Question: Question 1 Hobby Ltd has two group compaines, Leisre Ltd and Craft Ltd. The income statements for Hobby Ltd, Leisure Ltd and Craft Ltd for

Question 1

Hobby Ltd has two group compaines, Leisre Ltd and Craft Ltd. The income statements for Hobby Ltd, Leisure Ltd and Craft Ltd for the year ended 31 Decemeber 2021 are given as follows:

Income Statements for the year ending 31 Decemeber 2021

| Hobby Ltd | Leisure Ltd | Craft Ltd | |

| EUR | EUR | EUR | |

| Sales | 60,750,000 | 34,425,000 | 24,300,000 |

| Cost of sales | (23,895,000) | (11,947,500) | (17,820,000) |

| Gross Profit | 36,855,000 | 22,477,500 | 17,820,000 |

| Investment Income | 1,882,500 | - | - |

| Management Fee Income | 5,872,500 | - | - |

| Administrative Expenses | (4,107,375) | (5,692,500) | (4,185,000) |

| Distribution Costs | (1,890,000) | (1,759,500) | (776,250) |

| Interest Income | 1,012,500 | - | - |

| Interest Expense | (202,500) | (364,500) | - |

| Profit Before Tax | 39,422,625 | 14,661,000 | 12,858,750 |

| Tax | (2,025,000) | (1,417,500) | (1,903,500) |

| Profit after tax | 37,387,625 | 13,243,500 | 10,955,250 |

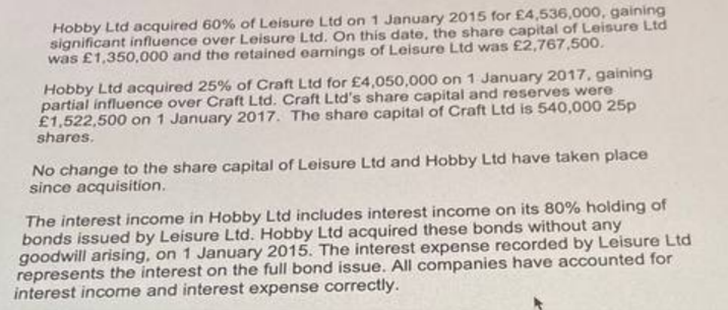

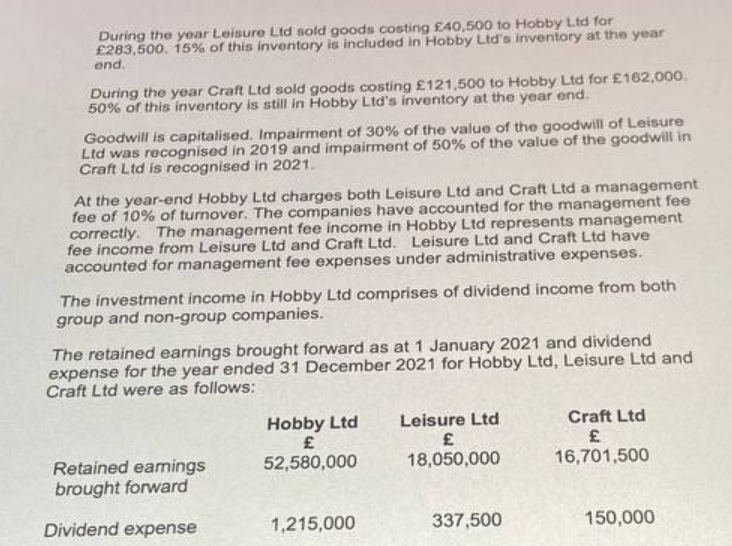

Hobby Ltd acquired 60% of Leisure Ltd on 1 January 2015 for 4,536,000, gaining significant influence over Leisure Ltd. On this date, the share capital of Leisure Ltd was 1,350,000 and the retained earnings of Leisure Ltd was 2,767,500. Hobby Ltd acquired 25% of Craft Ltd for 4,050,000 on 1 January 2017, gaining partial influence over Craft Ltd. Craft Ltd's share capital and reserves were 1,522,500 on 1 January 2017. The share capital of Craft Ltd is 540,000 25p shares. No change to the share capital of Leisure Ltd and Hobby Ltd have taken place since acquisition. The interest income in Hobby Ltd includes interest income on its 80% holding of bonds issued by Leisure Ltd. Hobby Ltd acquired these bonds without any goodwill arising, on 1 January 2015. The interest expense recorded by Leisure Ltd represents the interest on the full bond issue. All companies have accounted for interest income and interest expense correctly. During the year Leisure Ltd sold goods costing 40,500 to Hobby Ltd for 283,500. 15% of this inventory is included in Hobby Ltd's inventory at the year end. During the year Craft Ltd sold goods costing 121,500 to Hobby Ltd for 162,000. 50% of this inventory is still in Hobby Ltd's inventory at the year end. Goodwill is capitalised. Impairment of 30% of the value of the goodwill of Leisure Ltd was recognised in 2019 and impairment of 50% of the value of the goodwill in Craft Ltd is recognised in 2021. At the year-end Hobby Ltd charges both Leisure Ltd and Craft Ltd a management fee of 10% of turnover. The companies have accounted for the management fee correctly. The management fee income in Hobby Ltd represents management fee income from Leisure Ltd and Craft Ltd. Leisure Ltd and Craft Ltd have accounted for management fee expenses under administrative expenses. The investment income in Hobby Ltd comprises of dividend income from both group and non-group companies. The retained earnings brought forward as at 1 January 2021 and dividend expense for the year ended 31 December 2021 for Hobby Ltd, Leisure Ltd and Craft Ltd were as follows: Hobby Ltd 52,580,000 Leisure Ltd 18,050,000 Craft Ltd 16,701,500 Retained earnings brought forward Dividend expense 1,215,000 337,500 150,000 Required: Prepare the consolidated income statement for Hobby Ltd for the year ended 31 December 2021, showing retained earnings brought forward, dividend expense and retained earnings carried forward either on the face of the income statement or in the consolidated retained earnings section of the statement of changes in equity. Total 20 marks Hobby Ltd acquired 60% of Leisure Ltd on 1 January 2015 for 4,536,000, gaining significant influence over Leisure Ltd. On this date, the share capital of Leisure Ltd was 1,350,000 and the retained earnings of Leisure Ltd was 2,767,500. Hobby Ltd acquired 25% of Craft Ltd for 4,050,000 on 1 January 2017, gaining partial influence over Craft Ltd. Craft Ltd's share capital and reserves were 1,522,500 on 1 January 2017. The share capital of Craft Ltd is 540,000 25p shares. No change to the share capital of Leisure Ltd and Hobby Ltd have taken place since acquisition. The interest income in Hobby Ltd includes interest income on its 80% holding of bonds issued by Leisure Ltd. Hobby Ltd acquired these bonds without any goodwill arising, on 1 January 2015. The interest expense recorded by Leisure Ltd represents the interest on the full bond issue. All companies have accounted for interest income and interest expense correctly. During the year Leisure Ltd sold goods costing 40,500 to Hobby Ltd for 283,500. 15% of this inventory is included in Hobby Ltd's inventory at the year end. During the year Craft Ltd sold goods costing 121,500 to Hobby Ltd for 162,000. 50% of this inventory is still in Hobby Ltd's inventory at the year end. Goodwill is capitalised. Impairment of 30% of the value of the goodwill of Leisure Ltd was recognised in 2019 and impairment of 50% of the value of the goodwill in Craft Ltd is recognised in 2021. At the year-end Hobby Ltd charges both Leisure Ltd and Craft Ltd a management fee of 10% of turnover. The companies have accounted for the management fee correctly. The management fee income in Hobby Ltd represents management fee income from Leisure Ltd and Craft Ltd. Leisure Ltd and Craft Ltd have accounted for management fee expenses under administrative expenses. The investment income in Hobby Ltd comprises of dividend income from both group and non-group companies. The retained earnings brought forward as at 1 January 2021 and dividend expense for the year ended 31 December 2021 for Hobby Ltd, Leisure Ltd and Craft Ltd were as follows: Hobby Ltd 52,580,000 Leisure Ltd 18,050,000 Craft Ltd 16,701,500 Retained earnings brought forward Dividend expense 1,215,000 337,500 150,000 Required: Prepare the consolidated income statement for Hobby Ltd for the year ended 31 December 2021, showing retained earnings brought forward, dividend expense and retained earnings carried forward either on the face of the income statement or in the consolidated retained earnings section of the statement of changes in equity. Total 20 marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts