Question: Question 1 Klover ( Pty ) Ltd is the parent company of two subsidiary companies: Pasture ( Pty ) Ltd and Flavoured Milk ( Pty

Question

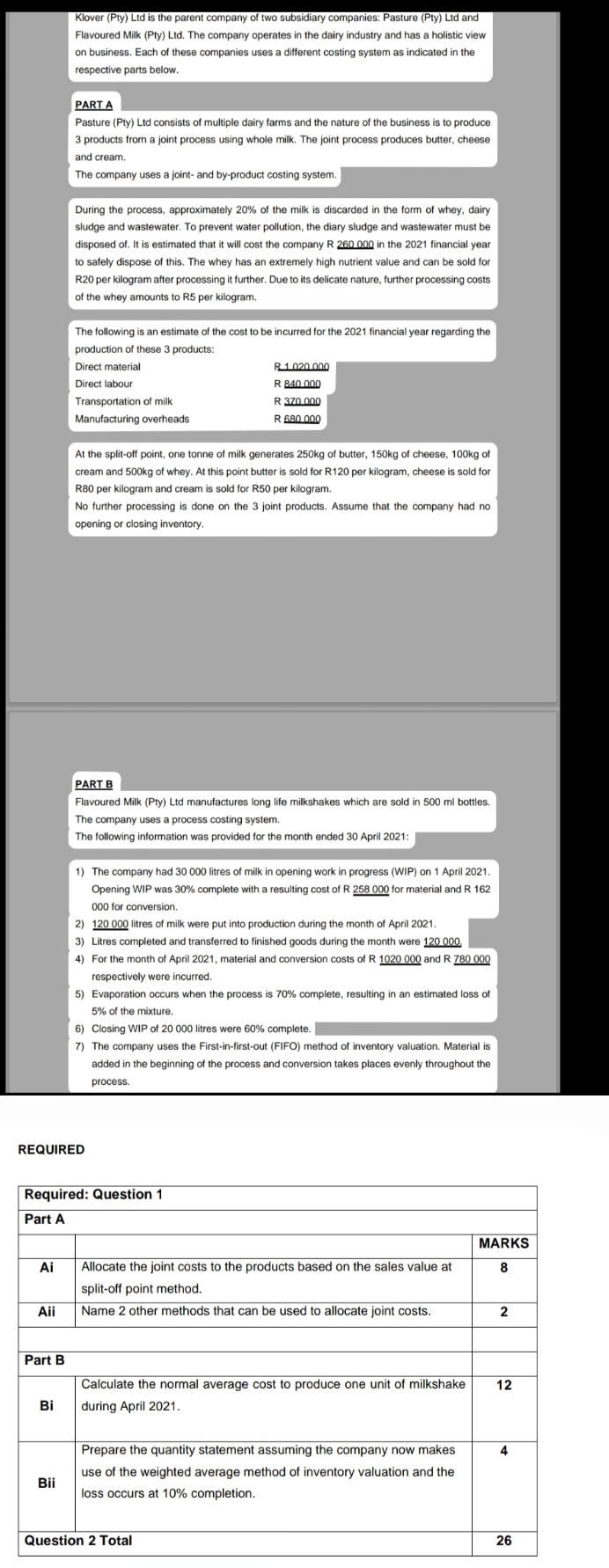

Klover Pty Ltd is the parent company of two subsidiary companies: Pasture Pty Ltd and Flavoured Milk Pty Ltd The company operates in the dairy industry and has a holistic view on business. Each of these companies uses a different costing system as indicated in the respective parts below.

PART A

Pasture Pty Ltd consists of multiple dairy farms and the nature of the business is to produce products from a joint process using whole milk. The joint process produces butter, cheese and cream.

The company uses a joint and byproduct costing system.

During the process, approximately of the milk is discarded in the form of whey, dairy sludge and wastewater. To prevent water pollution, the diary sludge and wastewater must be disposed of It is estimated that it will cost the company R in the financial year to safely dispose of this. The whey has an extremely high nutrient value and can be R per kilogram after processing it further. Due to its delicate nature, further processing of the whey amounts to R per kilogram.

The following is an estimate of the cost to be incurred for the financial year regarding the production of these products:

Direct material

R

Direct labour

R

Transportation of milk

R

Manufacturing overheads

R

At the splitoff point, one tonne of milk generates kg of butter, kg of cheese, kg of cream and kg of whey. At this point butter is sold for R per kilogram, cheese is sold for R per kilogram and cream is sold for R per kilogram.

No further processing is done on the joint products. Assume that the company had no opening or closing inventory.

PART B

Flavoured Milk Pty Ltd manufactures long life milkshakes which are sold in ml bottles.

The company uses a process costing system.

The following information was provided for the month ended April :

The company had litres of milk in opening work in progress WIP on April Opening WIP was complete with a resulting cost of R for material and R for conversion.

litres of milk were put into production during the month of April

Litres completed and transferred to finished goods during the month were

For the month of April material and conversion costs of R and R

respectively were incurred.

Evaporation occurs when the process is complete, resulting in an estimated loss of

of the mixture.

Closing WIP of litres were complete.

The company uses the Firstinfirstout FIFO method of inventory valuation. Materi added in the beginning of the process and conversion takes places evenly throughou process.

Required: Question

Part A

Ai

Allocate the joint costs to the products based on the sales value at splitoff point method.

Aii

Name other methods that can be used to allocate joint costs.

Part B

Bi

Calculate the normal average cost to produce one unit of milkshake during April

Bii

Prepare the quantity statement assuming the company now makes use of the weighted average method of inventory valuation and the loss occurs at completion.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock