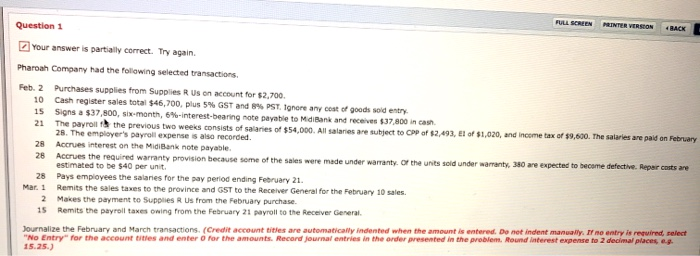

Question: Question 1 FULL SCREEN MENTER VERSION 4 BACK Your answer is partially correct. Try again Pharoah Company had the following selected transactions Feb. 2 Purchases

Question 1 FULL SCREEN MENTER VERSION 4 BACK Your answer is partially correct. Try again Pharoah Company had the following selected transactions Feb. 2 Purchases supplies from Supplies R Us on account for $2.700 10 Cash register sales total $46,700, plus 5% GST and PST. Ignore any cost of goods sold entry 15 Signs a $37,800, six-month, 6%-interest-bearing note payable to MidiBank and receives $37,800 in cas 21 The payroll the previous two weeks consists of salaries of $54,000. All salaries are subject to CPP of $2,493, 1 of $1,020, and income tax of $9,600. The salaries are paid on February 28. The employer's payroll expenses also recorded. 28 Accrues interest on the MidiBanknote payable 28 Accrues the required warranty provision because some of the sales were made under warranty. Or the units sold under warranty, 380 are expected to become defective. Repar costs are estimated to be $40 per unit. 28 Pays employees the salaries for the pay period ending February 21. Mar.1 Remits the sales taxes to the province and GST to the Receiver General for the February 10 sales 2 Makes the payment to Supplies R Us from the February purchase 15 Remits the payroll taxes owing from the February 21 payroll to the Receiver General Journalize the February and March transactions. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, elect "No Entry for the account titles and enter for the amounts Record journal entries in the order presented in the problem. Round interest expense to 2 decimal places 0.g. 15.25.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts