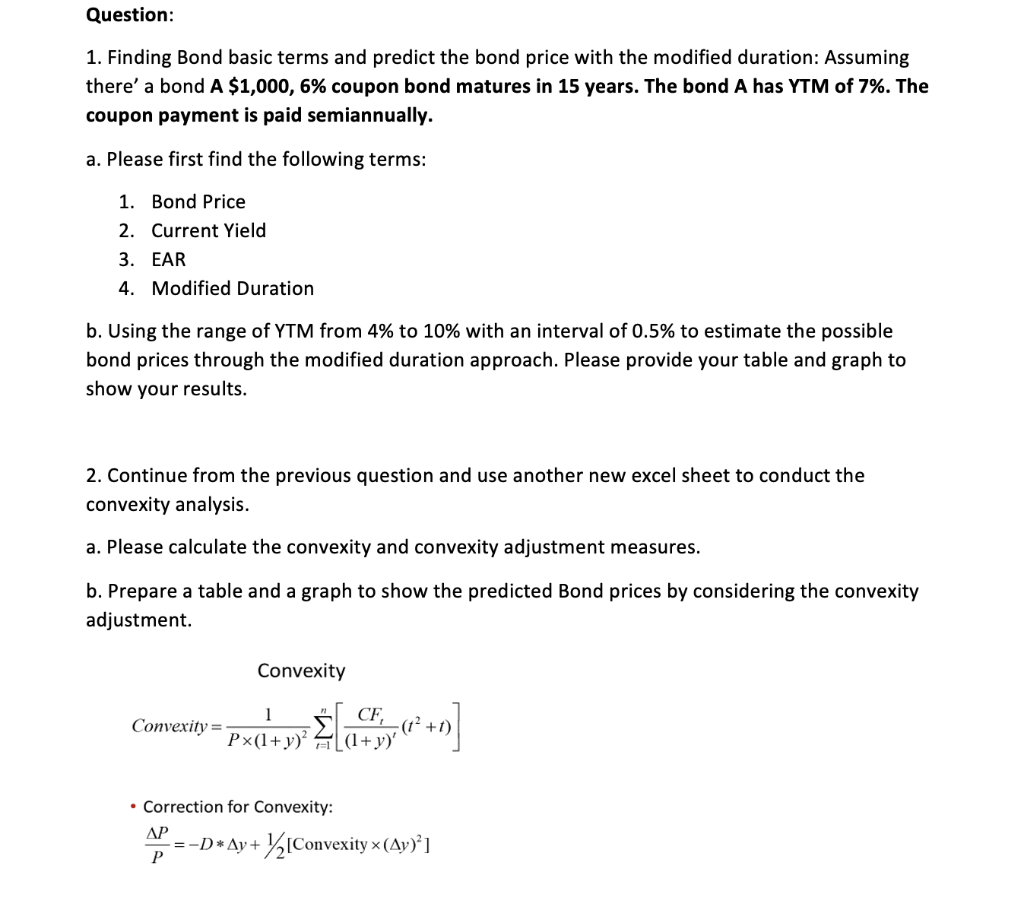

Question: 1. Finding Bond basic terms and predict the bond price with the modified duration: Assuming there' a bond A $1,000, 6% coupon bond matures in 15 years. The bond A has YTM of 7%. The coupon payment is paid semiannually. a. Please first find the following terms: 1. Bond Price 2. Current Yield 3. EAR 4. Modified Duration b. Using the range of YTM from 4% to 10% with an interval of 0.5% to estimate the possible bond prices through the modified duration approach. Please provide your table and graph to show your results. 2. Continue from the previous question and use another new excel sheet to conduct the convexity analysis. a. Please calculate the convexity and convexity adjustment measures. b. Prepare a table and a graph to show the predicted Bond prices by considering the convexity adjustment. Convexity 1 Convexity = CF, (t? +1) Px(1+y)? (1 + y) al Correction for Convexity: . =-D* Ay+ [Convexity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts