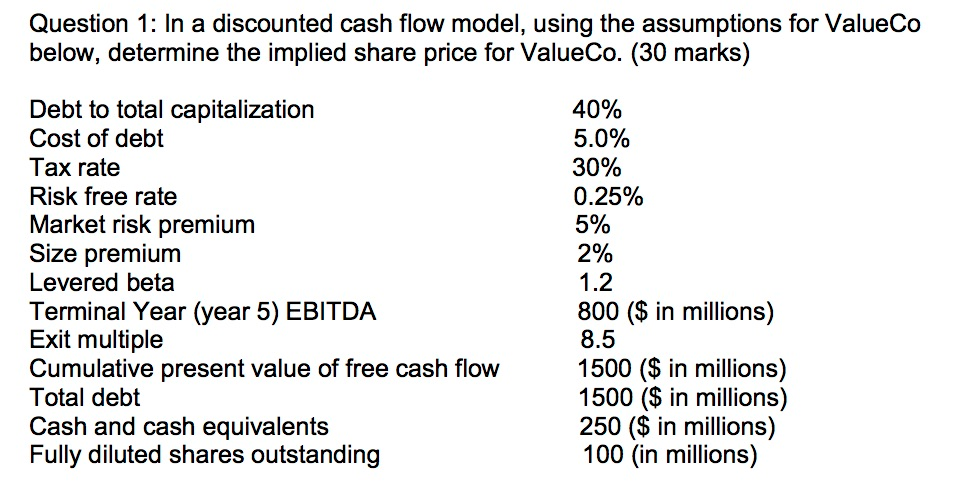

Question: Question 1: In a discounted cash flow model, using the assumptions for ValueCo below, determine the implied share price for ValueCo. (30 marks) 40% 5.0%

Question 1: In a discounted cash flow model, using the assumptions for ValueCo below, determine the implied share price for ValueCo. (30 marks) 40% 5.0% 30% 0.25% 5% 2% Debt to total capitalization Cost of debt Tax rate Risk free rate Market risk premium Size premium Levered beta Terminal Year (year 5) EBITDA Exit multiple Cumulative present value of free cash flow Total debt Cash and cash equivalents Fully diluted shares outstanding 800 ($ in millions) 8.5 1500 ($ in millions) 1500 (S in millions) 250 (S in millions) 100 (in millions)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock