Question: QUESTION 1 ICU Window, Inc., is trying to determine its cost of debt. The firm has a debt issue outstanding with seven years to maturity

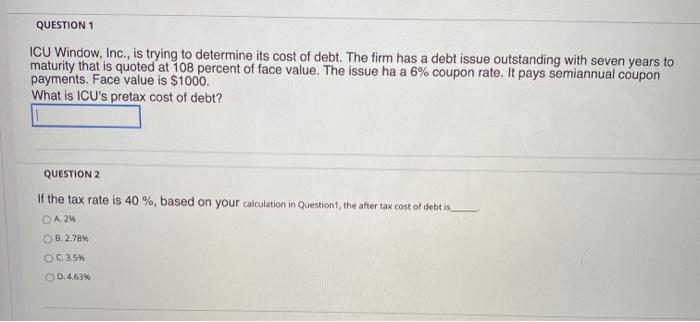

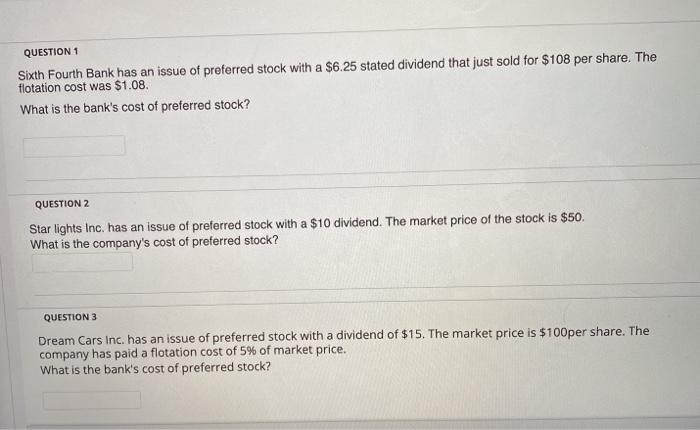

QUESTION 1 ICU Window, Inc., is trying to determine its cost of debt. The firm has a debt issue outstanding with seven years to maturity that is quoted at 108 percent of face value. The issue ha a 6% coupon rate. It pays semiannual coupon payments. Face value is $1000. What is ICU's pretax cost of debt? QUESTION 2 If the tax rate is 40 %, based on your calculation in Question, the after tax cost of debt is A2% B.2.78% O C.3.5% 0.4.63% QUESTION 1 Sixth Fourth Bank has an issue of preferred stock with a $6.25 stated dividend that just sold for $108 per share. The flotation cost was $1.08. What is the bank's cost of preferred stock? QUESTION 2 Star lights Inc. has an issue of preferred stock with a $10 dividend. The market price of the stock is $50 What is the company's cost of preferred stock? QUESTION 3 Dream Cars Inc. has an issue of preferred stock with a dividend of $15. The market price is $100 per share. The company has paid a flotation cost of 5% of market price. What is the bank's cost of preferred stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts