Question: Question 1 Genius Corporation is comparing two different capital structures, an all-equity plan (Plan A) and a levered plan (Plan B). Under Plan A, the

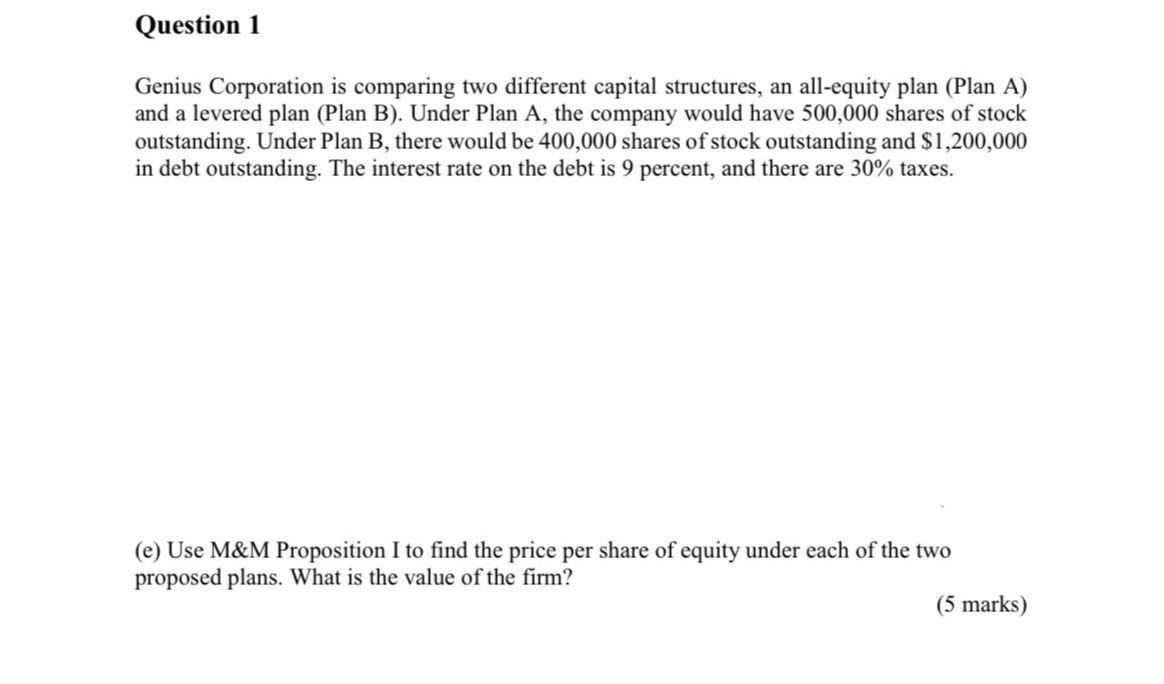

Question 1 Genius Corporation is comparing two different capital structures, an all-equity plan (Plan A) and a levered plan (Plan B). Under Plan A, the company would have 500,000 shares of stock outstanding. Under Plan B, there would be 400,000 shares of stock outstanding and $1,200,000 in debt outstanding. The interest rate on the debt is 9 percent, and there are 30% taxes. (e) Use M&M Proposition I to find the price per share of equity under each of the two proposed plans. What is the value of the firm? (5 marks) Question 1 Genius Corporation is comparing two different capital structures, an all-equity plan (Plan A) and a levered plan (Plan B). Under Plan A, the company would have 500,000 shares of stock outstanding. Under Plan B, there would be 400,000 shares of stock outstanding and $1,200,000 in debt outstanding. The interest rate on the debt is 9 percent, and there are 30% taxes. (e) Use M&M Proposition I to find the price per share of equity under each of the two proposed plans. What is the value of the firm

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts