Question: Question 1 - Lancelot is considering two different capital structures. Scenario I proposes 800 shares and $14,000 of debt. Scenario II proposes 900 shares and

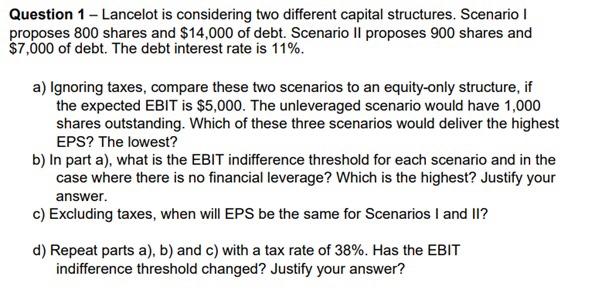

Question 1 - Lancelot is considering two different capital structures. Scenario I proposes 800 shares and $14,000 of debt. Scenario II proposes 900 shares and $7,000 of debt. The debt interest rate is 11%. a) Ignoring taxes, compare these two scenarios to an equity-only structure, if the expected EBIT is $5,000. The unleveraged scenario would have 1,000 shares outstanding. Which of these three scenarios would deliver the highest EPS? The lowest? b) In part a), what is the EBIT indifference threshold for each scenario and in the case where there is no financial leverage? Which is the highest? Justify your answer. c) Excluding taxes, when will EPS be the same for Scenarios I and II? d) Repeat parts a), b) and c) with a tax rate of 38%. Has the EBIT indifference threshold changed? Justify your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts