Question: Question 1: Jack has been operating a restaurant as a proprietorship. He and Michel have decided to form a partnership. Jack investment consists of cash,

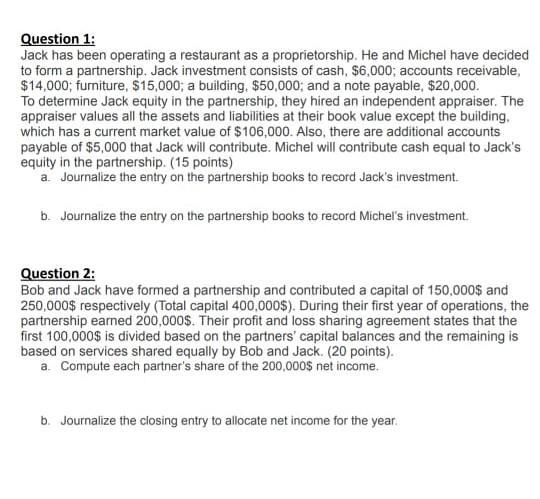

Question 1: Jack has been operating a restaurant as a proprietorship. He and Michel have decided to form a partnership. Jack investment consists of cash, $6,000; accounts receivable, $14,000; furniture, $15,000; a building, $50,000; and a note payable, $20,000. To determine Jack equity in the partnership, they hired an independent appraiser. The appraiser values all the assets and liabilities at their book value except the building, which has a current market value of $106,000. Also, there are additional accounts payable of $5,000 that Jack will contribute. Michel will contribute cash equal to Jack's equity in the partnership (15 points) a Journalize the entry on the partnership books to record Jack's Investment. b. Journalize the entry on the partnership books to record Michel's investment Question 2: Bob and Jack have formed a partnership and contributed a capital of 150,000$ and 250,000$ respectively (Total capital 400,000$). During their first year of operations, the partnership earned 200,000$. Their profit and loss sharing agreement states that the first 100,000$ is divided based on the partners' capital balances and the remaining is based on services shared equally by Bob and Jack. (20 points). a. Compute each partner's share of the 200,000$ net income. b. Journalize the closing entry to allocate net income for the year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts