Question: Question #1 is complete & only needed for reference. i omly need help with #2 1) Calculate the cost of float for a firm using

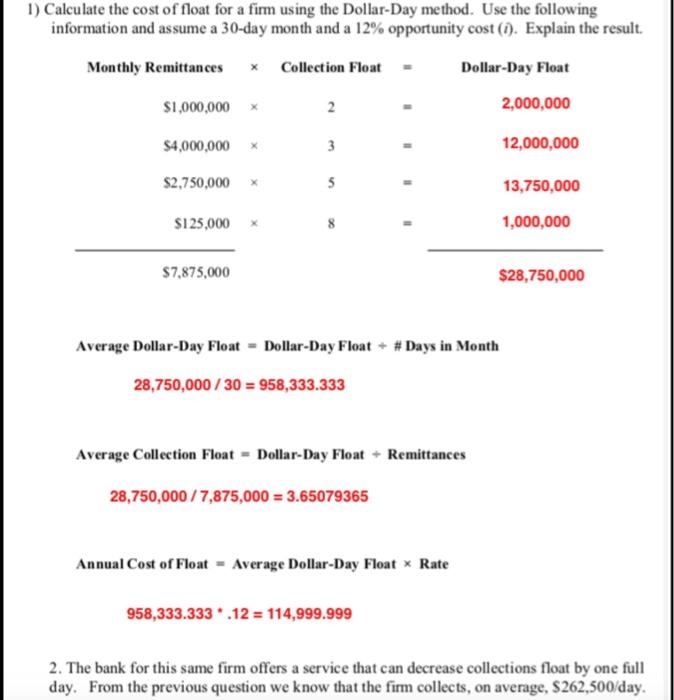

1) Calculate the cost of float for a firm using the Dollar-Day method. Use the following information and assume a 30-day month and a 12% opportunity cost (1). Explain the result. Monthly Remittances * Collection Float Dollar-Day Float $1,000,000 2. 2,000,000 $4,000,000 3 12,000,000 $2,750,000 5 13,750,000 $125,000 - 1,000,000 $7,875,000 $28,750,000 Average Dollar-Day Float - Dollar-Day Float + # Days in Month 28,750,000 / 30 = 958,333.333 Average Collection Float - Dollar-Day Float - Remittances 28,750,000 / 7,875,000 = 3.65079365 Annual Cost of Float - Average Dollar-Day Float x Rate 958,333.333.12 = 114,999.999 2. The bank for this same firm offers a service that can decrease collections float by one full day. From the previous question we know that the firm collects, on average, $262,500/day. A. Ignoring the cost of the service calculate the incremental value of the service for one day. (Hint: calculate the PV of the average daily sales with the existing float of 3.65 day, then again if the float was I day shorter, or 2.65 days). CF PV B. Assuming this is a permanent change to cash flow, calculate the incremental perpetuity value of the service. NPV = DailyNPV 365 C. Does the benefit outweigh the cost if the service fee is $500/month? Compare the perpetuity value of the service from Question 2) B. to the perpetuity cost based on the monthly fee. D. Calculate the incremental balances the firm would be required to maintain if it paid for the new service in balances. Assume an average 30-day month and a current ecr of 35%. Also, assume the firm is required to compensate the bank for the 10% reserve requirement CBR SC (1-RRR)*(ECR D 365 E. Would the firm prefer to pay with balances or fees? Explain. 1) Calculate the cost of float for a firm using the Dollar-Day method. Use the following information and assume a 30-day month and a 12% opportunity cost (1). Explain the result. Monthly Remittances * Collection Float Dollar-Day Float $1,000,000 2. 2,000,000 $4,000,000 3 12,000,000 $2,750,000 5 13,750,000 $125,000 - 1,000,000 $7,875,000 $28,750,000 Average Dollar-Day Float - Dollar-Day Float + # Days in Month 28,750,000 / 30 = 958,333.333 Average Collection Float - Dollar-Day Float - Remittances 28,750,000 / 7,875,000 = 3.65079365 Annual Cost of Float - Average Dollar-Day Float x Rate 958,333.333.12 = 114,999.999 2. The bank for this same firm offers a service that can decrease collections float by one full day. From the previous question we know that the firm collects, on average, $262,500/day. A. Ignoring the cost of the service calculate the incremental value of the service for one day. (Hint: calculate the PV of the average daily sales with the existing float of 3.65 day, then again if the float was I day shorter, or 2.65 days). CF PV B. Assuming this is a permanent change to cash flow, calculate the incremental perpetuity value of the service. NPV = DailyNPV 365 C. Does the benefit outweigh the cost if the service fee is $500/month? Compare the perpetuity value of the service from Question 2) B. to the perpetuity cost based on the monthly fee. D. Calculate the incremental balances the firm would be required to maintain if it paid for the new service in balances. Assume an average 30-day month and a current ecr of 35%. Also, assume the firm is required to compensate the bank for the 10% reserve requirement CBR SC (1-RRR)*(ECR D 365 E. Would the firm prefer to pay with balances or fees? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts