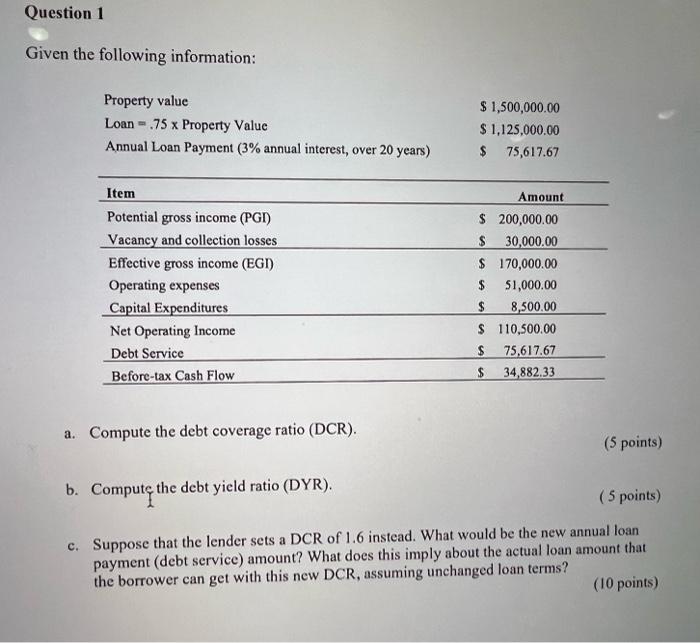

Question: Question 1 Given the following information: Property value Loan = .75 x Property Value Annual Loan Payment (3% annual interest, over 20 years) Item Potential

Given the following information: a. Compute the debt coverage ratio (DCR). ( 5 points) b. Compute the debt yield ratio (DYR). ( 5 points) c. Suppose that the lender sets a DCR of 1.6 instead. What would be the new annual loan payment (debt service) amount? What does this imply about the actual loan amount that the borrower can get with this new DCR, assuming unchanged loan terms? (10 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts