Question: Question 1: (from chapter 25) D. Facaulti started in business buying and selling law textbooks, on 1 st January 2018 . At the end of

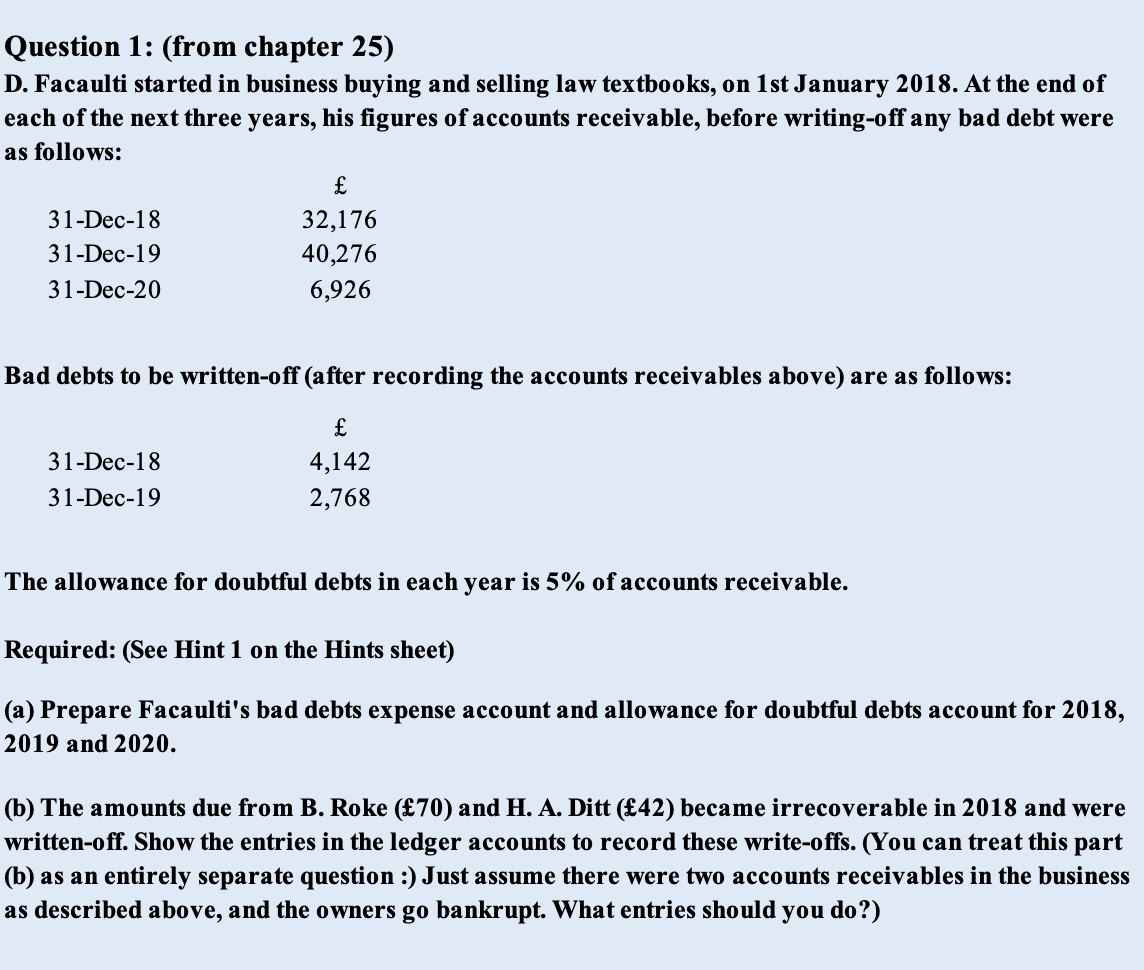

Question 1: (from chapter 25) D. Facaulti started in business buying and selling law textbooks, on 1 st January 2018 . At the end of each of the next three years, his figures of accounts receivable, before writing-off any bad debt were as follows: Bad debts to be written-off (after recording the accounts receivables above) are as follows: The allowance for doubtful debts in each year is 5% of accounts receivable. Required: (See Hint 1 on the Hints sheet) (a) Prepare Facaulti's bad debts expense account and allowance for doubtful debts account for 2018 , 2019 and 2020. (b) The amounts due from B. Roke (70) and H. A. Ditt (42) became irrecoverable in 2018 and were written-off. Show the entries in the ledger accounts to record these write-offs. (You can treat this part (b) as an entirely separate question :) Just assume there were two accounts receivables in the business as described above, and the owners go bankrupt. What entries should you do?)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts