Question: Question 1. In equilibrium which relationship st hold so that all assets have pasitive demand? All assets must have about the same expected returns. All

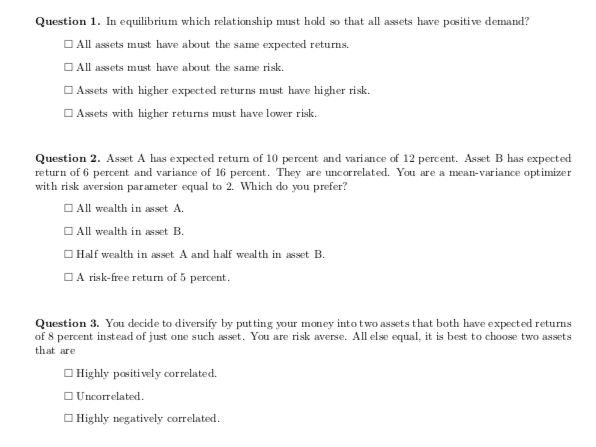

Question 1. In equilibrium which relationship st hold so that all assets have pasitive demand? All assets must have about the same expected returns. All assets must have about the same risk Assets with higher expected returns must have higher risk. Assets with higher returns must have lower risk. Question 2. Asset A has expected return of 10 percent and variance of 12 percent. Asset B has expected return of 6 percent and variance of 16 percent. They are uncorrelated. You are a mean-variance optimizer with risk aversion parameter equal to 2. Which do you prefer? OAll wealth in asset A All wealth in asset B. Half wealth in asset A and half wealth in asset B O A risk-free return of 5 percent. Question 3. You decide to diversify by putting your money into t wo assets that both have expected returns of 8 percent instead of ust one such asset. You are risk averse. All else equal, it is best to choose two assets that are Highly positively correlated Unrlated Highly negatively correlated

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts