Question: question 1) help me learn and understand problems 1-10 on A-E question 2) help me learn and understand steps 1-10 on A - D question

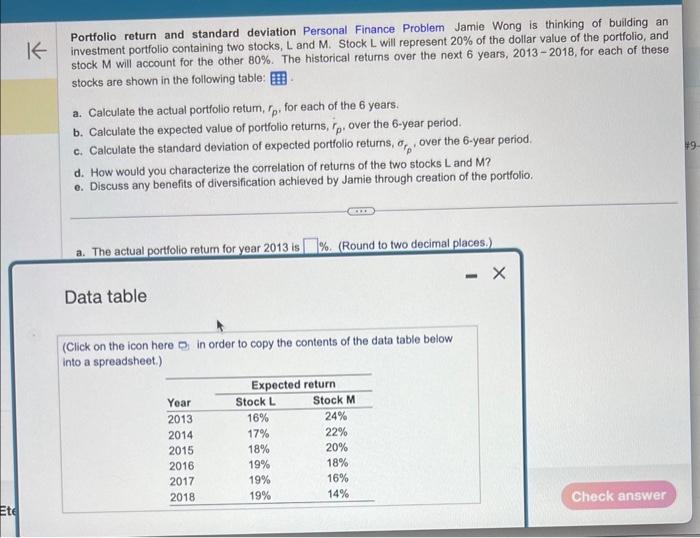

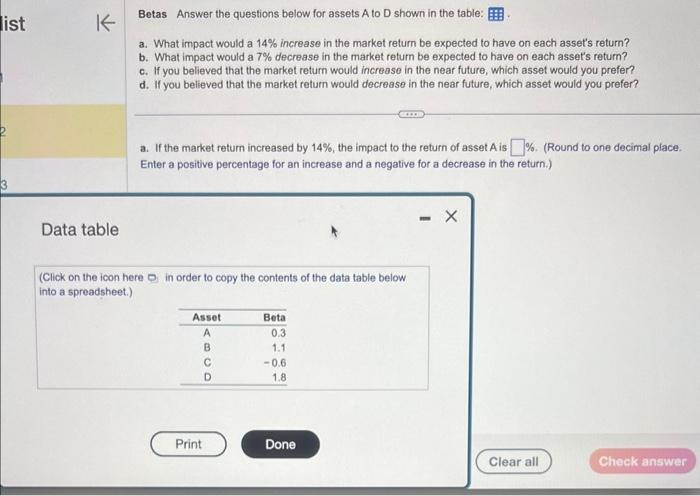

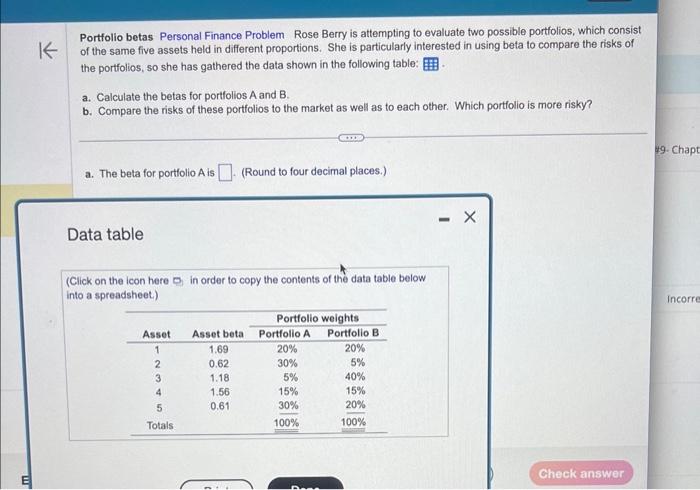

Portfolio return and standard deviation Personal Finance Problem Jamie Wong is thinking of building an investment portfolio containing two stocks, L and M. Stock L will represent 20% of the dollar value of the portfolio, and stock M will account for the other 80%. The historical retums over the next 6 years, 20132018, for each of these stocks are shown in the following table: a. Calculate the actual portfolio retum, rp, for each of the 6 years. b. Calculate the expected value of portfolio returns, rp, over the 6 -year period. c. Calculate the standard deviation of expected portfolio retums, rp, over the 6-year period. d. How would you characterize the correlation of returns of the two stocks L and M? e. Discuss any benefits of diversification achieved by Jamie through creation of the portfolio. a. The actual portfolio retum for year 2013 is \%. (Round to two decimal places.) Data table (Click on the icon here p in order to copy the contents of the data table below into a spreadsheet.) Betas Answer the questions below for assets A to D shown in the table: a. What impact would a 14% increase in the market return be expected to have on each asset's return? b. What impact would a 7% decrease in the market retum be expected to have on each asset's return? c. If you believed that the market return would increase in the near future, which asset would you prefer? d. If you believed that the market return would decrease in the near future, which asset would you prefer? a. If the market return increased by 14%, the impact to the return of asset A is %. (Round to one decimal place. Enter a positive percentage for an increase and a negative for a decrease in the return.) Data table (Click on the icon here Q. in order to copy the contents of the data table below into a spreadsheet.) Portfolio betas Personal Finance Problem Rose Berry is attempting to evaluate two possible portfolios, which consist of the same five assets held in different proportions. She is particularly interested in using beta to compare the risks of the portfolios, so she has gathered the data shown in the following table: a. Calculate the betas for portfolios A and B. b. Compare the risks of these portfolios to the market as well as to each other. Which portfolio is more risky? a. The beta for portfolio A is (Round to four decimal places.) Data table (Click on the icon here P. in order to copy the contents of the data table below into a spreadsheet.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts