Question: Question 1: Identify five reasons why a taxpayer should use an LLC taxed as a partnership as compared to an S- corporation and vice-versa. The

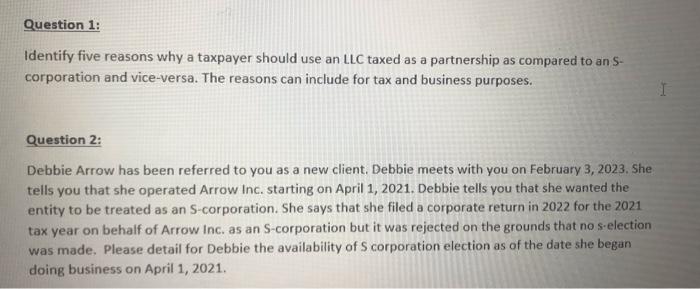

Question 1: Identify five reasons why a taxpayer should use an LLC taxed as a partnership as compared to an S- corporation and vice-versa. The reasons can include for tax and business purposes. Question 2: Debbie Arrow has been referred to you as a new client. Debbie meets with you on February 3, 2023. She tells you that she operated Arrow Inc. starting on April 1, 2021. Debbie tells you that she wanted the entity to be treated as an S-corporation. She says that she filed a corporate return in 2022 for the 2021 tax year on behalf of Arrow Inc. as an S-corporation but it was rejected on the grounds that no s-election was made. Please detail for Debbie the availability of corporation election as of the date she began doing business on April 1, 2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts