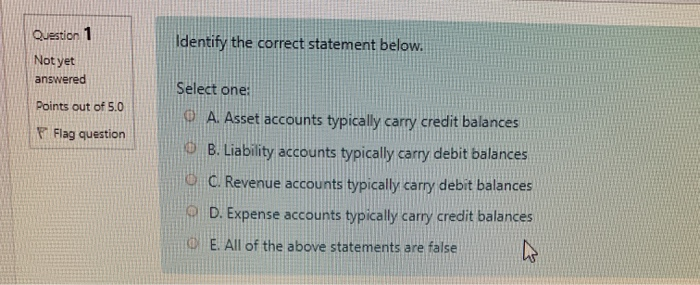

Question: Question 1 Identify the correct statement below. Not yet answered Points out of 5.0 Flag question Select one: A. Asset accounts typically carry credit balances

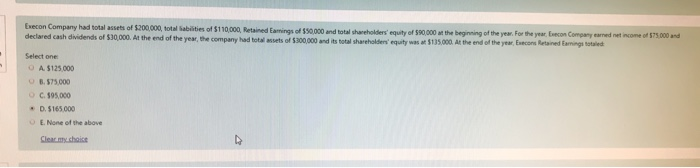

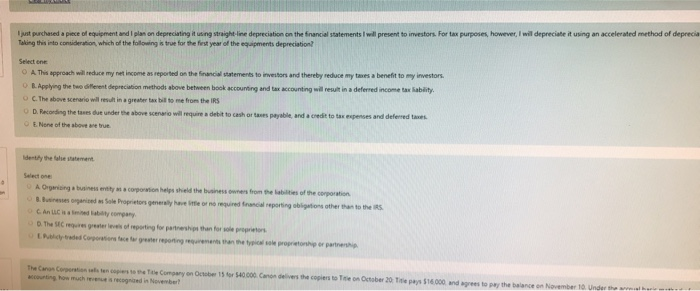

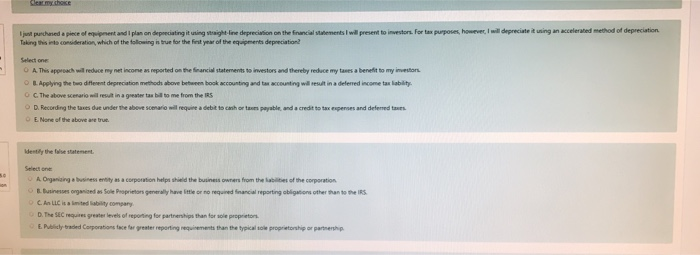

Question 1 Identify the correct statement below. Not yet answered Points out of 5.0 Flag question Select one: A. Asset accounts typically carry credit balances O B. Liability accounts typically carry debit balances O. Revenue accounts typically carry debit balances C D. Expense accounts typically carry credit balances O E. All of the above statements are false 5000 and Execon Company had total assets of $200,000, total sabates of $110,000, Retained Earnings of $50.000 and total shareholders equity of 590,000 at the beginning of the year. For the year con Companyament com declared cash dividends of S1000. At the end of the yew the company had to set of 10000 and its shah 15.000 the end of the contened A $125.000 8.575.000 C. 195.000 161000 - N above Clemy choice just purchased a piece of equipment and I plan on depreciating it using straight-line depreciation on the financial statements I will present to investors. For tax purposes, however, I will depreciate it using an accelerated method of deprecia Taking this into consideration, which of the following is true for the furst year of the gaments depreciation? Select O A This approach will reduce my net income as reported on the financial statements to investors and thereby reduce mytes a benefit to my investors. B. Applying the two different depreciation methods above between book accounting and tax accounting will result in a deferred income tax ability C.The above scenario will result in a greater tax bill to me from the IRS D. Recording the taxes due under the above scenario will require a debit to cash or as payable and credit to tax expenses and deferred O None of the above we true A Orging business corporion helps held the business owners from the b es of the corporation B esonda Sole Proprietors geen vereor nord foreporting obligations other than to the Can Ci t y company The St r eet reporting for partnerships than forsorge L aded Contac ter reporting r ent than the program The Canon Corti n as Company on October 15 for 54000 anos deives the capiers To ing how much needed in November w ber 20 1 6.000 d o the bande Under derece sing an accredethod of depreciation just purchased a piece o n e and plan on depreciating it in t e precision on the financial statements I will present to investors. For tax purposes, how Taking this into consideration, which of the following is true for the first year of the equipments depreciation? O A This approach will reduce my net icone sported on the financial statements to investors and thereby reduce my taxes a benefit to my investors Lapplying the two different de reconh ech have been look counting and counting will result in a deferred income tax liability OC. The above scenario ingles e from the IRS D. Recording the taxes de under the above are will required to cash or paytland credit to taxpenses and deferred to E None of the above are i A Dayang b Busines CALLC sa corporation has had the business owners from the Partnerhaven Br a ncaireporting como of the corporation to other than to the IRS s

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts