Question: Question 1 Finham Limited UK has just signed a contract for the sale of a new manufacturing equipment for 400,000 to an Italian company. The

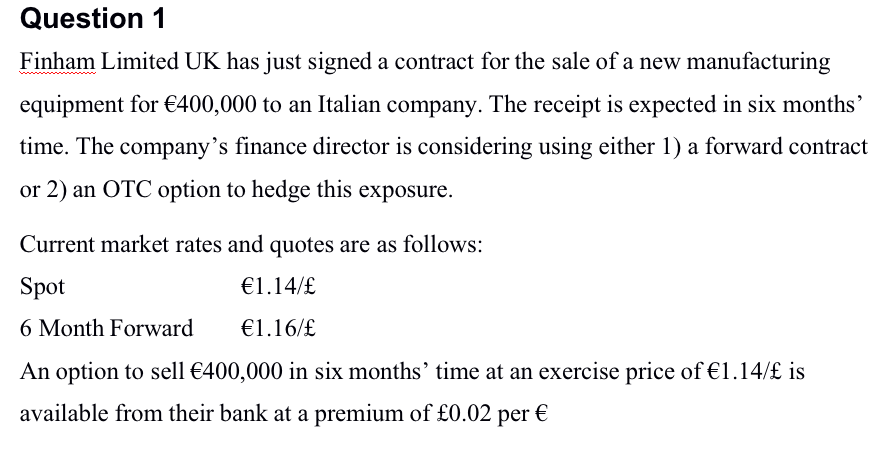

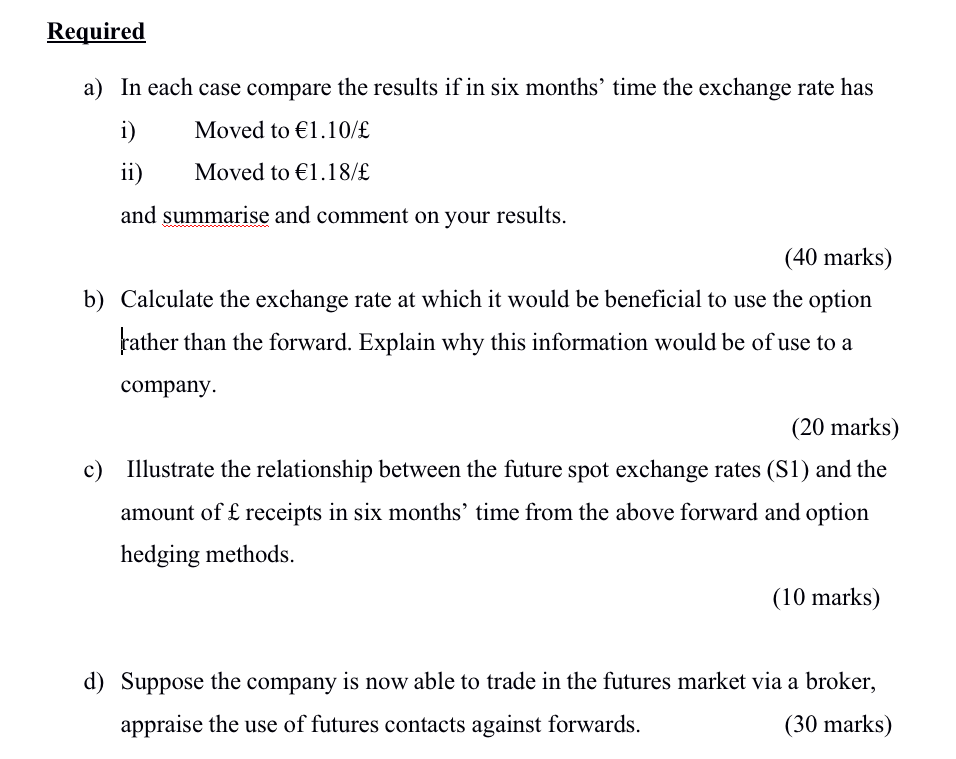

Question 1 Finham Limited UK has just signed a contract for the sale of a new manufacturing equipment for 400,000 to an Italian company. The receipt is expected in six months' time. The company's finance director is considering using either 1) a forward contract or 2) an OTC option to hedge this exposure. Current market rates and quotes are as follows: Spot 1.14/ 6 Month Forward 1.16/ An option to sell 400,000 in six months' time at an exercise price of 1.14/ is available from their bank at a premium of 0.02 per Required a) In each case compare the results if in six months' time the exchange rate has i) Moved to 1.10/ ii) Moved to 1.18/ and summarise and comment on your results. (40 marks) b) Calculate the exchange rate at which it would be beneficial to use the option rather than the forward. Explain why this information would be of use to a company. (20 marks) c) Illustrate the relationship between the future spot exchange rates (S1) and the amount of receipts in six months' time from the above forward and option hedging methods. (10 marks) d) Suppose the company is now able to trade in the futures market via a broker, appraise the use of futures contacts against forwards. (30 marks) Question 1 Finham Limited UK has just signed a contract for the sale of a new manufacturing equipment for 400,000 to an Italian company. The receipt is expected in six months' time. The company's finance director is considering using either 1) a forward contract or 2) an OTC option to hedge this exposure. Current market rates and quotes are as follows: Spot 1.14/ 6 Month Forward 1.16/ An option to sell 400,000 in six months' time at an exercise price of 1.14/ is available from their bank at a premium of 0.02 per Required a) In each case compare the results if in six months' time the exchange rate has i) Moved to 1.10/ ii) Moved to 1.18/ and summarise and comment on your results. (40 marks) b) Calculate the exchange rate at which it would be beneficial to use the option rather than the forward. Explain why this information would be of use to a company. (20 marks) c) Illustrate the relationship between the future spot exchange rates (S1) and the amount of receipts in six months' time from the above forward and option hedging methods. (10 marks) d) Suppose the company is now able to trade in the futures market via a broker, appraise the use of futures contacts against forwards. (30 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts