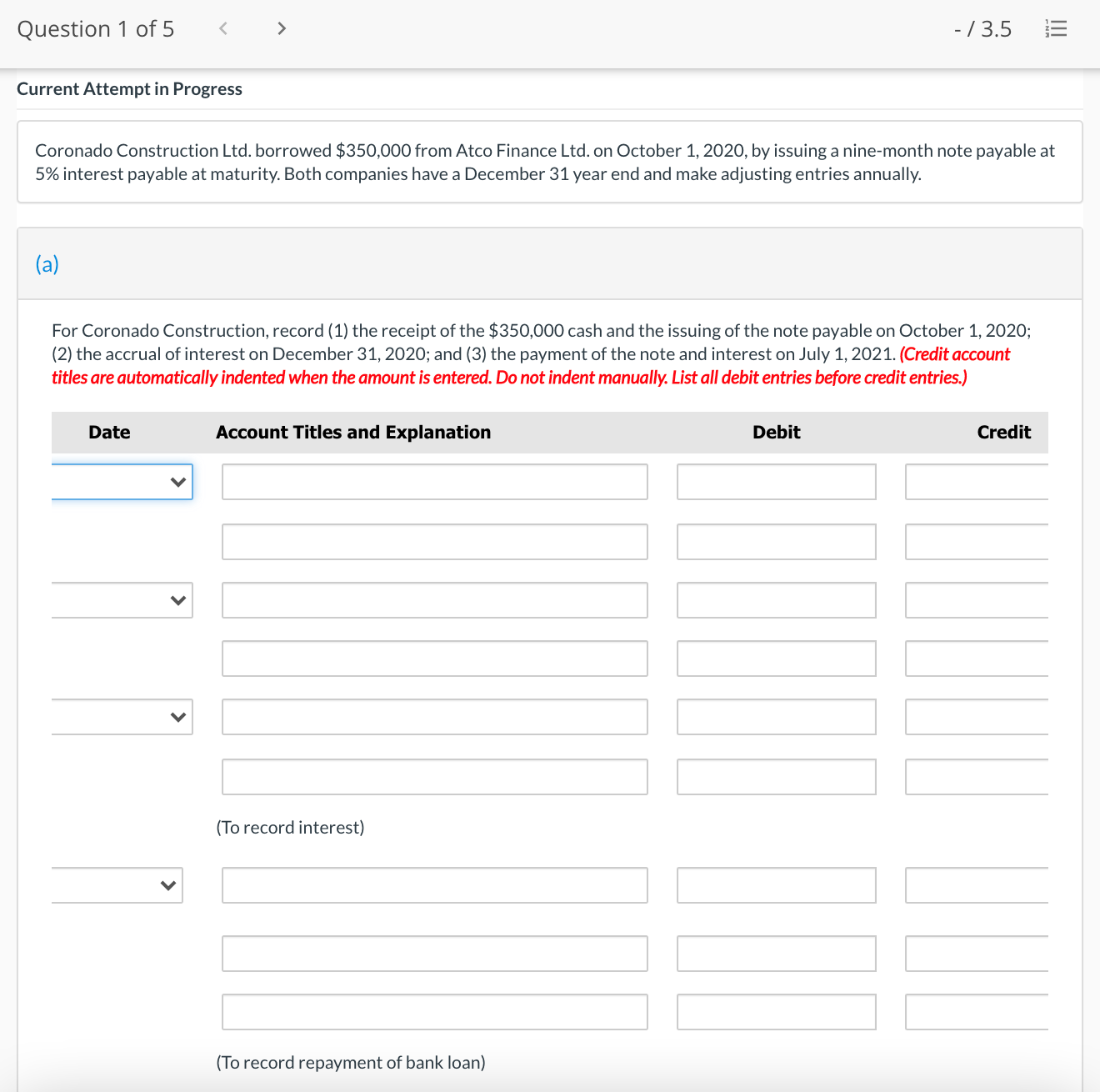

Question: Question 1 of5 Current Attempt in Progress /3.5 E Coronado Construction Ltd. borrowed $350,000 from Atco Finance Ltd. on October 1, 2020, by issuing a

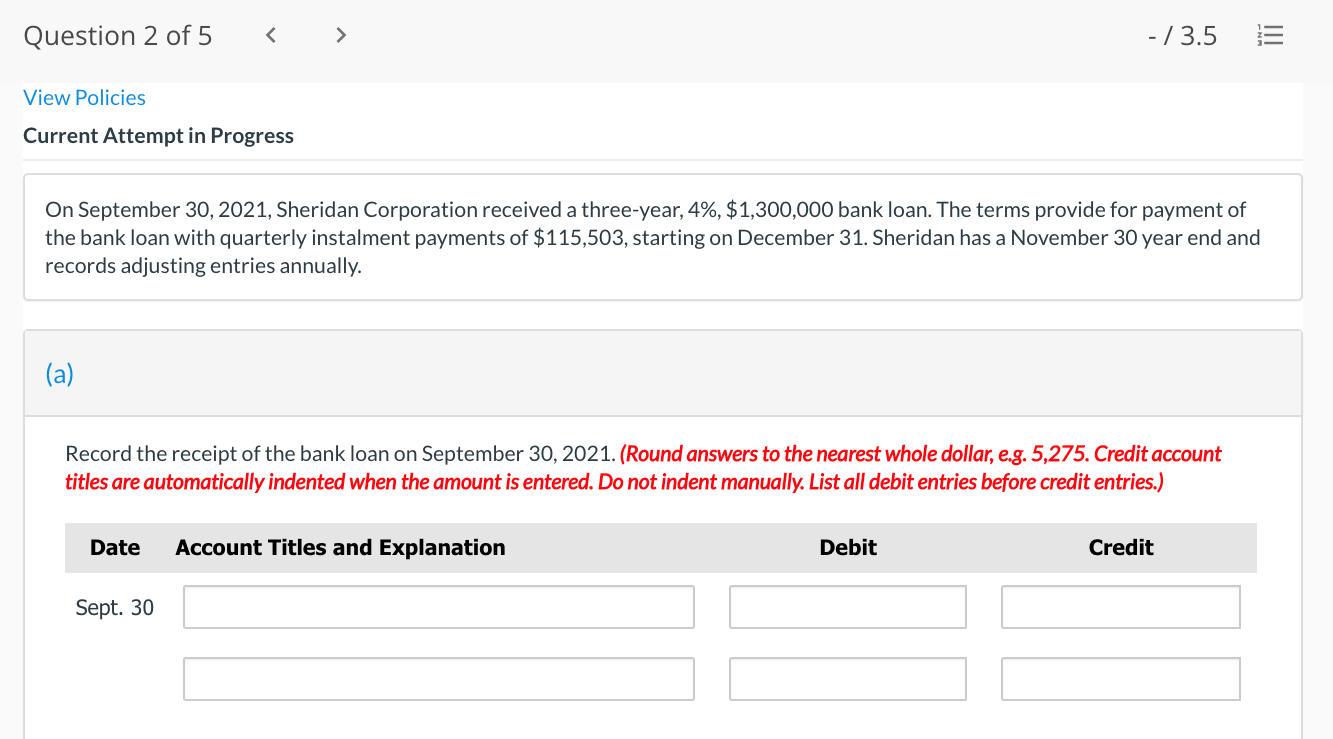

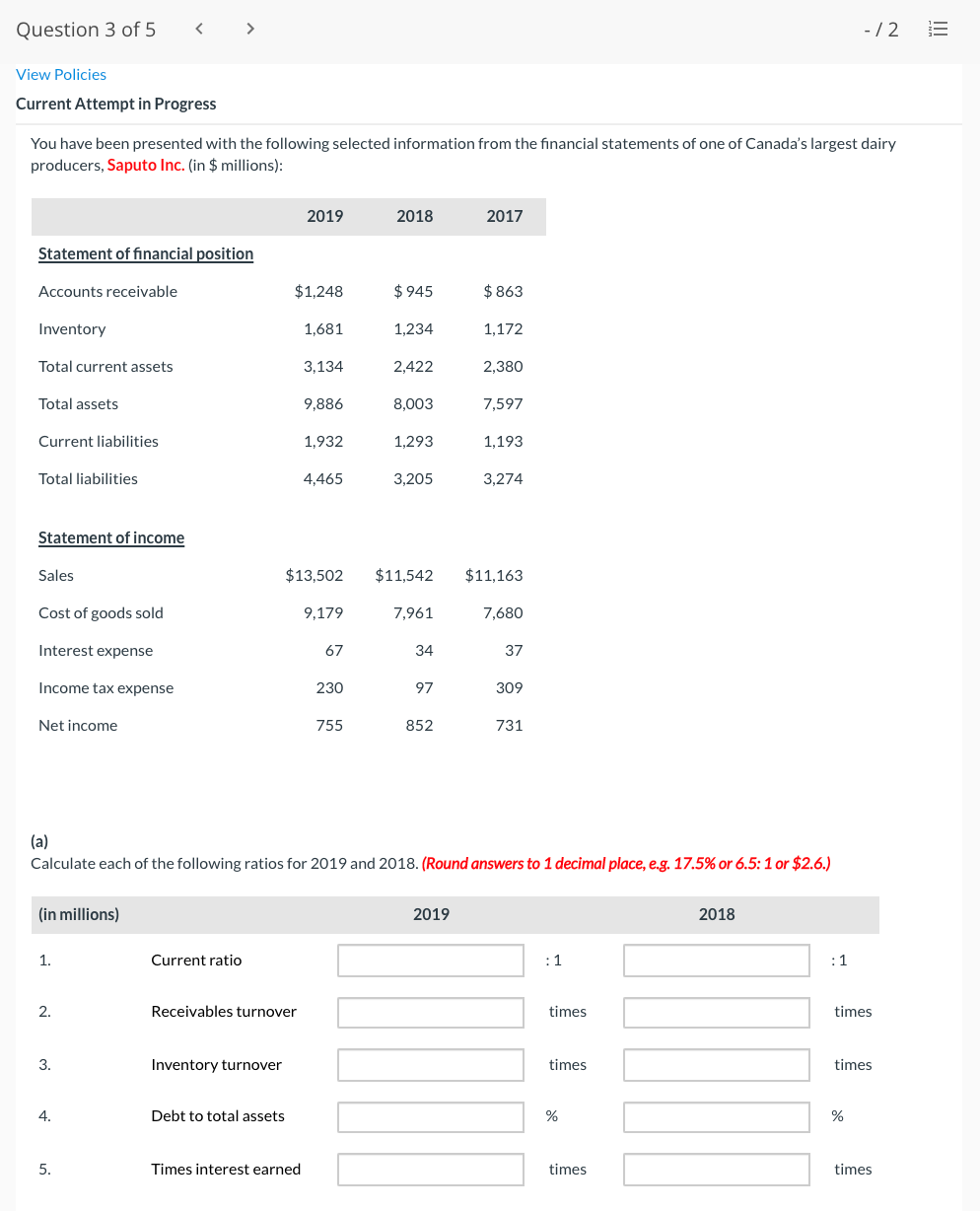

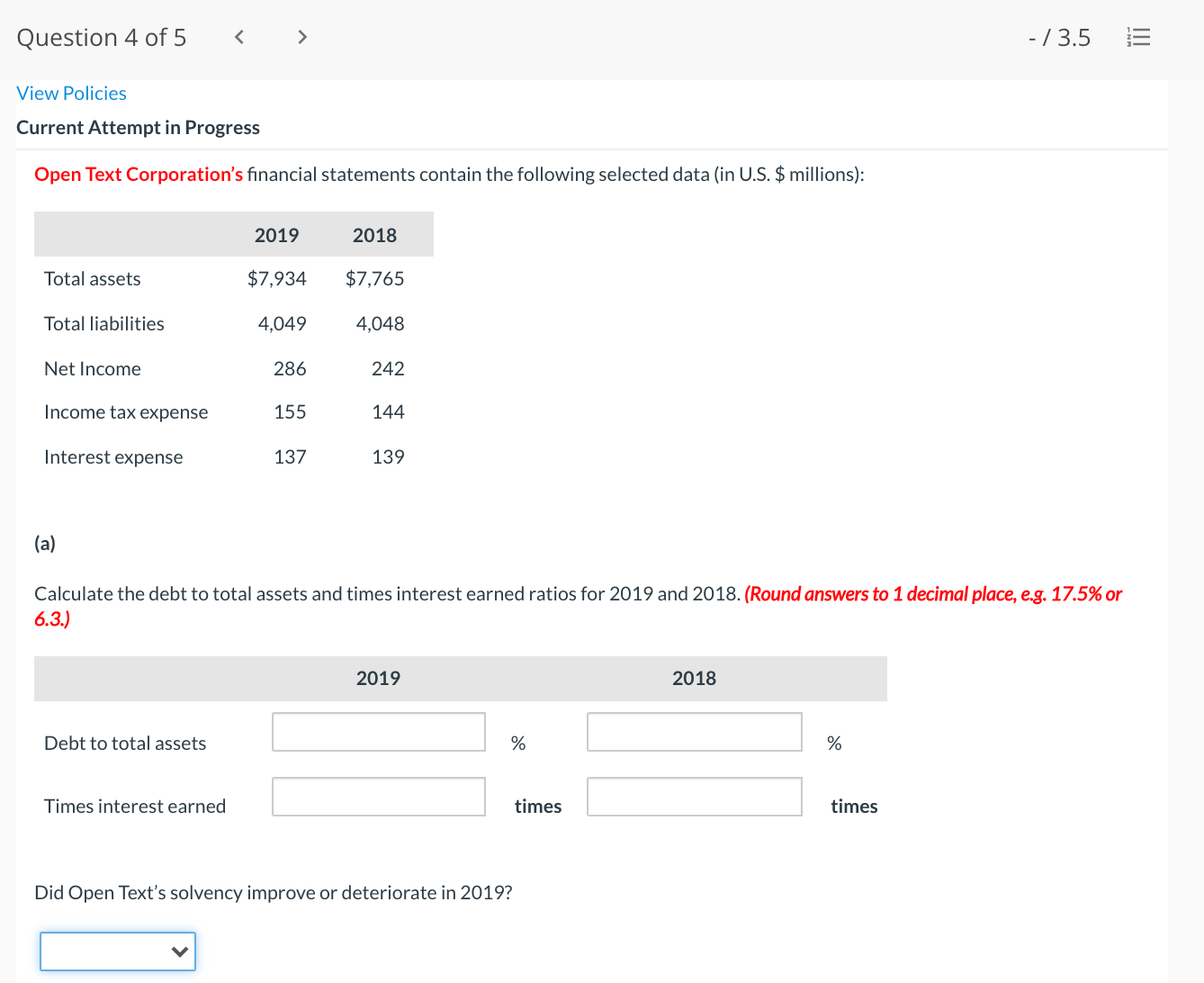

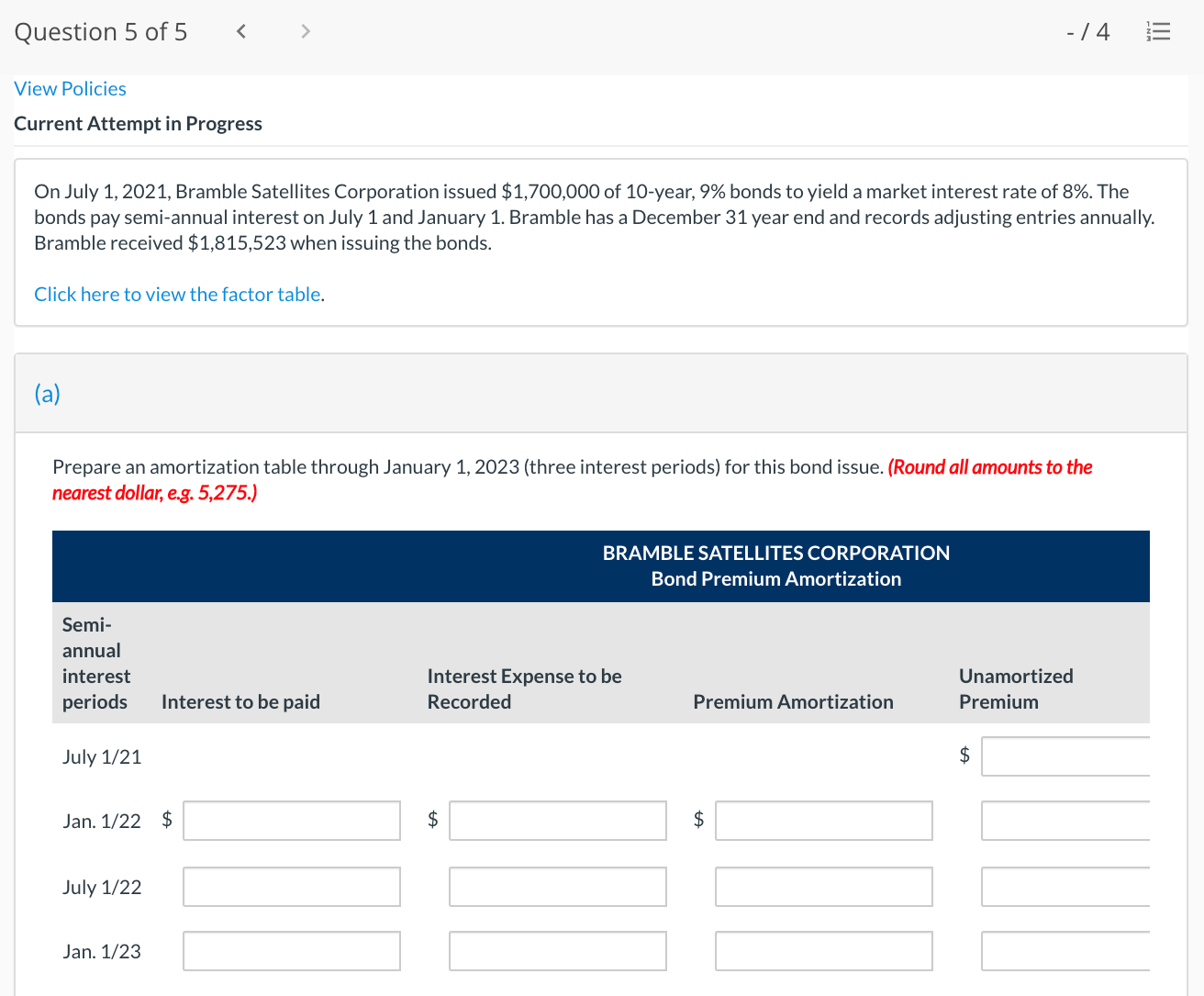

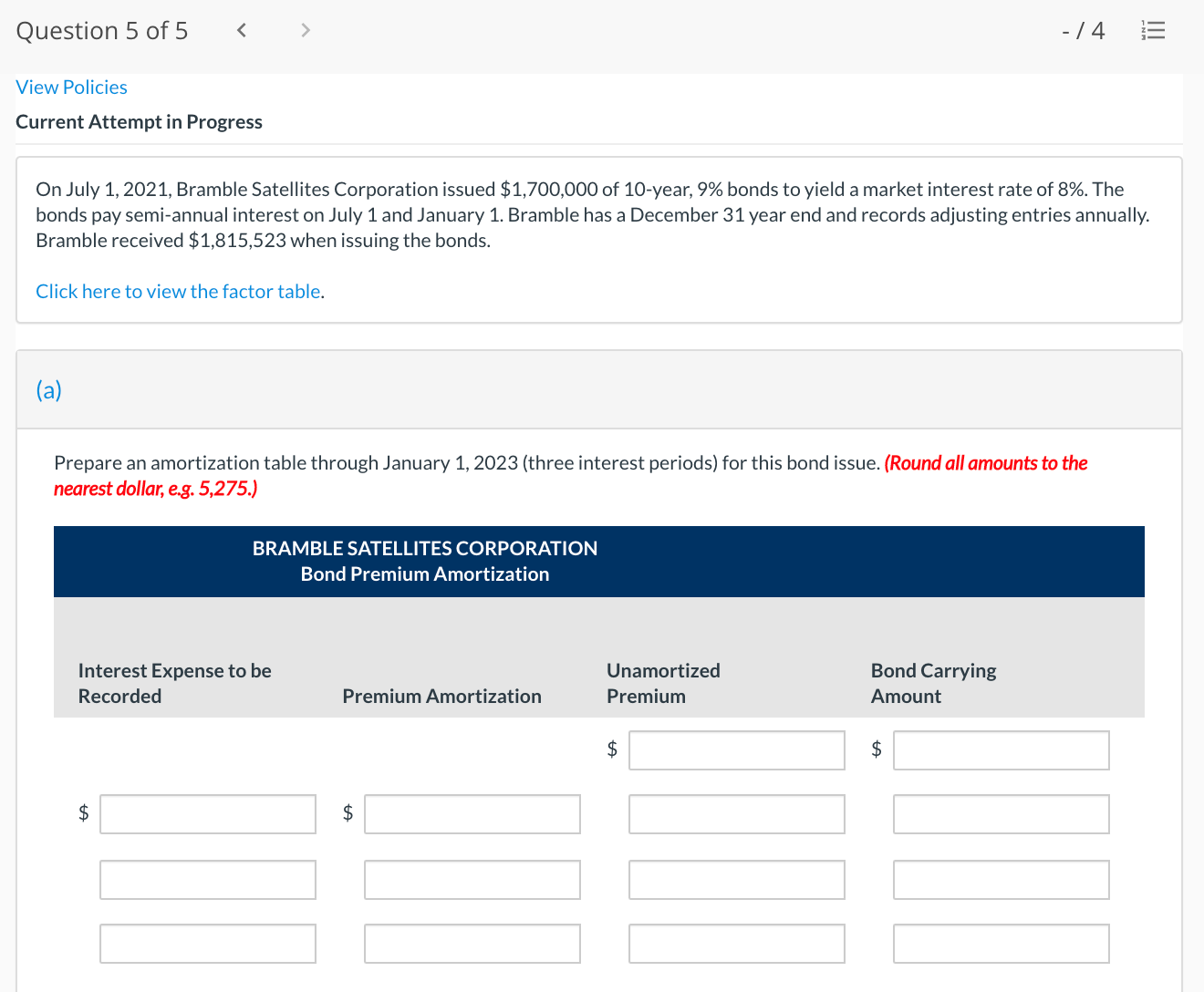

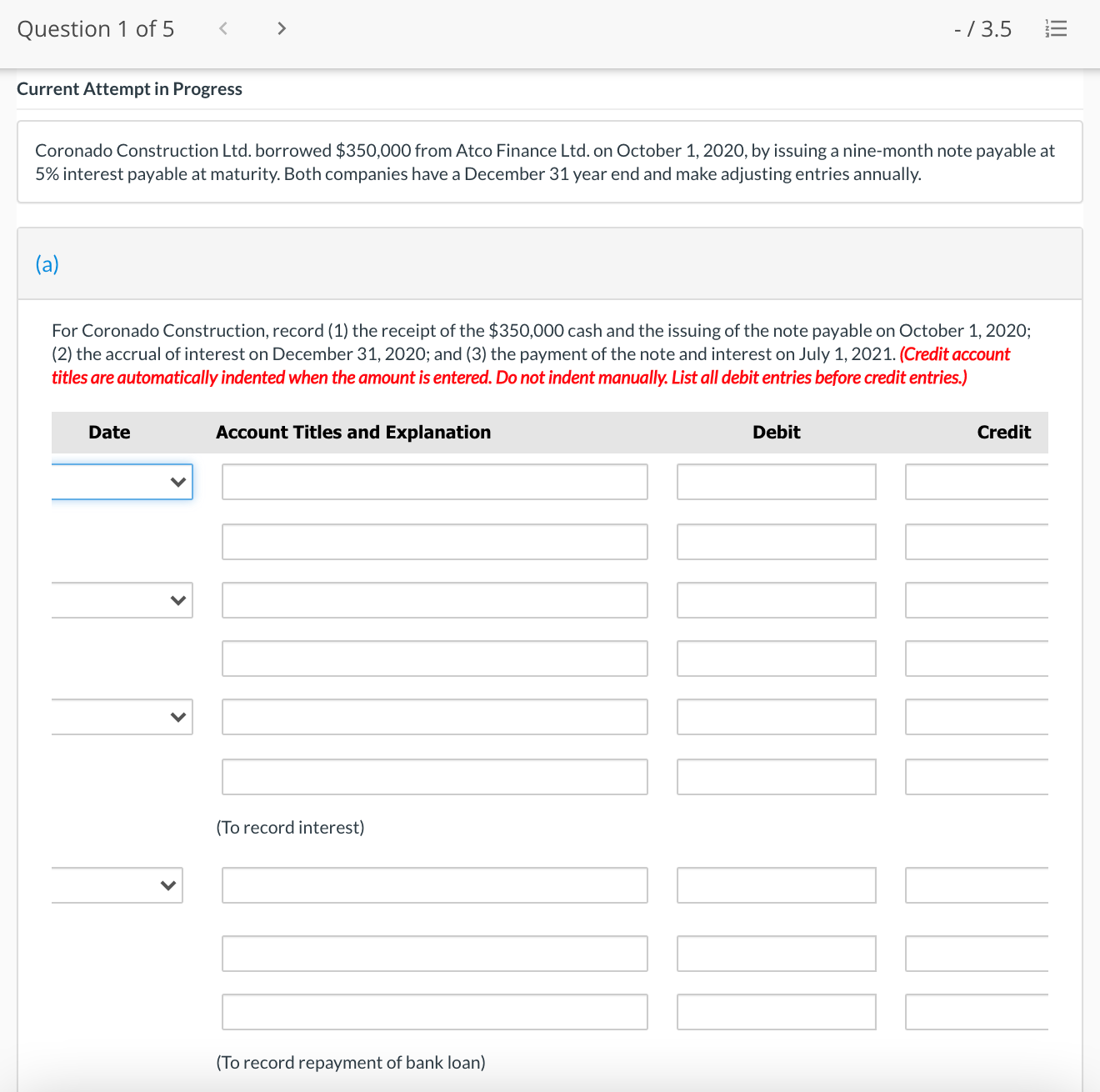

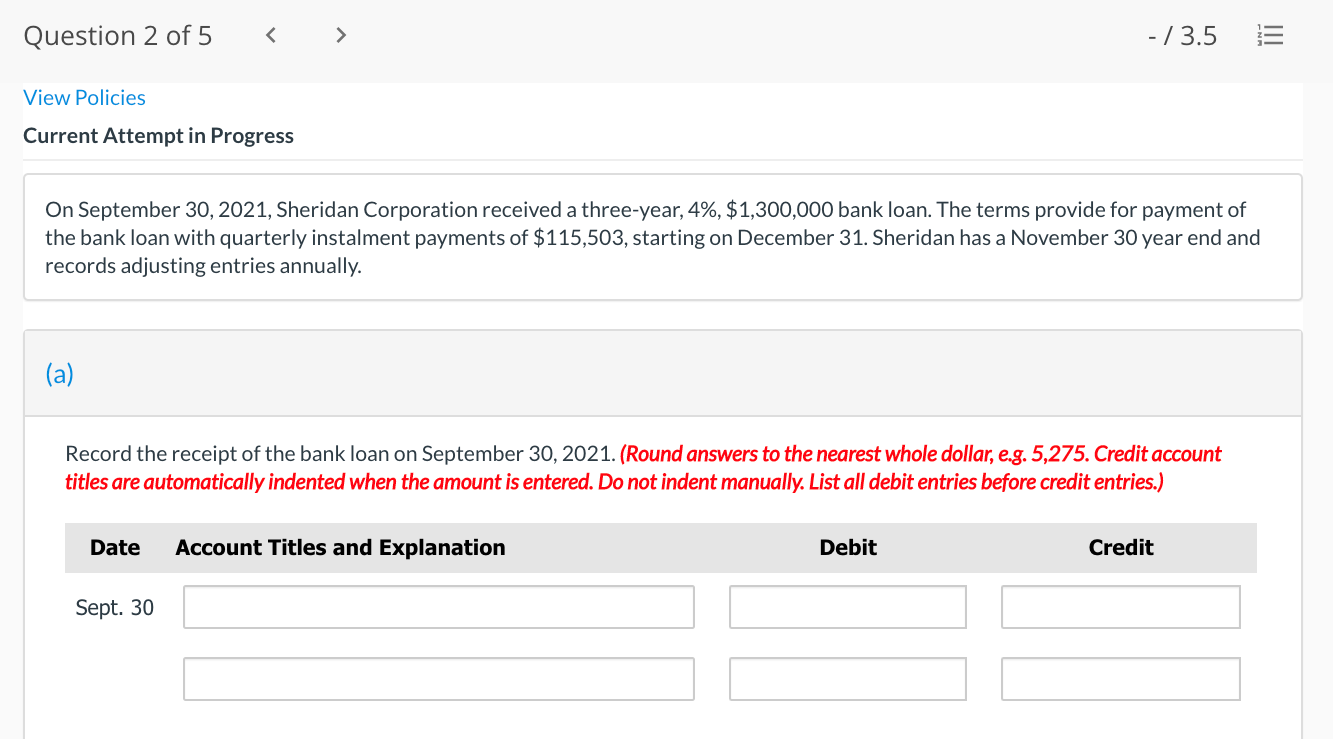

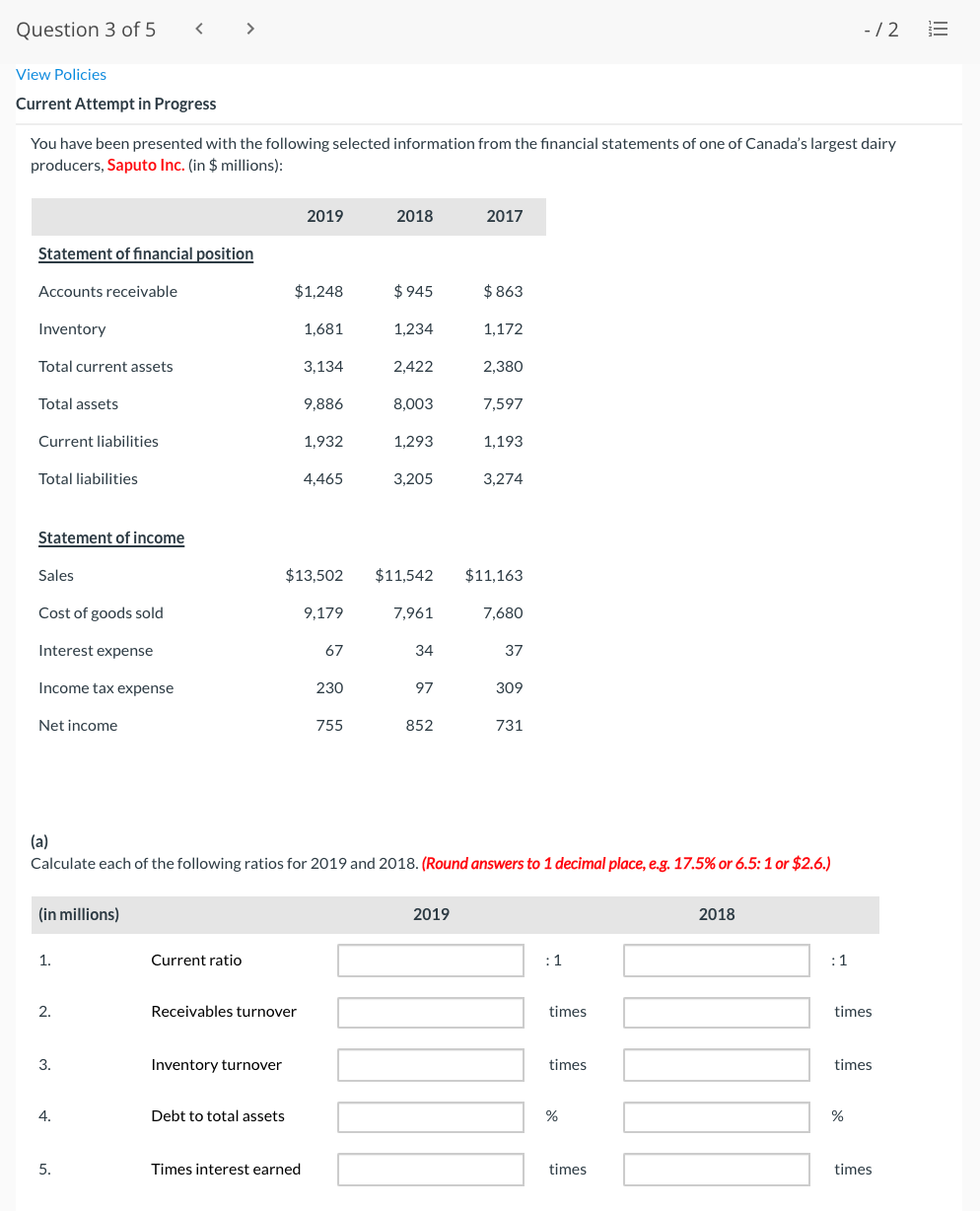

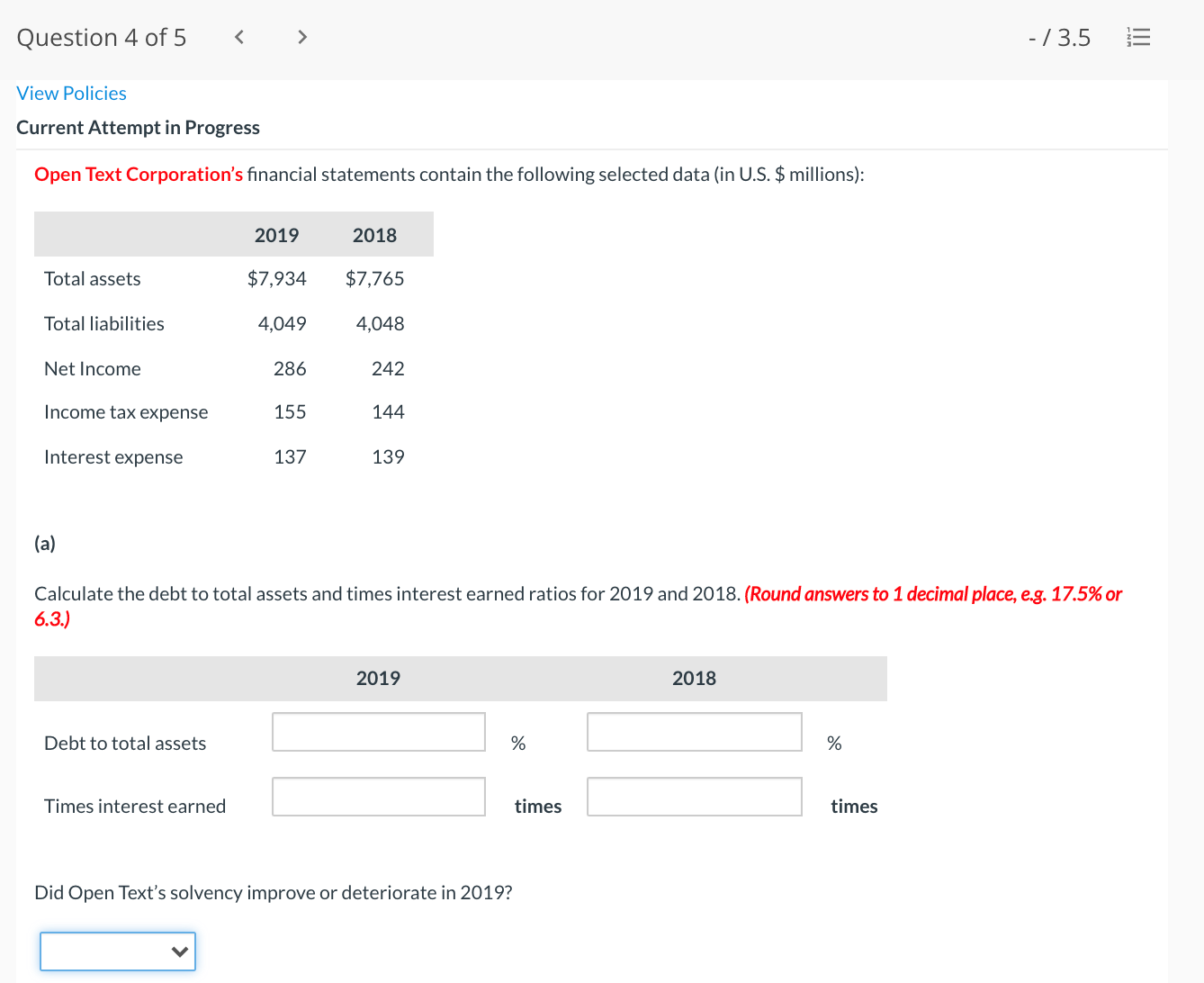

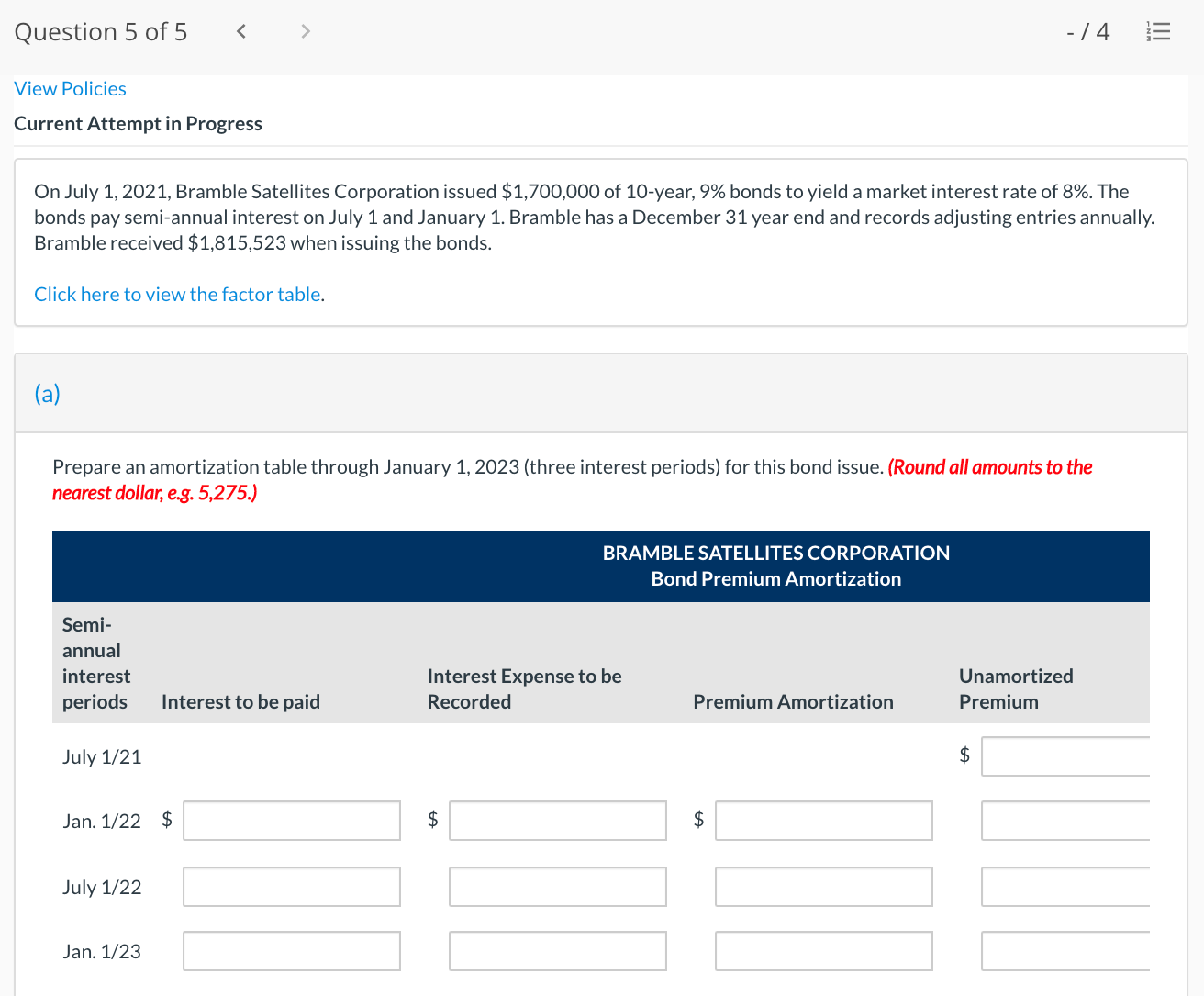

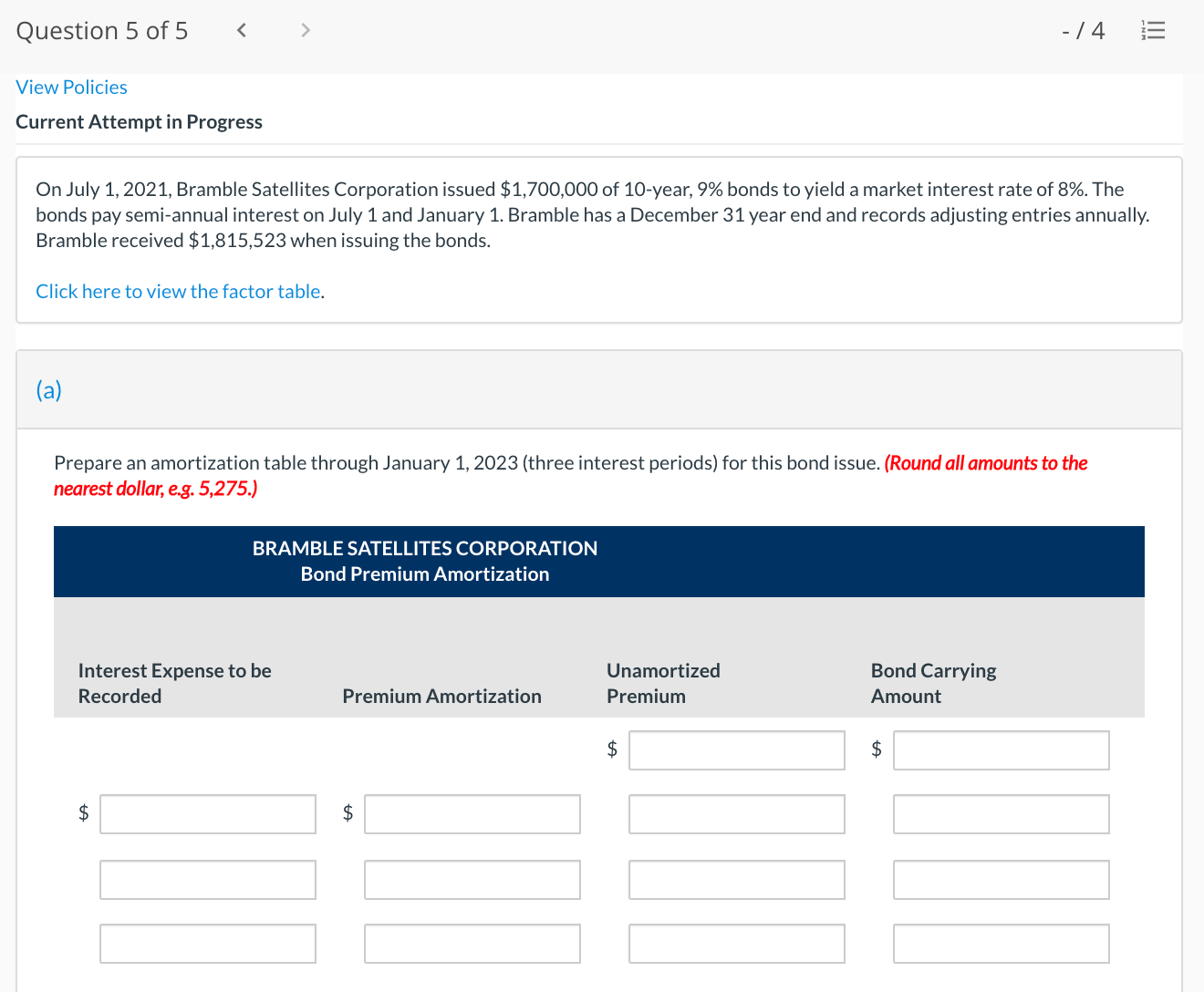

Question 1 of5 Current Attempt in Progress /3.5 E Coronado Construction Ltd. borrowed $350,000 from Atco Finance Ltd. on October 1, 2020, by issuing a nine-month note payable at 5% interest payable at maturity. Both companies have a December 31 year end and make adjusting entries annually. (60 For Coronado Construction, record (1) the receipt of the $350,000 cash and the issuing of the note payable on October 1, 2020; {2) the accrual of interest on December 31,2020; and (3) the payment of the note and interest on July 1, 2021. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries) Account Titles and Explanation :: E j: Z I: E (To record interest) I: Z Z (T 0 record repayment of ban k loan) Debit HHH HHHHHH Question 2 of5 _ l 3_5 L: View Policies Current Attempt in Progress On September 30. 2021, Sheridan Corporation received a three-year, 4%, $1,300,000 bank loan. The terms provide for payment of the bank loan with quarterly instalment payments of $115,503, starting on December 31. Sheridan has a November 30 year end and records adjusting entries annually. (3) Record the receipt of the bank loan on September 30. 2021. {Round answers to the nearest whole dollar. 8.3. 5,275. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.) Date Account Titles and Explanation Debit Credit S S Question 3 of 5 - 12 IE View Policies Current Attempt in Progress You have been presented with the following selected information from the financial statements of one of Canada's largest dairy producers, Saputo Inc. (in $ millions): 2019 2018 2017 Statement of financial position Accounts receivable $1,248 $ 945 $ 863 Inventory 1,681 1,234 1,172 Total current assets 3,134 2,422 2,380 Total assets 9,886 8,003 7,597 Current liabilities 1,932 1,293 1,193 Total liabilities 4,465 3,205 3,274 Statement of income Sales $13,502 $11,542 $11,163 Cost of goods sold 9,179 7,961 7,680 Interest expense 67 34 37 Income tax expense 230 97 309 Net income 755 852 731 (a) Calculate each of the following ratios for 2019 and 2018. (Round answers to 1 decimal place, e.g. 17.5% or 6.5: 1 or $2.6.) (in millions) 2019 2018 1 Current ratio : 1 : 1 2. Receivables turnover times times 3. Inventory turnover times times 4 Debt to total assets 5. Times interest earned times timesQuestion 4 of 5 - 13.5 View Policies Current Attempt in Progress Open Text Corporation's financial statements contain the following selected data (in U.S. $ millions): 2019 2018 Total assets $7,934 $7,765 Total liabilities 4,049 4,048 Net Income 286 242 Income tax expense 155 144 Interest expense 137 139 (a) Calculate the debt to total assets and times interest earned ratios for 2019 and 2018. (Round answers to 1 decimal place, e.g. 17.5% or 6.3.) 2019 2018 Debt to total assets % % Times interest earned times times Did Open Text's solvency improve or deteriorate in 2019?Question 5 of 5 44 ;: View Policies Current Attempt in Progress On July 1, 2021, Bramble Satellites Corporation issued $1,700,000 of 10-year, 9% bonds to yield a market interest rate of 8%. The bonds pay semi-annual interest on July 1 and January 1. Bramble has a December 31 year end and records adjusting entries annually. Bramble received $1,815,523 when issuing the bonds. Click here to View the factor table. (a) Prepare an amortization table through January 1, 2023 (three interest periods) for this bond issue. (Round all amounts to the nearest dollar, es. 5,275.) BRAMBLE SATELLITES CORPORATION Bond Premium Amortization Interest Expense to be Unamortized Bond Carrying Recorded Premiu m Amortization Premium Amount $ $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts