Question: Question 1: HerbTech Inc., invests aggressively in basic R&D1; this research tends to be hit or miss! The company is hoping to successfully launch a

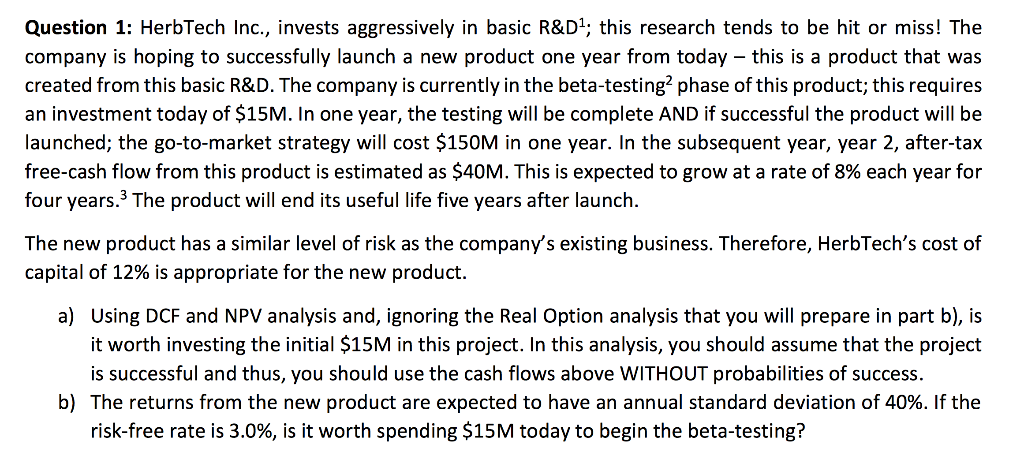

Question 1: HerbTech Inc., invests aggressively in basic R&D1; this research tends to be hit or miss! The company is hoping to successfully launch a new product one year from today - this is a product that was created from this basic R&D. The company is currently in the beta-testing phase of this product; this requires an investment today of $15M. In one year, the testing will be complete AND if successful the product will be launched; the go-to-market strategy will cost $150M in one year. In the subsequent year, year 2, after-tax free-cash flow from this product is estimated as $40M. This is expected to grow at a rate of 8% each year for four years. The product will end its useful life five years after launch. The new product has a similar level of risk as the company's existing business. Therefore, HerbTech's cost of capital of 12% is appropriate for the new product. a) Using DCF and NPV analysis and, ignoring the Real Option analysis that you will prepare in part b), is it worth investing the initial $15M in this project. In this analysis, you should assume that the project is successful and thus, you should use the cash flows above WITHOUT probabilities of success. b) The returns from the new product are expected to have an annual standard deviation of 40%. If the risk-free rate is 3.0%, is it worth spending $15M today to begin the beta-testing? Question 1: HerbTech Inc., invests aggressively in basic R&D1; this research tends to be hit or miss! The company is hoping to successfully launch a new product one year from today - this is a product that was created from this basic R&D. The company is currently in the beta-testing phase of this product; this requires an investment today of $15M. In one year, the testing will be complete AND if successful the product will be launched; the go-to-market strategy will cost $150M in one year. In the subsequent year, year 2, after-tax free-cash flow from this product is estimated as $40M. This is expected to grow at a rate of 8% each year for four years. The product will end its useful life five years after launch. The new product has a similar level of risk as the company's existing business. Therefore, HerbTech's cost of capital of 12% is appropriate for the new product. a) Using DCF and NPV analysis and, ignoring the Real Option analysis that you will prepare in part b), is it worth investing the initial $15M in this project. In this analysis, you should assume that the project is successful and thus, you should use the cash flows above WITHOUT probabilities of success. b) The returns from the new product are expected to have an annual standard deviation of 40%. If the risk-free rate is 3.0%, is it worth spending $15M today to begin the beta-testing

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts