Question: Question 1 Ms . Ulsan has been thinking about starting her own independent gasoline station. Ms . Ulsan's problem is to decide how large her

Question

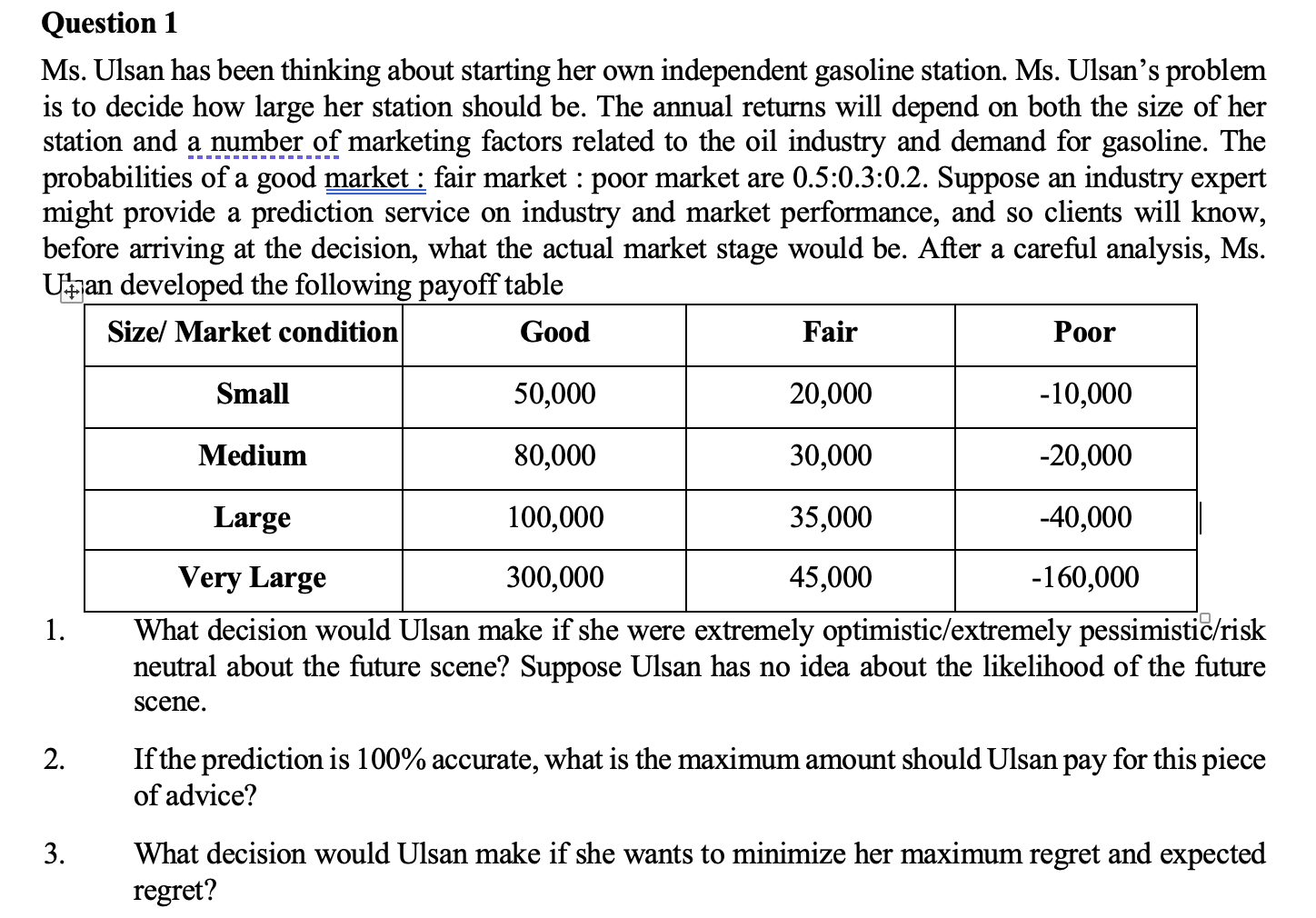

Ms Ulsan has been thinking about starting her own independent gasoline station. Ms Ulsan's problem is to decide how large her station should be The annual returns will depend on both the size of her station and a number of marketing factors related to the oil industry and demand for gasoline. The probabilities of a good market : fair market : poor market are :: Suppose an industry expert might provide a prediction service on industry and market performance, and so clients will know, before arriving at the decision, what the actual market stage would be After a careful analysis, Ms U an developed the following payoff table

tableSize Market condition,Good,Fair,PoorSmallMediumLargeVery Large,

What decision would Ulsan make if she were extremely optimisticextremely pessimisticrisk neutral about the future scene? Suppose Ulsan has no idea about the likelihood of the future scene.

If the prediction is accurate, what is the maximum amount should Ulsan pay for this piece of advice?

What decision would Ulsan make if she wants to minimize her maximum regret and expected regret?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock