Question: - = = Question (1) (Minimum Variance Frontier, Efficient Portfolios and Optimal Portfolio Selection) (10 points) The Triad family of mutual funds allows investors to

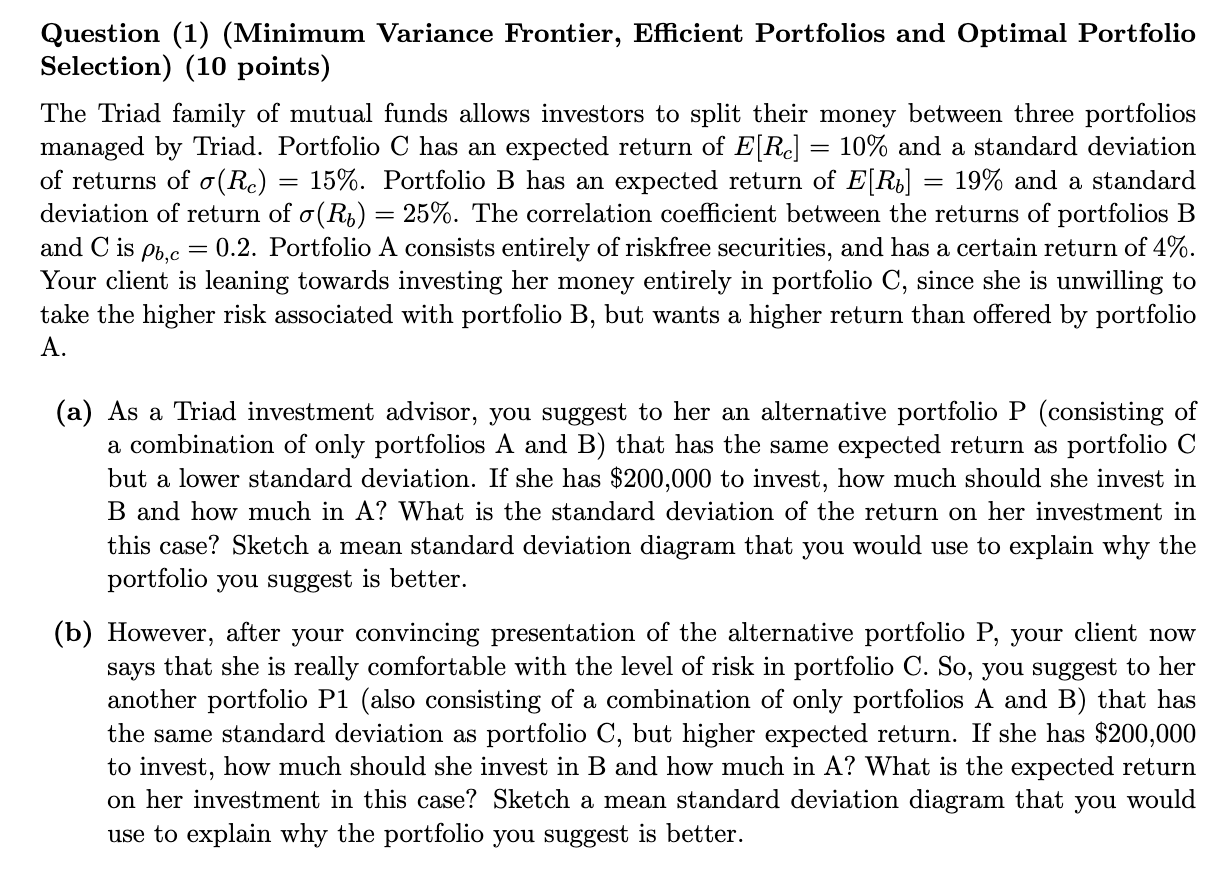

- = = Question (1) (Minimum Variance Frontier, Efficient Portfolios and Optimal Portfolio Selection) (10 points) The Triad family of mutual funds allows investors to split their money between three portfolios managed by Triad. Portfolio C has an expected return of E[Rc] = 10% and a standard deviation of returns of o(Rc) 15%. Portfolio B has an expected return of E[Ru] = 19% and a standard deviation of return of o(Rb) = 25%. The correlation coefficient between the returns of portfolios B = 0.2. Portfolio A consists entirely of riskfree securities, and has a certain return of 4%. Your client is leaning towards investing her money entirely in portfolio C, since she is unwilling to take the higher risk associated with portfolio B, but wants a higher return than offered by portfolio A. and C is Pb,c (a) As a Triad investment advisor, you suggest to her an alternative portfolio P (consisting of a combination of only portfolios A and B) that has the same expected return as portfolio C but a lower standard deviation. If she has $200,000 to invest, how much should she invest in B and how much in A? What is the standard deviation of the return on her investment in this case? Sketch a mean standard deviation diagram that you would use to explain why the portfolio you suggest is better. (b) However, after your convincing presentation of the alternative portfolio P, your client now says that she is really comfortable with the level of risk in portfolio C. So, you suggest to her another portfolio P1 (also consisting of a combination of only portfolios A and B) that has the same standard deviation as portfolio C, but higher expected return. If she has $200,000 to invest, how much should she invest in B and how much in A? What is the expected return on her investment in this case? Sketch a mean standard deviation diagram that you would use to explain why the portfolio you suggest is better

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts