Question: Question 1 i. a) Bonds A and B are both risk-free government bonds and have two years to maturity. Bond A has a coupon rate

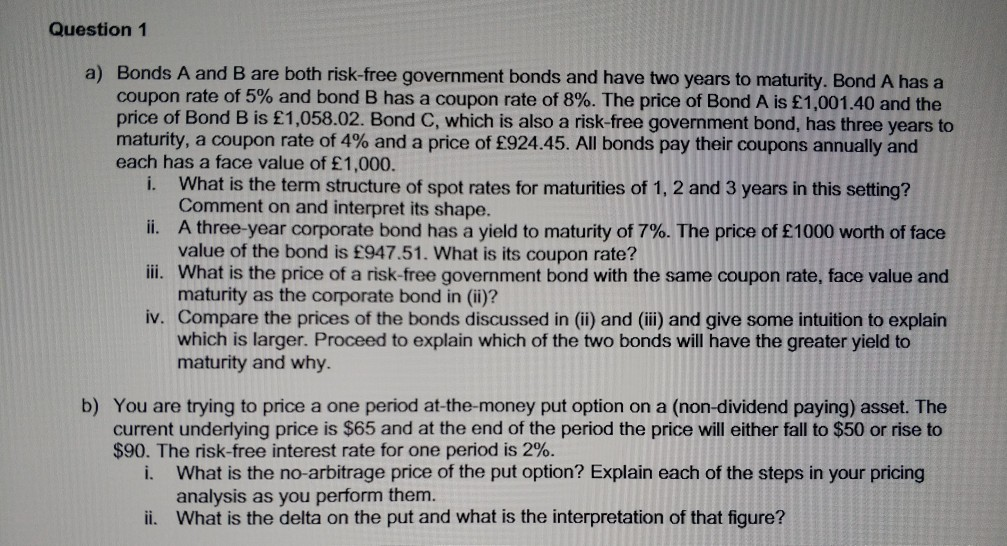

Question 1 i. a) Bonds A and B are both risk-free government bonds and have two years to maturity. Bond A has a coupon rate of 5% and bond B has a coupon rate of 8%. The price of Bond A is 1,001.40 and the price of Bond B is 1,058.02. Bond C, which is also a risk-free government bond, has three years to maturity, a coupon rate of 4% and a price of 924.45. All bonds pay their coupons annually and each has a face value of 1,000. What is the term structure of spot rates for maturities of 1, 2 and 3 years in this setting? Comment on and interpret its shape. ii. A three-year corporate bond has a yield to maturity of 7%. The price of 1000 worth of face value of the bond is 947.51. What is its coupon rate? iii. What is the price of a risk-free government bond with the same coupon rate, face value and maturity as the corporate bond in (ii)? iv. Compare the prices of the bonds discussed in (ii) and (iii) and give some intuition to explain which is larger. Proceed to explain which of the two bonds will have the greater yield to maturity and why. b) You are trying to price a one period at-the-money put option on a (non-dividend paying) asset. The current underlying price is $65 and at the end of the period the price will either fall to $50 or rise to $90. The risk-free interest rate for one period is 2%. i. What is the no-arbitrage price of the put option? Explain each of the steps in your pricing analysis as you perform them. ii. What is the delta on the put and what is the interpretation of that figure

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts