Question: Question 1 - Monte Carlo simulation a) Succinctly describe two applications of Monte Carlo simulation we covered in this unit. In your answer, demonstrate your

Question 1 - Monte Carlo simulation

a) Succinctly describe two applications of Monte Carlo simulation we covered in this unit. In your answer, demonstrate your own understanding and interpretation instead of listing the steps from the lecture slides. Expected length: maximum 10 sentences.

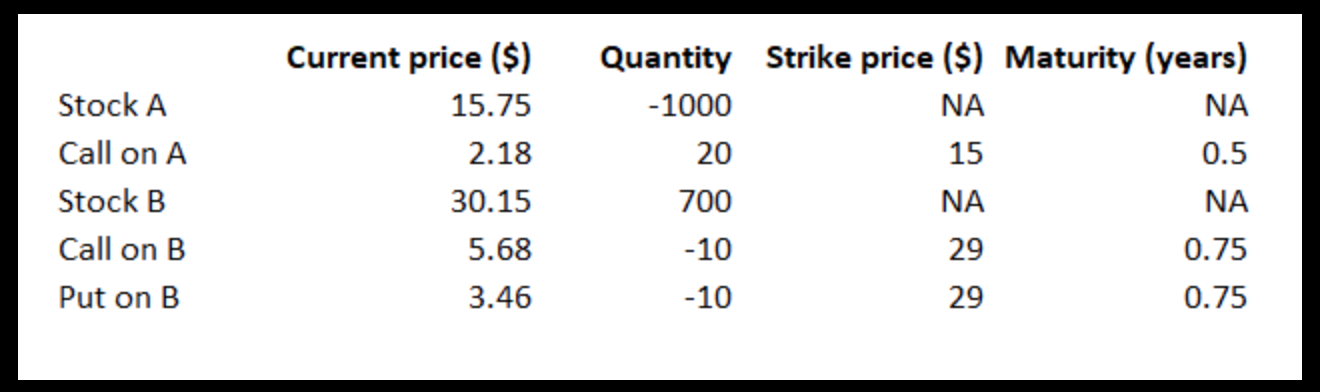

b) The table below lists various positions in stocks and options a trading desk is currently holding:

Negative quantities refer to short positions and positive quantities refer to long positions. Each option contract covers 100 shares (meaning, for instance, the 20 contracts listed for the call option on A cover 20x100 = 2000 shares).

"Current price" is the price per share (meaning, for instance, the $2.18 price listed for the call option on A is the price of a call on 1 share). "NA" means "not applicable".

Assume the risk-free rate for all maturities is 5% per annum (with continuous compounding). Neither stock pays dividend and the options can be treated as European. Returns on Stock A and Stock B have a correlation of 0.45.

i) Using the information provided, perform full Monte Carlo simulation to estimate the 10-day 99% VaR (Value-at-Risk) for this portfolio. State assumptions if applicable. Interpret the final result. Note that standard deviation is deliberately left out of the table, instead option prices were provided, which should allow you to extract information on volatility.

Provide commentary here

ii) Compute the 10-day 99% VaR for the individual components of the portfolio also using full Monte Carlo simulation, using the same random samples.

Show that the sum of the individual VaR values is greater than the portfolio VaR computed above. Comment on the result.

StockACallonAStockBCallonBPutonBCurrentprice($)15.752.1830.155.683.46Quantity1000207001010Strikeprice($)NA15NA2929Maturity(years)NA0.5NA0.750.75

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts