Question: QUESTION 1 Gavin Henckert, aged 4 0 , is about to sign to revised employment agreement and has approached you to clarify some of the

QUESTION

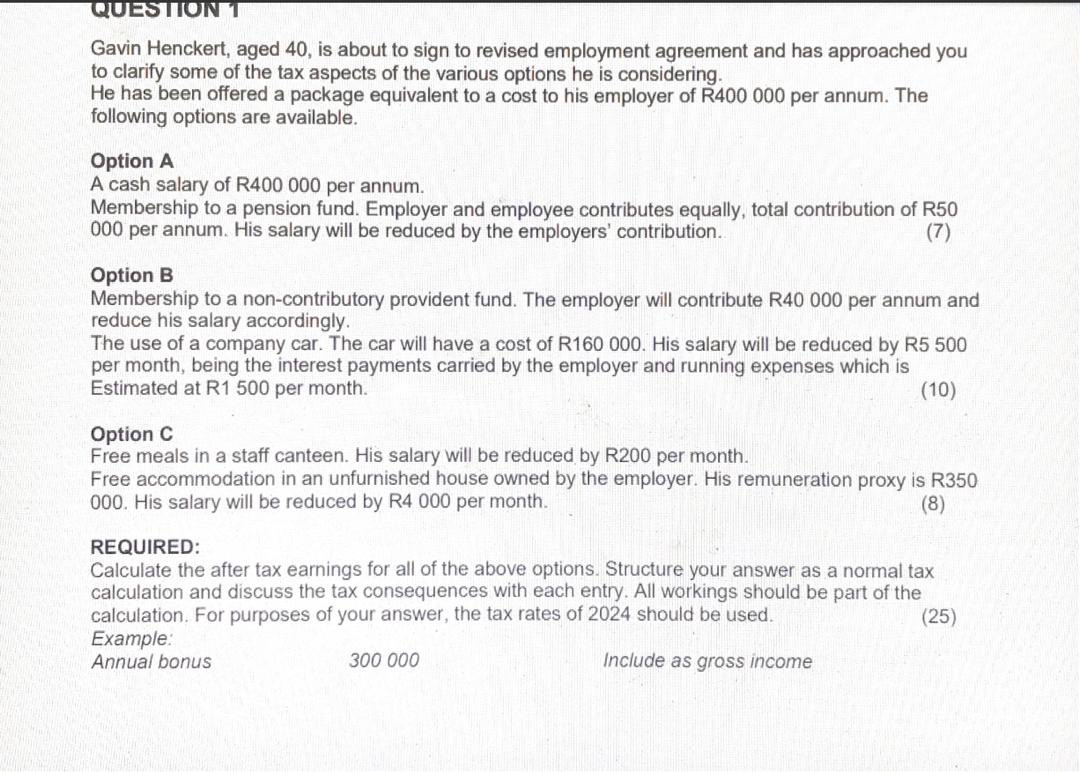

Gavin Henckert, aged is about to sign to revised employment agreement and has approached you to clarify some of the tax aspects of the various options he is considering.

He has been offered a package equivalent to a cost to his employer of R per annum. The following options are available.

Option A

A cash salary of R per annum.

Membership to a pension fund. Employer and employee contributes equally, total contribution of R per annum. His salary will be reduced by the employers' contribution.

Option B

Membership to a noncontributory provident fund. The employer will contribute R per annum and reduce his salary accordingly.

The use of a company car. The car will have a cost of R His salary will be reduced by R per month, being the interest payments carried by the employer and running expenses which is Estimated at R per month.

Option C

Free meals in a staff canteen. His salary will be reduced by R per month.

Free accommodation in an unfurnished house owned by the employer. His remuneration proxy is R His salary will be reduced by R per month.

REQUIRED:

Calculate the after tax earnings for all of the above options. Structure your answer as a normal tax calculation and discuss the tax consequences with each entry. All workings should be part of the calculation. For purposes of your answer, the tax rates of should be used.

Example:

Annual bonus

Include as gross income

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock