Question: QUESTION 1 If 1) the expected return for Arlington Bakery stock is 9.5 percent: 2) the dividend is expected to be 50 in one year,

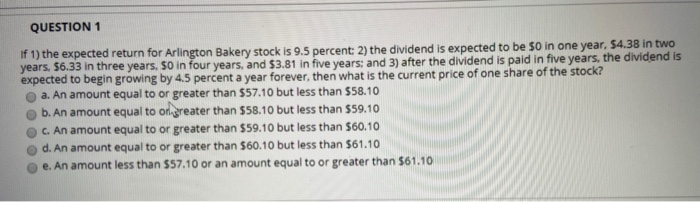

QUESTION 1 If 1) the expected return for Arlington Bakery stock is 9.5 percent: 2) the dividend is expected to be 50 in one year, 54.38 in two years. 56.33 in three years. So in four years, and 53.81 in five years, and 3) after the dividend is paid in five years, the dividend is expected to begin growing by 4.5 percent a year forever, then what is the current price of one share of the stock? a. An amount equal to or greater than $57.10 but less than 558.10 b. An amount equal to or greater than $58.10 but less than $59.10 C. An amount equal to or greater than $59.10 but less than 560.10 d. An amount equal to or greater than $60.10 but less than $61.10 e. An amount less than 557.10 or an amount equal to or greater than $61.10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts