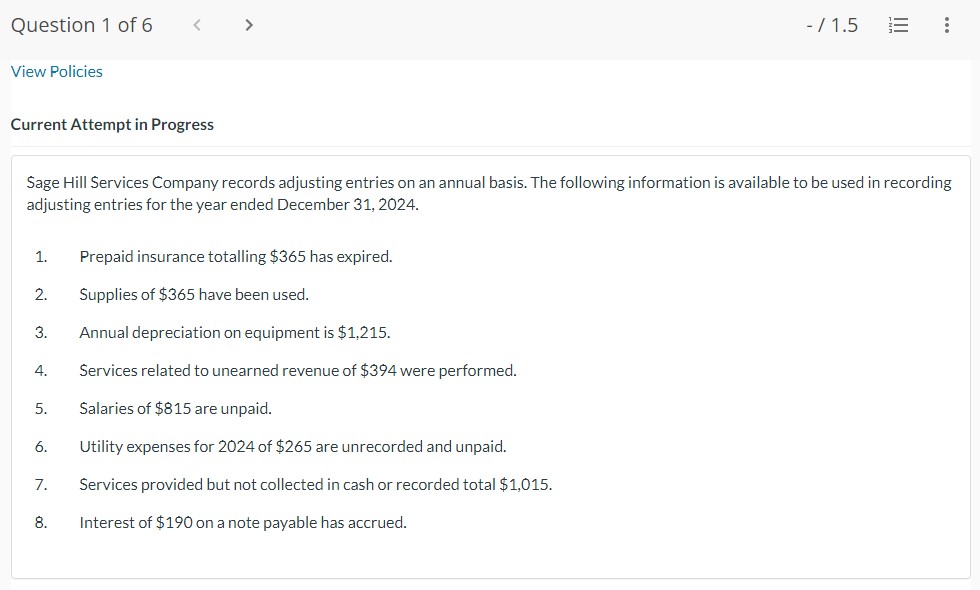

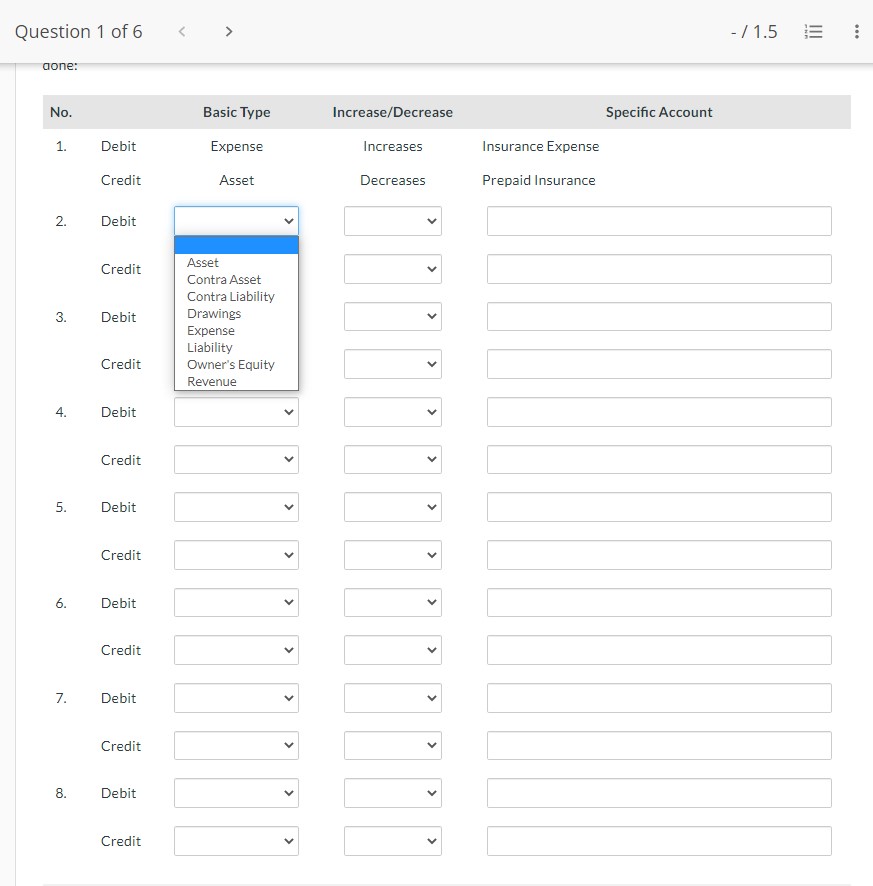

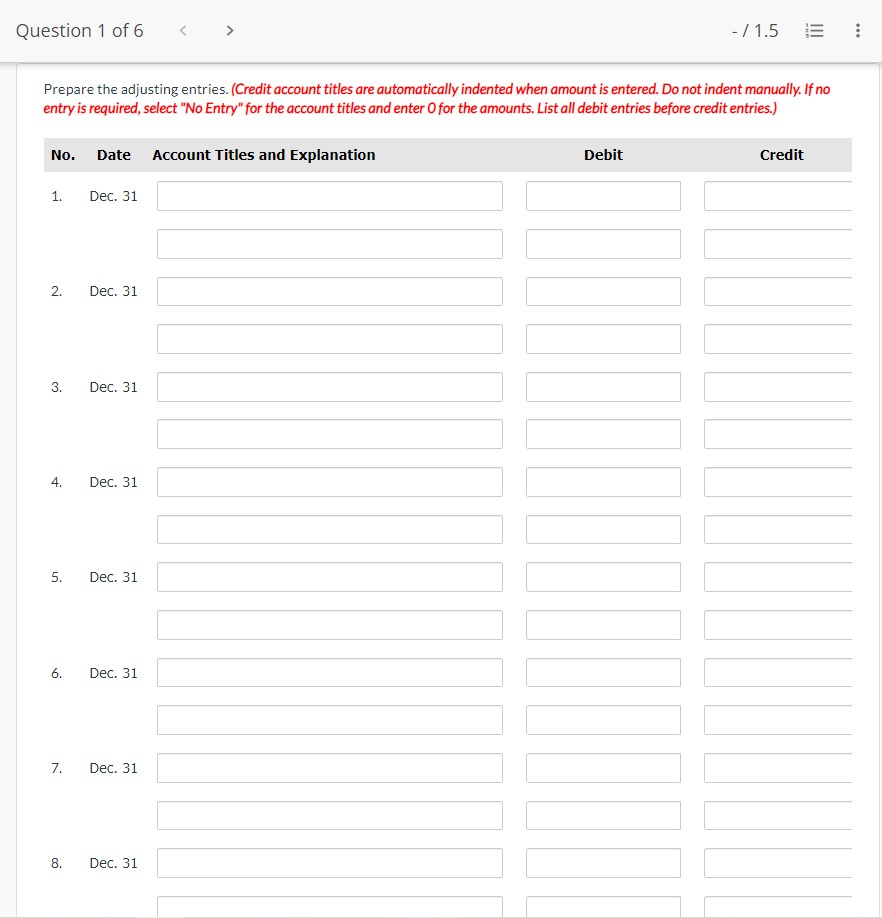

Question: Question 1 of6 > 41.5 E View Policies Current Attempt in Progress Sage Hill Services Company records adjusting entries on an annual basis. The following

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts