Question: QUESTION 1 George created a trust today by transferring $ 2 . 5 million into an irrevocable trust. He wants to ensure his daughter Rebecca,

QUESTION

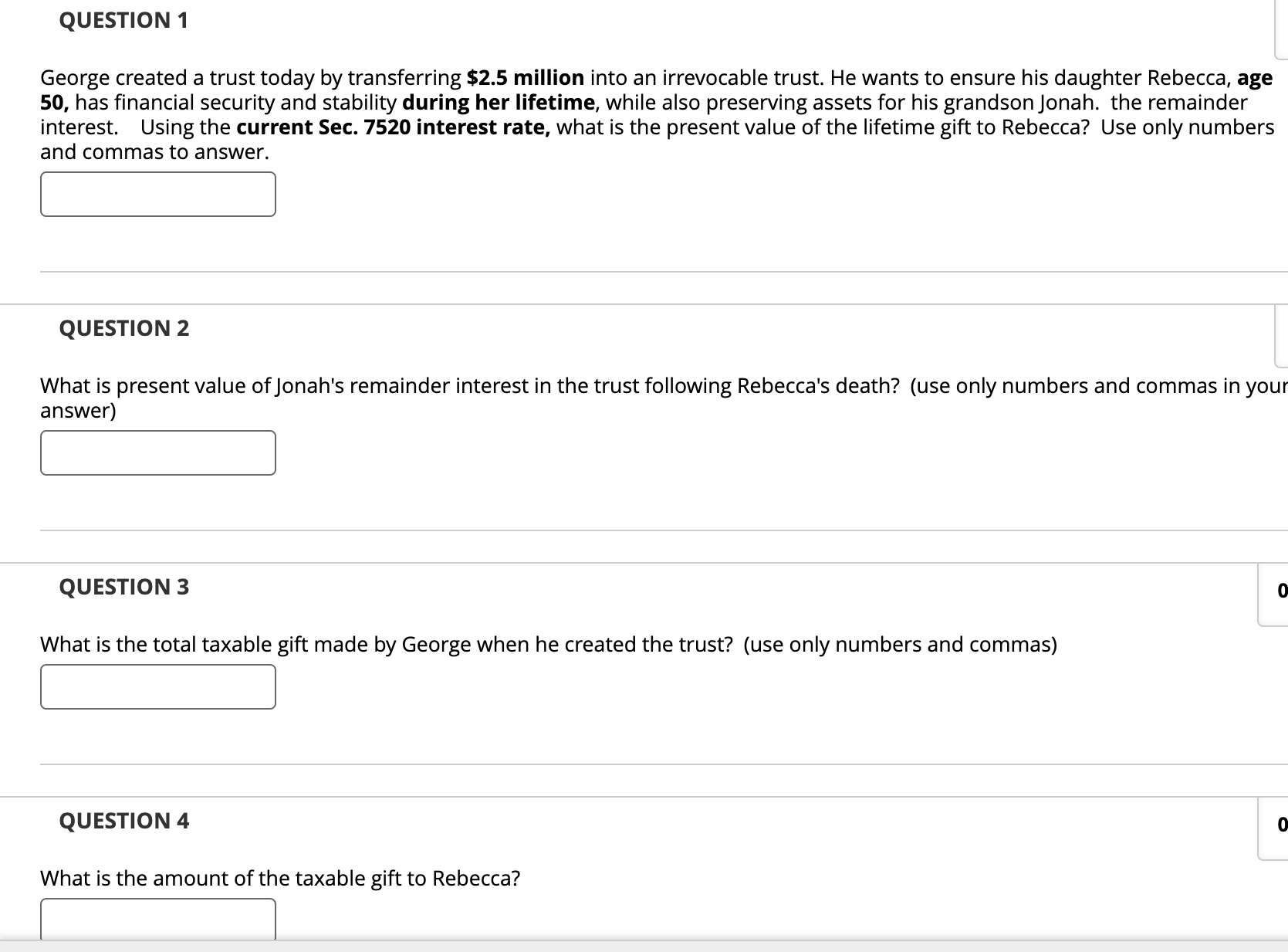

George created a trust today by transferring $ million into an irrevocable trust. He wants to ensure his daughter Rebecca, age

has financial security and stability during her lifetime, while also preserving assets for his grandson Jonah. the remainder

interest. Using the current Sec. interest rate, what is the present value of the lifetime gift to Rebecca? Use only numbers

and commas to answer.

QUESTION

What is present value of Jonah's remainder interest in the trust following Rebecca's death? use only numbers and commas in your

answer

QUESTION

What is the total taxable gift made by George when he created the trust? use only numbers and commas

QUESTION

What is the amount of the taxable gift to Rebecca?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock