Question: Question 1. Four Calculation Questions. (20 marks) Question 1A. (5 marks) Leslie borrowed $630457 to purchase his new house. The loan required monthly repayments over

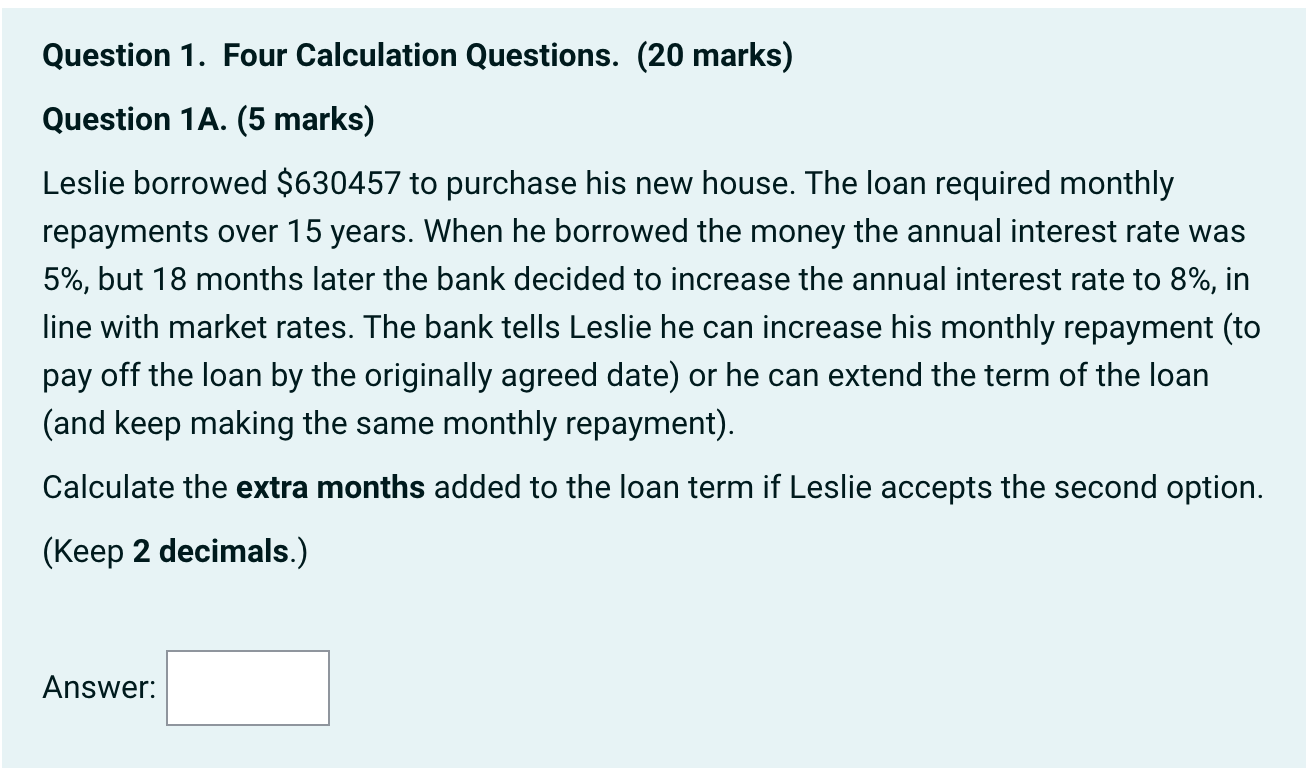

Question 1. Four Calculation Questions. (20 marks) Question 1A. (5 marks) Leslie borrowed $630457 to purchase his new house. The loan required monthly repayments over 15 years. When he borrowed the money the annual interest rate was 5%, but 18 months later the bank decided to increase the annual interest rate to 8%, in line with market rates. The bank tells Leslie he can increase his monthly repayment (to pay off the loan by the originally agreed date) or he can extend the term of the loan (and keep making the same monthly repayment). Calculate the extra months added to the loan term if Leslie accepts the second option. (Keep 2 decimals.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts